INTERNATIONAL INVESTMENT

AND PORTAL

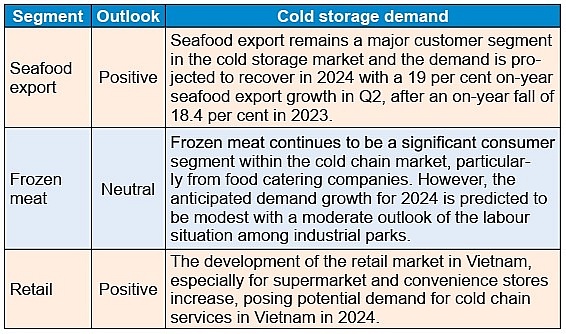

The cold storage market remains one of the most promising logistics segments in Vietnam, propelled by the robust growth of import-export activities, food and beverage franchised stores, and modern retail trade.

The total designed capacity of cold storage in Vietnam recorded a noticeable increase during the last four years with compound annual growth rate 2020-2023 of 13.1 per cent thanks to the active investment from new players.

Particularly, Vietnam’s cold storage segment comprised over 100 commercial cold storage providers with a total designed capacity of 1.24 million pallets in 2023. Most of the cold storage is in the south, serving high cold storage demand from aqua processing companies and buoyant import-export activities.

Anh Nguyen, manager of Market Research and Consulting, FiinGroup Vietnam

Anh Nguyen, manager of Market Research and Consulting, FiinGroup Vietnam

The robust increase in new supply of cold storage is driven by aggressive investments/expansions of both local and foreign investors. Local cold storage providers in Vietnam significantly contribute to the sector’s growth, holding 70 per cent of the market share in designed capacity. They are continuously expanding their facilities and increasing their capacity to meet the rising demand for cold storage.

Furthermore, the growing demand for cold storage in the Asia-Pacific region, particularly in Vietnam, has attracted a wave of foreign investment. Over the past three years, the market has witnessed a surge in participation and expansion by international companies, highlighting Vietnam’s increasing prominence in the cold storage sector.

Earlier in July, Nichirei TBA Logistics Vietnam commenced commercial operations of a 10,000-pallet cold storage facility, marking an expansion of Nichirei Logistics Group (Japan) in collaboration with Tan Bao An Logistics JSC. Just a few months earlier, Meito Vietnam held the opening ceremony for a 30,000-pallet cold storage facility in Tan Long An province, doubling its storage capacity.

In July 2023, Sojitz Corporation and KOKUBU Group announced the commercial operation of a new cold storage facility with a total designed capacity of 37,000 pallets.

The following month, Lineage Logistics announced the formation of a joint venture with SK Logistics, a local cold storage warehouse operator based in Hanoi. This collaboration is expected to enhance Lineage’s business in northern Vietnam, leveraging SK Logistics’ local expertise and market presence.

Next year, the cold storage sector is anticipated to witness the expansion of Japanese investor Yokorei, with an 18,000-pallet facility and a $52 million investment in the Mekong Delta province of Long An. Foreign investors are expected to continue leading the wave of investment in Vietnam’s cold storage real estate sector in the coming period.

The aggressive expansion by both existing and new players is expected to increase market competitiveness, resulting in a temporarily low occupancy rate in areas with a high number of new projects.

The oversupply in the market is expected to be triggered by aggressive participation in the next two years, with nine new cold storage facilities entering the market with a total designed capacity of over 343,000 pallets. Given the robust expansion and participation of new players, FiinGroup forecasts the occupancy rate of the cold storage market in 2025 to remain modest at 81 per cent.

End-to-end logistics is anticipated to become a trend in the cold storage market. With the extension of supply chains, many customers in the cold chain sector prefer end-to-end logistics solutions for cost and optimisation. To meet rising demand, cold storage providers are diversifying their service offerings.

For instance, HTNS and Transimex are major players offering comprehensive transportation services, including cold, chilled, and dry transportation, as well as inland waterway and cross-border delivery services. Meanwhile, notable providers such as Lineage, AJ Total, and NLVJ offer a wide range of storage services with various and adaptable temperature adjustments.

Daiwa House Logistics Trust acquires cold storage asset in Vietnam

Daiwa House Logistics Trust acquires cold storage asset in Vietnam

On December 29, Daiwa House Asset Management Asia Pte., Ltd., as manager of Daiwa House Logistics Trust (DHLT), announced the acquisition of D Project Tan Duc 2, a built-to-suit cold storage facility located in Long An province.

Cold storage supply remains behind requirements

Cold storage supply remains behind requirements

Although Vietnam’s cold storage industry is forecast to have a bright future, the current supply on the market is still very limited.

Foreign companies ramp up interest in Vietnam's cold storage market

Foreign companies ramp up interest in Vietnam's cold storage market

On August 11, Lineage Logistics, a United States-based international cold chain solutions provider, announced its expansion in Vietnam through a joint venture with Hanoi-based, cold-storage warehouse operator SK.

Investors eager to boost cold storage

Investors eager to boost cold storage

The demand for cold storage is increasing thanks to the growth of agriculture and seafood, which is boosting investment trends in the market.

By Anh Nguyen