INTERNATIONAL INVESTMENT

AND PORTAL

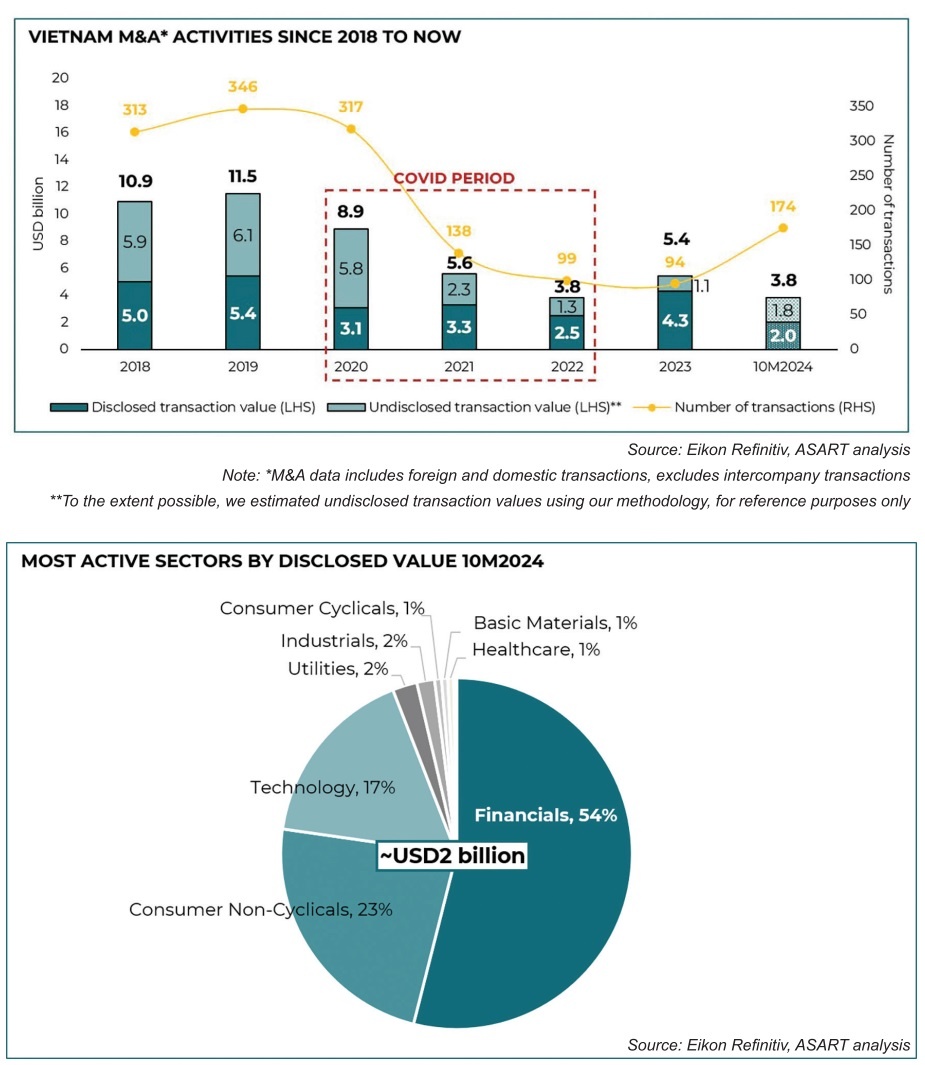

Vietnam’s merger and acquisition (M&A) market in 2024 has been slower than anticipated, with lower deal values reflecting a cautious approach from investors. By October, there were about 174 transactions, totalling approximately $2 billion in disclosed value.

While the number of deals grew by around 21 per cent on-year, the total deal value dropped by 54 per cent, showing a significant decline from the previous year. This reduction can be attributed to global economic headwinds, a prolonged high USD interest rates environment, and investor hesitancy amid lingering uncertainties. Investors, though still active, are now prioritising strategic, value-driven deals over speculative ones.

Despite this overall market downturn, several key sectors continued to attract interest. The technology sector remained active, particularly in fintech and e-commerce, as businesses in Vietnam pushed for digital transformation. The financial sector also garnered attention, driven by increasing consolidation and the expansion of consumer finance services to meet growing demand.

Binh Le, CEO and head of M&A, ASART Deal Advisory and Duy Vo, associate of M&A, ASART Deal Advisory

Binh Le, CEO and head of M&A, ASART Deal Advisory and Duy Vo, associate of M&A, ASART Deal Advisory The healthcare sector showed resilience as well, supported by Vietnam’s ongoing investments in healthcare infrastructure and rising demand for pharmaceutical products. Renewable energy continued to see deals, albeit at a slower pace, as government policies emphasised sustainability and green energy initiatives. Logistics and education attracted a lot of interest, but qualified targets are still limited.

