INTERNATIONAL INVESTMENT

AND PORTAL

On June 30, the European Chamber of Commerce in Vietnam (EuroCham) released the Q2/2025 edition of the Business Confidence Index (BCI), revealing an evolving but still resilient outlook among European businesses operating in Vietnam. The index eased slightly to 61.1 points amidst global uncertainty, but the overarching message remains one of tempered optimism. Despite turbulence in international markets and temporary bottlenecks in domestic reforms, businesses maintain confidence in Vietnam’s long-term growth trajectory.

"European businesses in Vietnam remain confident in the investment climate," remarked EuroCham chairman Bruno Jaspaert. "Around three in every four (72 per cent) surveyed business leaders would recommend Vietnam as an investment destination – and this has been a consistent trend across recent BCI reports. That level of consistency speaks volumes."

Among the key factors influencing sentiment is the unresolved impact of US tariffs. Following the third round of Vietnam – US trade negotiations in June with no definitive outcomes, uncertainty over tariff adjustments continues to weigh on strategic planning, particularly for companies managing cross-border supply chains. Open-ended responses from this BCI survey repeatedly flagged these evolving cards as a concern – not yet a crisis, but a development worth monitoring closely.

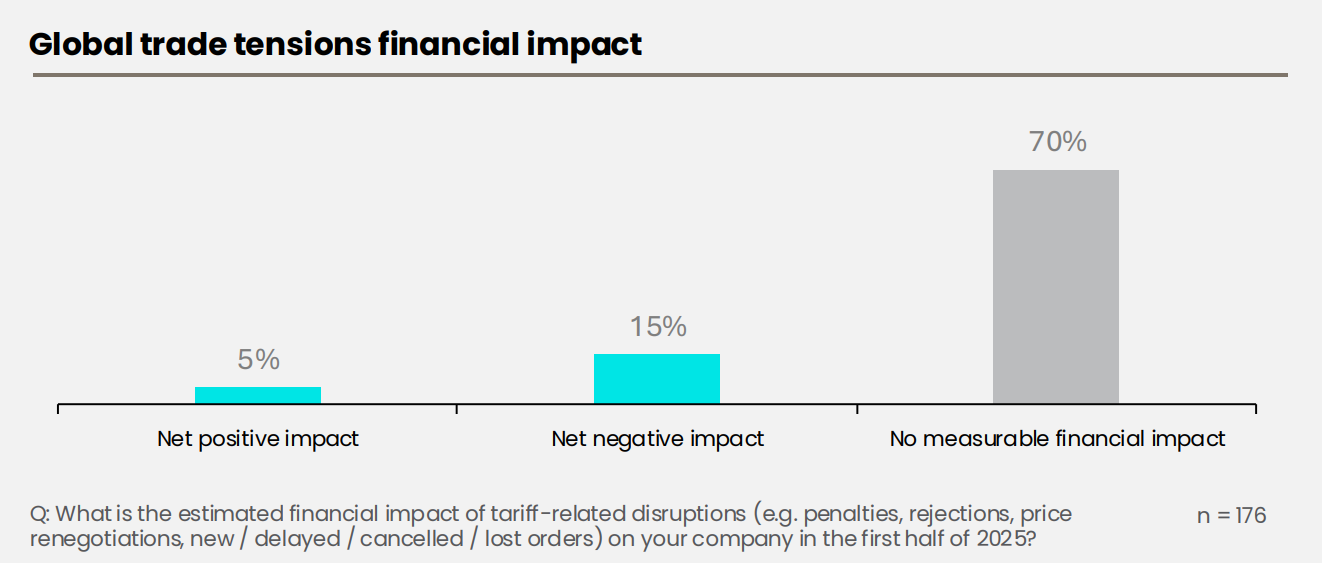

While business leaders are increasingly alert to rising global trade instability, most are yet to feel major financial impacts on the ground. The geopolitical environment continues to evolve, but so far, the effects on European businesses in Vietnam remain limited.

Although concerns around sourcing strategies and supply chain resilience are rising, only 15 per cent of respondents reported net negative financial impacts – including penalties, cancelled orders, or price renegotiations. 70 per cent said they had experienced no measurable impact, and 5 per cent even reported net gains thus far.

One of the tools helping businesses maintain this resilience is the Certificate of Origin (C/O): a strategic asset that underpins preferential trade access and trust in increasingly complex global markets. More than just a formality for tariffs exemption, C/O serves as a core pillar of credibility, traceability, and compliance in modern trade. 56 per cent of BCI respondents reported submitting C/O documents on a monthly basis, especially among larger enterprises.

