INTERNATIONAL INVESTMENT

AND PORTAL

Vu Hong Phu, MB board member, shared MB's digital transformation experience

Vu Hong Phu, MB board member, discussed digital banking challenges at the Shark Tank Forum 2022 in Ho Chi Minh City on November 25, and shared MB's experience with a presentation on the digital economy.

At the beginning of the presentation, he explained why digital transformation was an inevitable trend for small and medium-sized enterprises (SMEs) in the post-pandemic era.

He noted that over 50 per cent of SMEs in Asia have yet to access official capital and adequate financial resources. This means that about $1.1 trillion of bank capital for SMEs has yet to be deployed. This has huge potential for Vietnam's digital economy. Even though banks are actively innovating products and improving customer experiences, 45 per cent of SMEs face difficulties due to the lengthy time it takes to process loans.

According to a survey of over 2,000 businesses conducted by McKinsey in Southeast Asia and India, around 70 per cent of businesses will switch to a digital sales platform in the next three years. With this shift, it is expected that revenue from digital platforms will account for about 69 per cent by 2025, while revenue from traditional channels will decrease to 31 per cent.

“This poses new challenges for SMEs but also shows the potential for digital partnerships between banks and merchants to promote cross-selling of integrated banking and beyond banking services," Phu said.

The MB leader pointed out four major pillars of a successful partnership ecosystem for banks and SMEs

Phu identified four pillars of a successful partnership ecosystem for banks and SMEs. The first is to build a standard cooperation ecosystem, which is the most crucial element for SMEs undergoing digital transformation. The second is putting the customer first. The third is maintaining a strong collaborative process - addressing exclusivity, data sharing and revenue sharing. The fourth is data analytics.

