INTERNATIONAL INVESTMENT

AND PORTAL

More than 95,000 businesses have been established in the past seven months alone, creating 600,000 jobs

More than 95,000 businesses have been established in the past seven months alone, creating 600,000 jobs

The economy has entered the second half of the year with some encouraging developments, notably a rise in industrial production, according to the General Statistics Office (GSO).

“Industrial production has maintained its positive growth momentum. It is estimated that the index of industrial production (IIP) in July increased by 0.7 per cent on-month and 11.2 per cent on-year,” the GSO reported.

Compared to the same period last year, the July IIP saw a 13.3 per cent increase in the manufacturing and processing industry, nearly 10 per cent in the electricity production and distribution industry, and 12.1 per cent in the waste and wastewater management and treatment industry.

In the first seven months of this year, the on-year IIP is estimated to have risen by 8.5 per cent.

However, a closer examination reveals that these substantial on-year increases in July and the first seven months are based on relatively low on-year growth rates in the corresponding periods last year.

Specifically, the IIP’s on-year increase in July last year was 3.7 per cent, while the IIP for the first seven months of 2023 decreased by 0.8 per cent.

Additionally, the seven-month IIP rose by 9.5 per cent for the manufacturing and processing industry, compared to an on-year decline of 1.2 per cent in the same period last year; 12.4 per cent for the electricity production and distribution industry, compared to a modest on-year rise of 1.4 per cent; and 7.2 per cent for the waste and wastewater management and treatment industry, compared to an on-year increase of 5.2 per cent in the first seven months of last year.

According to the GSO, in July, the country saw 14,700 new businesses established with registered capital of $4.6 billion, representing a decrease of 6.3 and 22.8 per cent from June, respectively.

“Despite ongoing difficulties, the overall economic situation and industrial production are clearly bouncing back,” said Prime Minister Pham Minh Chinh.

“Enterprises’ confidence is rising, and the government expects a growth rate of around 7 per cent this year, higher than the previously anticipated 6-6.5 per cent.”

The IIP in July rebounded strongly in several localities. For instance, in the northern province of Bac Ninh, home to Samsung’s factories, the province’s IIP grew by 15.2 per cent on-year. Its seven-month IIP increased by 10.4 per cent on-year.

Since the beginning of the year, Bac Ninh has granted new investment certificates to nearly 280 projects with a total registered capital of $1.46 billion. Additionally, 109 existing projects added capital amounting to $1.6 billion. As of now, Bac Ninh hosts 2,370 valid foreign-invested projects with registered capital exceeding $28 billion.

Recently, Bac Ninh authorities approved Amkor Technology Singapore Holdings to invest an additional $1.07 billion in its semiconductor plant at the Yen Phong II-C Industrial Park, raising the total investment to $1.6 billion. The expanded plant will have an annual production capacity of 3.6 billion units.

Other industrial production hubs in Vietnam have also experienced positive on-month IIP increases in July, including Bac Giang (8.7 per cent), Vinh Phuc (6.5 per cent), Ba Ria - Vung Tau (5.6 per cent), Can Tho (4.8 per cent), and Thanh Hoa (4.6 per cent).

“The on-year IIP for the first seven months of 2024 has increased in 60 provinces and cities, while only three provinces have seen a decline,” the GSO highlighted. “Many localities have experienced high on-year increases in the IIP of the manufacturing and processing industries, such as Lai Chau (43.1 per cent), Phu Tho (38.4 per cent), Bac Giang (27.5 per cent), Binh Phuong (17.1 per cent), Thanh Hoa (15.1 per cent), and Dien Bien (8.8 per cent).”

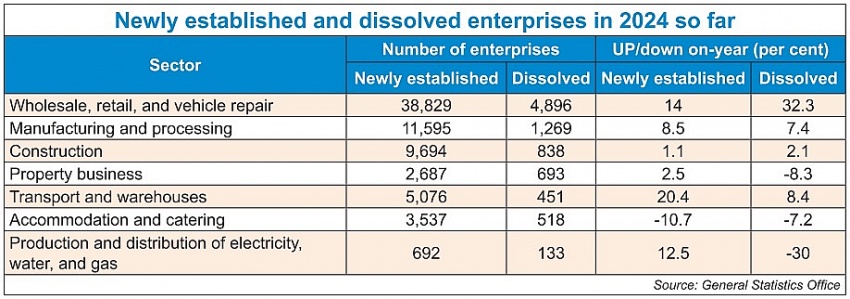

According to the GSO, enterprise confidence is on the rise. In the first seven months of this year, Vietnam saw more than 95,200 new businesses established with registered capital of $35.6 billion, creating around 600,000 jobs, marking increases of 6.3, 2.4, and 2 per cent, respectively, compared to the same period last year.

These figures reflect the significant efforts of the business community amid increasing challenges, the GSO said. However, it also noted that the economy still faces substantial challenges. When including an additional $38.3 billion registered by over 27,100 existing enterprises, the total capital injected into the economy in the first seven months amounts to nearly $74 billion.

“But this figure still represents a 9.1 per cent decrease compared to the same period last year,” the GSO stressed.

In the first seven months, over 78,000 businesses ceased operations in Vietnam, up 16.7 per cent on-year; more than 35,500 enterprises stopped operations and are awaiting dissolution procedures, down only 1.5 per cent on-year; and 11,900 enterprises completed dissolution procedures, up 14.5 per cent. On average, over 17,900 businesses exited the market each month.

PM Chinh emphasised that, in addition to advancing infrastructure development, the government, authorised agencies, and localities must review and revise all regulations and remove legal barriers to mobilise all available resources domestically and abroad for national development.

“More dialogues must be organised to support enterprises in overcoming difficulties. Anti-corruption efforts must be intensified, along with the development of e-government and e-society, promoting digital data and non-cash payments across all sectors and transaction types,” PM Chinh said.

Shantanu Chakraborty, country director for Vietnam Asian Development Bank

The first half of 2024 was quite impressive, with Vietnam’s GDP growth at 6.4 per cent compared to the same period last year. This was primarily driven by a strong recovery in trade, with exports increasing by 14.5 per cent and imports by 17 per cent. However, domestic demand was sluggish.

Vietnam can sustain its growth momentum in 2024 through continued trade recovery in export-led manufacturing and positive inflows of foreign direct investment (FDI) and remittances, while focusing on restoring growth in services, stabilising agricultural production, and boosting domestic consumption.

We maintain our projection for the economy to grow at 6 per cent this year and forecasts a further increase to 6.2 per cent growth in 2025. Inflation is expected to remain benign at 4 per cent in both years, despite pressure from geopolitical tensions and supply chain disruption.

Although the economy is expected to show solid growth this year and a slightly higher pace next year, several external risks could slow momentum. The first risk is reduced global demand due to slow economic recovery among trading partners and ongoing geopolitical tensions, which could dampen Vietnam’s export-led growth.

The second risk is the slower pace of interest rate normalisation in the US and other advanced economies, which could continue to exert pressure on the exchange rate. Growth in 2024 will also depend on the effective implementation of the government’s fiscal measures and public investment.

Recent years have highlighted structural fragilities in the Vietnamese economy, such as reliance on FDI-led export manufacturing, nascent capital markets, and overreliance on bank credit. Addressing these risks in a timely manner could lead to stronger growth.

Vietnam’s economy to pick up pace in 2024

Vietnam’s economy to pick up pace in 2024

Vietnam’s economy is maintaining solid growth momentum in 2024 amid global macroeconomic and geopolitical uncertainties.