INTERNATIONAL INVESTMENT

AND PORTAL

According to the Ministry of Finance (MoF), it is expected that in this year the government will have loans worth total $29.3 billion. This includes loans for the central budget balance of up to $28.1 billion. Of which, borrowing to offset the central budget deficit will be a maximum of $19.6 billion, borrowing to repay the principal will not exceed $8.52 billion, and on-lending is $1.16 billion.

Such loans will come from government bond issuance instruments, with the average issuance term may be less than nine years; from official development assistance loans and foreign preferential loans; and from other lawful financial sources or from issuance of government bonds directly to the State Bank of Vietnam.

Also, according to the MoF, the government’s debt repayment is about $14.6 billion, of which the government’s direct debt payment is a maximum of $13 billion and the repayment of on-lending projects is $1.56 billion.

When it comes to the loan and repayment plan of localities, borrowing from the government’s foreign loans and other domestic loans is as much as $1.24 billion. Localities’ debt repayment is $265.7 billion, including principal payment of $158.1 million and interest payment of $107.56 million.

As for foreign commercial loans of enterprises that are not guaranteed by the government, the limit of medium and long-term foreign commercial loans of enterprises and credit institutions by self-borrowing and self-payment method is up to $7.3 billion; the growth rate of short-term foreign debt balance is about 25 per cent as compared to the outstanding balance as of the end of 2021.

The government has reported to the National Assembly (NA) that based on the country’s borrowing scheme, Vietnam’s public debt at the end of this year may be about 43-44 per cent of GDP; the government’s debt may be 40-41 per cent of GDP; while the nation’s foreign debt is set to be 40-41 per cent of GDP, and the government’s direct debt repayment obligation will likely stand at 18-19 per cent of total state budget revenue.

All these rates are still lower than the warning limits set by the NA.

According to The Economist’s Global Debt Clock, by late last week, Vietnam’s public debt in GDP sat at 45.6 per cent, and per capita public debt was $1,039, while total public debt was almost $94.85 billion.

It is calculated by the MoF that the total state budget revenue and expenditure for this year is estimated to be $70.18 billion and $88.5 billion, meaning a deficit of $18.32 billion.

Under a resolution adopted by the NA last month on allocation of central budget in 2023, total central and local budget revenues will be $37.54 billion and $32.92 billion, respectively. Total central budget expenditure will be $56.26 billion. This would mean a central budget deficit of $14.2 billion.

Based on this, it has also been suggested that the government’s direct debt repayment obligation for next year will be about 19-20 per cent of total state budget revenues – lower than the NA’s permissible limit of 25 per cent.

It is expected that by late 2023, the economy’s public debt will be as much as 44-45 per cent of GDP, the government’s debt around 41-42 per cent of GDP, foreign debt 41-42 per cent of GDP – these levels are also lower than the NA’s permissible limits.

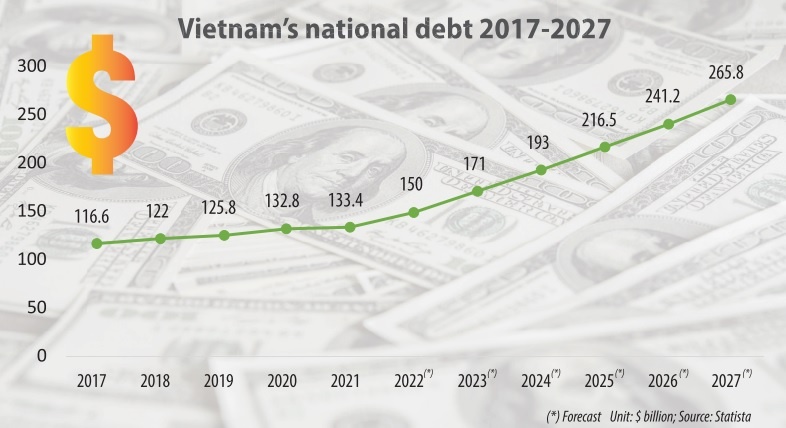

However, according to German data provider Statista, the national debt of Vietnam is projected to continuously increase between 2022 and 2027 by a total of $115.9 billion, up 77.2 per cent. After consecutive increasing years, the national debt is estimated to reach $265.8 billion and therefore a new peak in 2027 (see chart).

According to Trading Economics global macro models and analysts expectations, the government debt to GDP in Vietnam is expected to reach 40 per cent of GDP by the end of 2022. In the long term, the ratio is projected to trend around 41 per cent of GDP in 2023.

Meanwhile, Fitch Ratings also stated, “We forecast a rise in the general government debt-GDP ratio to 41.3 per cent in 2022, from about 39 per cent in 2021, but this would still be far below the ‘BB’ median. The increase is driven by a widening of the budget deficit to our forecast of 4.5 per cent of GDP in 2022.”

General government revenues are lower than the peer median, while cuts to VAT, environmental tax, and certain tax exemptions, part of a near-term economic recovery programme, will dampen revenues in the near term. “These are measures to keep inflation under control and are likely to be reversed as inflationary pressures subside,” Fitch Ratings added.

According to the MoF, by late last year, Vietnam’s biggest bilateral creditors include Japan (around $13.74 billion), South Korea ($1.39 billion), France ($1.3 billion), and Germany ($608.7 million). Meanwhile, the biggest multilateral creditors are the World Bank (over $16.52 billion) and the Asian Development Bank (more than $8.17 billion).

Debt obligations and fund access head banking issues

Debt obligations and fund access head banking issues

Vietnam’s banking sector is likely to experience a bumpy road ahead. Tran Thi Khanh Hien, research director of VNDIRECT Securities Corporation, spoke with VIR’s Hong Dung about the outlook for the sector.

Growing bond market illustrating bad debt snags

Growing bond market illustrating bad debt snags

While the bad debt market in Vietnam is still in its infancy and positive conditions have converged, stronger steps need to be taken.