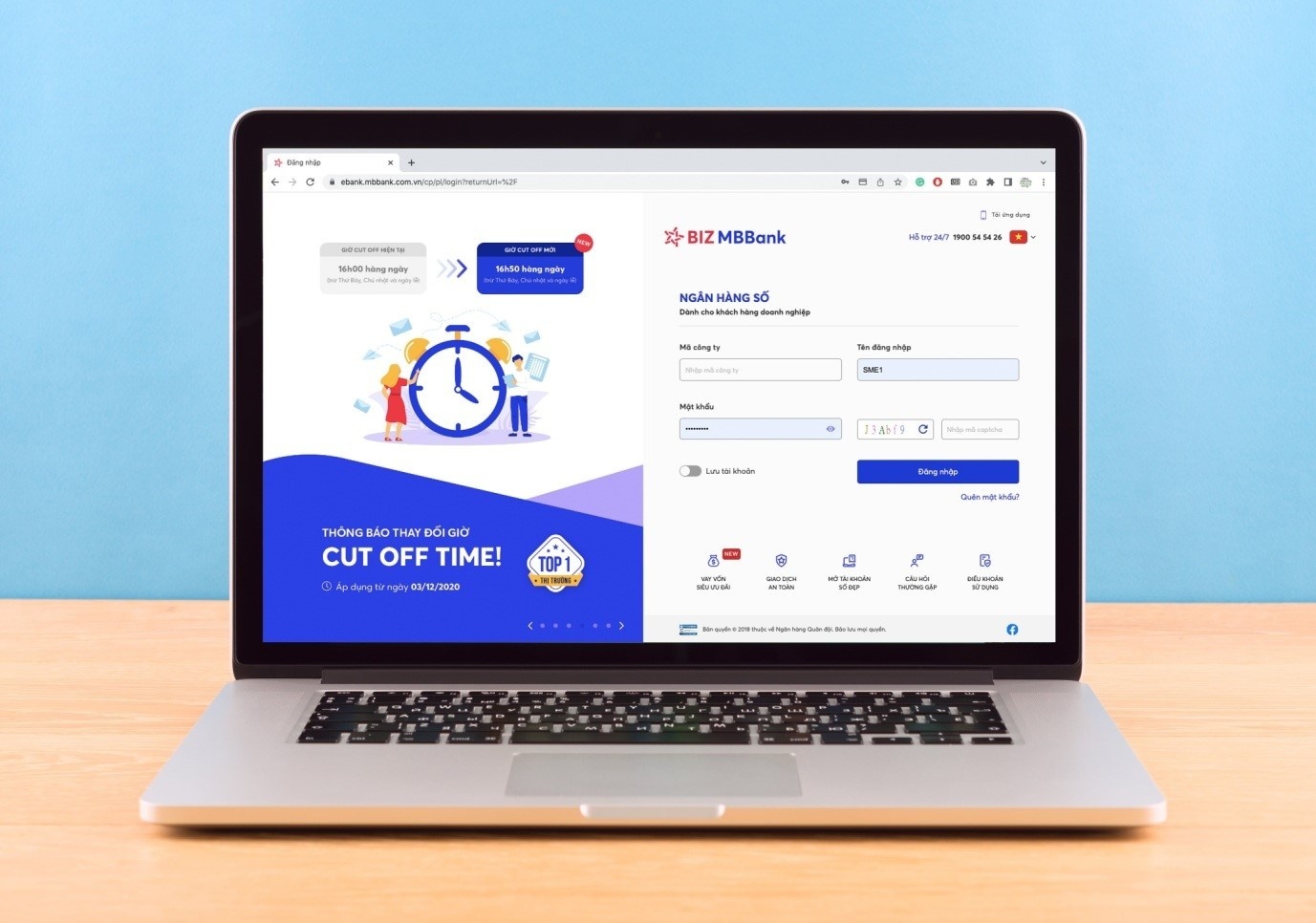

MBBank has two main digital platforms MBBank for individual customers and BIZ MBBank for corporate customers. Besides digital banking services, the platform has provided numerous services for individual and corporate customers. Over 200 enterprises have been connected with two MB platforms to provide products and services.

MB's digital ecosystem integrates business management platforms such as financial and accounting, human resources, and sales management.

"In the future, after being upgraded, this platform will be able to be integrated with an ERP solution for customers," said Phu. "With the Market Place component, businesses participating in MB's ecosystem can network, share products with customers, and optimise costs when participating in a digital ecosystem."

BIZ MBBank platform offers cutting-edge features for corporate clients

In addition, MB has been a trailblazer in implementing blockchain for import-export businesses.

"This solution helps connect customers with banks, customs, and shipping lines in exports and imports. It enables users to monitor the entire process on the Contour platform," said Phu.

He added that this is a new step for the bank in the digital transformation roadmap for financial and banking activities, especially digitising products and services for export and import customers and improving the customer experience.

With the view to becoming a digital firm, over the past five years, MB has focused on mastering technology and promoting services and products via digital channels.

The BIZ MBBank digital platform has garnered over 200,000 users, including 100,000 frequent users, accounting for 10 per cent of the number of businesses in Vietnam. Meanwhile, the MBBank app has served over 20 million customers, including 12 million frequent monthly transactions.

"MB has reached a milestone of one billion transactions on digital channels this year, compared with 380 million transactions in 2021. The bank boasts the highest market proportion in terms of the number of transactions made via Napas," said MB’s leader.

By completing its financial ecosystem and drastically implementing its digital strategy, MB has thrived even during the tough time of the pandemic, with growth in width and depth.

Entering its new strategic period from 2022-2026, MB has established a vision to become a leading digital and financial behemoth and reach the top 3 in the market in terms of efficiency while leading in Asia.

Fitch Ratings has recently upgraded the Long-Term Issuer Default Rating of MB from BB- to B+, with a positive outlook.

MB comes top at Vietnam Digital Transformation Awards 2022

MB comes top at Vietnam Digital Transformation Awards 2022

MB's three award-winning solutions at the Vietnam Digital Awards 2022 outperformed more than a thousand other innovations.

Digital transformation accompanying SMEs for viability and growth

Digital transformation accompanying SMEs for viability and growth

The Ministry of Planning and Investment (MPI), the Vietnam Chamber of Commerce and Industry (VCCI), and Meta just organised the Forum on Accompanying SMEs with Digital Transformation.

Fitch Ratings upgrades MB's international credit rating

Fitch Ratings upgrades MB's international credit rating

On November 17, international rating agency Fitch Ratings announced its annual credit rating results for 2022, in which MB's long-term debt issuer credit rating (IDR) was upgraded from B+ to BB-, with a Positive outlook.