While the majority of businesses received their C/O within the standard 3-5 working days, 12 per cent experienced delays of over a week, potentially disrupting order fulfilment and increasing costs. On the other hand, a standout 5 per cent of businesses received C/O within 24 hours – a benchmark that reflects the growing efficiency of certain customs procedures.

Since May 5, the Ministry of Industry and Trade has taken over the C/O issuance process, with plans to roll out a fully digital system nationwide. This move is widely welcomed by the business community. The digital transition is expected to reduce paperwork, improve turnaround times, and integrate more seamlessly with digital customs systems and electronic signatures.

"As geopolitical shifts continue to redraw global supply chains, having a clear, verifiable origin story for products becomes an even more competitive advantage than ever," said Jaspaert. "This push towards digitalisation is not just about reducing paperwork – it is about positioning Vietnam as a trusted, future-ready trade partner. If Vietnam can secure its entire supply chain and increase the share of truly domestically made goods, it will gain a powerful edge in the global trade game. The Certificate of Origin is more than a passport to tariff advantages – it is a mark of credibility and trust in end markets. With digitalisation, we can accelerate trade flows, reduce friction, and build a more transparent, resilient system that benefits all."

These trade facilitation efforts provide a necessary foundation for investor confidence. Evidently, long-term confidence is strengthening. A solid 78 per cent of respondents (up 7 percentage points from Q1) expect improved business conditions over the next five years. This growing optimism signals continued belief in Vietnam’s structural growth story, even as the near-term picture remains clouded.

As reforms unfold, European businesses in Vietnam remain hopeful, but also pragmatic. The latest BCI data reflects a softened optimism – best described as a strategic pause amid a shifting economic landscape.

Thue Quist Thomasen, CEO of Decision Lab, the survey partner for BCI, said, "The share of companies confident in economic stabilisation for Q3 2025 has dipped slightly to 50 per cent (down 8 percentage points from the previous quarter). However, this shift does not signal growing pessimism. Rather, it suggests that businesses expect limited near-term changes given the complexity of a volatile international environment. Most are not forecasting deterioration (11 per cent reporting a gloomy outlook, only up 1 percentage point since last quarter) – just a period of holding steady."

This wait-and-see stance is echoed in the sentiment breakdown: 39 per cent of respondents hold a neutral short-term outlook, while 43 per cent continue to rate their business prospects as 'Good' or 'Excellent'.

Yet through it all, resilience remains the dominant theme. Vietnam's steady growth, dynamic workforce, and expanding trade network continue to inspire confidence.

This future-facing optimism is grounded in clear business priorities. As outlined in EuroCham’s Whitebook 2025, European enterprises see several 'must-win battles' essential for improving Vietnam’s foreign investment appeal: core infrastructure development, legal clarity, consistent enforcement, streamlined administrative procedures, and easier visa and work permit regulations. And yet, these very issues remain the most persistent bottlenecks in the business environment.

The Q2/2025 BCI may have reaffirmed Vietnam’s status as a top destination for European investment, but sustaining this trajectory will require continued commitment to reform and responsiveness to business needs.

"European companies are clear about what they need: streamlined procedures, harmonised regulations, simplified work permits, tax refunds, and customs frameworks, and improved cross-border trade facilitation. These are not just business asks, but they are preconditions for high-quality, sustainable foreign investment. With clearer rules and stronger reform commitments, Vietnam is on the cusp of becoming a magnet for high-quality investment and sustainable development," Jaspaert concluded. "EuroCham is proud to stand with our partners here and serve as a bridge to this shared future."

European firms’ confidence in Vietnam’s business environment slightly declines but still strong: EuroCham

European firms’ confidence in Vietnam’s business environment slightly declines but still strong: EuroCham

The confidence of European enterprises in Vietnam’s investment and business environment slipped further to 62.2 percentage points in the wake of a worsening global economic downturn but still remains strong, according to the recent Business Climate Index (BCI) survey published by the European Chamber of Commerce (EuroCham) in Vietnam.

European firms interested in various sectors in Central Highlands: EuroCham leader

European firms interested in various sectors in Central Highlands: EuroCham leader

Tourism, agriculture, and renewable energy, which have high potential in the Central Highlands, are sectors that European enterprises are interested in, said Alain Cany, President of the European Chamber of Commerce in Vietnam (EuroCham).

European firms confident in Vietnam’s ability to navigate global trade tensions

European firms confident in Vietnam’s ability to navigate global trade tensions

The latest Business Confidence Index (BCI) released by EuroCham Vietnam offers a snapshot of guarded optimism among European businesses in the country.