Meanwhile, the consumer goods and retail sector, though impacted by weakening demands and tightening market conditions, still drew investments in firms with established brands and strong customer bases.

Key investor countries in Vietnam’s M&A market this year included South Korea, Japan, and Singapore. However, activities from these countries slowed slightly, mirroring the broader market conditions. South Korean and Japanese investors maintained their focus on Vietnam, with South Korea showing interest in technology and Japan in healthcare and consumer goods.

Singaporean investors remained active in real estate and logistics, aligning with Vietnam’s urban growth trends. In contrast, European investments saw a dip, as firms there adopted a cautious, wait-and-see stance amid economic uncertainties.

Notable transactions in 2024 highlighted areas of strategic interest across diverse sectors, especially in consumer, financial, food and beverages (F&B), technology, and renewable energy sectors.

Siam Commercial Bank of Thailand acquired Home Credit Vietnam, a Ho Chi Minh City-based consumer lending provider, for $851.7 million, marking one of the year’s largest transactions. SK Group Corp from South Korea purchased Iscvina Manufacturing, a Vinh Yen-based semiconductor manufacturer, for $300 million.

In the energy sector, Switzerland’s SUSI Asia Energy Transition Fund acquired Dam Nai wind farm from Norway’s Scatec for $40 million. The F&B sector also witnessed significant activities, with Nutifood acquiring a 51 per cent stake in Kido Frozen Foods, and Saigon Beer Alcohol Beverage Corporation raising its stake in Saigon Binh Tay Beer Group to 59.62 per cent through a tender offer worth $33.64 million.

Several strategic trends emerged in Vietnam’s 2024 M&A landscape. With economic uncertainties, companies took a cautious approach, favouring smaller, incremental investments rather than committing large sums up front. There was an increase in domestic participation, reflecting a growing confidence among Vietnamese companies to lead acquisitions.

This shift, however, was accompanied by a heightened focus on due diligence, with investors inspecting deals more closely, leading to delays in deal closures.

Challenges in high USD interest rates, global economic uncertainties, and information transparency placed pressure on cost of equity and return on investment, creating valuation gaps that led to more sophisticated deal structures. AI-adoption and digital transformation remained a priority for firms seeking greater operational efficiencies.

Vietnam’s exit environment has improved, driven by regulatory advancements and new consolidation opportunities, particularly in sectors where M&A can offer diversity, expand supply chains, enhance market presence, or support technical and technological advancement.

Vietnam’s M&A market is expected to see gradual recovery in 2025, contingent on a stabilising global economy, improving laws and regulations, favourable USD interest rate policies, positive geopolitical landscape, and investors’ confidence. Investor sentiment may remain cautious during 2025’s first half, but various factors could drive renewed interest. As inflation stabilises, interest rates alleviate, and exchange rates steady, investor confidence should strengthen and encourage more activities.

The healthcare sector is set to grow further, with rising demand for quality services and infrastructure improvements. Education is also expected to draw investment, spurred by the growth of private institutions and a rising middle class. Logistics will likely continue to attract interest as Vietnam cements its role as a regional manufacturing hub, and agriculture is poised for strong recovery through sustainable growth awareness and initiatives.

Renewable energy is also expected to be more focused, aligning with Vietnam’s clean energy goals. Technology and the digital economy, supported by a young, tech-savvy population, remain promising as well.

Although the M&A market in 2024 faced lingering challenges, Vietnam’s mid-term and long-term prospects are still favourable. As macroeconomic conditions improve, the market is expected to rebound, with sustainability, AI-adoption, and digital transformation likely to be the main drivers for near future deals.

Foreign investors step up M&A activities in Vietnam

Foreign investors step up M&A activities in Vietnam Vietnam’s merger and acquisition transactions are being driven by foreign investors across various sectors. Ngu Truong, managing partner of law firm Vilasia, spoke with VIR’s Thy Nguyet about the current trends and tastes among investors.

M&As working in tandem with health development

M&As working in tandem with health development 2024 has been a relatively soft period for Vietnam’s merger and acquisition (M&A) market, as was 2023, in comparison with the three strong years which preceded 2023. Vietnam’s M&A experience during the first three quarters of 2024 was largely consistent with regional and global trends, although jurisdiction-specific headwind factors have also played a part.

M&A prospects bright in many sectors

M&A prospects bright in many sectors Dealmaking activities are arising in emerging fields ranging from semiconductors and data centres to liquefied natural gas, indicating ample room for buyers.