INTERNATIONAL INVESTMENT

AND PORTAL

Hoang Trung Thanh, general director of Viettel Post, said that competition has been intensified in logistics, delivery, and e-commerce. Foreign players with strong financial capability and technology are expanding the market share via franchise, indirect investments and other strategies.

Disruptors and array of key players to support logistics, illustration photo/ Le Toan

Disruptors and array of key players to support logistics, illustration photo/ Le Toan

In this fierce competition, Viettel Post is restructuring its infrastructure and operations through large warehouse centres and 1,500 post offices. The company also has a plan to develop a logistics system for cross-border e-commerce.

General director Chu Quang Hao said that the company had launched a northern regional transportation and logistics centre in Hanoi. Thus, the company can complete its closed ecosystem including seven regional warehouse centres, 700 district-level centres, and 10,600 service and exchange points.

“Going forward, the company will develop Vietnam’s largest automatic order fulfilment facility, contributing to facilitating goods flow and the growth of the e-commerce market,” Hao said.

Since the logistics market as a whole is especially a huge market with diverse sub-sectors and business models, the number of businesses participating in the industry is huge. In 2021, the number of newly established businesses in the transportation and storage sector was about 6,000 in Vietnam. The main type of business contributing was traditional logistics and transportation services providers.

However, sections of the market are also being grabbed by popular international incumbents like Maersk, DB Schenker, and Samsung SDS. But more and more, local players with newly updated business models, including rising startups, are competing aggressively in the region to grab a piece of the action.

Express delivery service as a sub-category of last-mile delivery service, a rising sector of the logistics market, is governed by a few major players such as Viettel Post and Vietnam Post. The advantages they have, including the post office network, the number of shippers, office staff, and transportation vehicles, is the main motive incentivising them to grab market share, followed by business expansion and product launch.

According to the latest report by South Korea-based venture capital firm Nextrans, the size of the logistics service market in Vietnam is estimated to hit $73.6 billion in 2030 with a compound annual growth rate (CAGR) of about 23 per cent in the 2020-2022 period. Players in the market follow sustainable development, at a growth rate ranging from 12 to 15 per cent depending on the line of business.

The report pointed out that throughout a 5-year period, total funding amounts raised by logistics companies reached a CAGR of 102 per cent at $75.4 million funded in 2022. The optimistic forecast for the market is exhibited through the growth of average deal value.

In 2020 and 2021, on-demand last-mile delivery platforms were the model receiving the largest funding value as a consequence of strong demand. However, by 2022 the capital raised mainly went to the road freight marketplace, warehousing platforms, and ecommerce fulfilment.

Prominent deals include Be Group’s $60 million loan from Deutsche Bank; and Boxme, a Vietnam-based ecommerce logistics startup bagging $6.4 million in a funding round from local technology firm NextTech Group and digital payment platform Ngan Luong. Meanwhile, Wareflex, a Vietnamese on-demand warehousing platform, raised $785,000 in a pre-seed funding round led by Genesia Ventures and joined by Antler.

It is expected that more startups will evolve to become mature disruptors in their respective industries. Similar to existing incumbents, many are developing a global footprint. In the near future, major competition with established incumbents with a global end-to-end product is improbable, yet upstart businesses are emerging as more competitive in particular areas and regions.

With the ballooning volume of e-commerce, these startups have focused on technology to optimise operation and provide more digital offerings. Wareflex CEO Rajnish Sharma told VIR, “Because of rising customer concerns, companies are adopting Internet of Things devices to rapidly, precisely follow their product flows. It helps improve visibility of the supply chain, and understand their processes better. This technology guarantees to enhance overall supply chain efficiency.”

Integrating AI in logistics is another game-changer when it comes to business optimisation and Wareflex is bringing some AI-powered features for its customers, according to Sharma.

He also noted that companies are applying data mining in analytics, which involves analysing large volumes of information to detect and extract patterns automatically. “In Logistics 4.0, automatic data methods are redefining business management. It will also enhance demand forecasting, identifying bottlenecks to solve challenges in the supply chain. With the advanced data analytics, strategic decisions will be improved,” Sharma insisted.

Seaport and logistics advances get European flavour

Seaport and logistics advances get European flavour

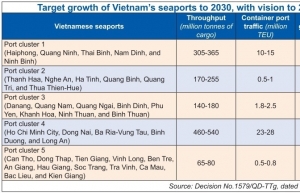

Vietnam is seeking European experiences and support in developing seaport and logistics infrastructure projects, with opportunities available for investors who are showing increased interest in the Southeast Asian market.

Hai Phong aims to become an international logistics centre

Hai Phong aims to become an international logistics centre

The northern city of Hai Phong aims to become a regional and international logistics centre due to its many advantages as a transportation hub for all five types of traffic, including sea, road, air, railway, and inland waterways.