INTERNATIONAL INVESTMENT

AND PORTAL

The iconic line “If you build it, [they] will come,” from the 1989 film Field of Dreams has long resonated with those embarking on ambitious plans.

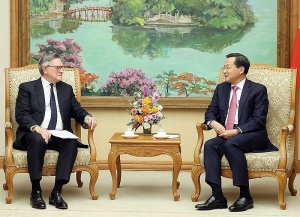

Tyler McElhaney, country director of APEX Group

Tyler McElhaney, country director of APEX Group

The movie, set in an Iowa cornfield, centres around the construction of a mythical baseball field, designed to lure long-passed baseball legends to play ball again. This phrase often echoes in my mind when I think of Vietnam’s micro economy, where budding entrepreneurs frequently set up small roadside stands, offering food and beverages of all sorts.

Despite their humble beginnings, these businesses attract an increasing number of passersby, creating a communal space that fosters connection and economic growth. Much like these budding entrepreneurs, Vietnam envisions building an attractive financial landscape to draw investors and be a catalyst for achieving aggressive growth projections.

With the government setting an ambitious goal of achieving 8 per cent growth in 2025, we see immense potential for development and collaboration from the private sector for the creation of an investor-focused international financial centre (IFC). We are committed to expanding Apex in Vietnam and the region, where the largest asset managers are looking to allocate capital.

For us, this means that firms like BlackRock, Blackstone, KKR, and Goldman Sachs are seeking to create investment vehicles to either invest or raise capital - and we want Apex to be there. This is why Vietnam is a crucial area for our development and why the establishment of local IFC frameworks is so important to us and the asset managers we serve globally.

Recent examples of successful IFCs include Dubai, Abu Dhabi, and Riyadh. These cities have developed “cities within cities” each with its own laws, regulations, and policies designed to attract and foster financial activities. The success of Dubai and Abu Dhabi over the last two decades has been particularly notable, as they transformed their economies into global financial hubs, driving both inbound and outbound investments and solidifying their places in the global financial landscape.

While some argue that Vietnam cannot rival its Middle Eastern counterparts due to a lack of cash resources driven by oil production, Vietnam possesses unique advantages that the Middle East did not have when developing its IFCs.

As the country approaches 50 years since reunification, it reflects on a period of relative modesty and a focus on bamboo diplomacy. These masterful strategies have created a unique value proposition that few nations can offer. Vietnam may not have monetary riches, but it has built strength and potential that money cannot buy. Vietnam’s rise as a global economic player can be attributed to its strategic use of intellectual and social capital, rather than raw financial power.

Keys to IFC development

In recent decades, Ho Chi Minh City and the central city of Danang have undergone significant economic expansion, evolving into thriving business hubs. With an influx of foreign investments, the financial sector has become crucial to this progress. To sustain this momentum, both cities need a financial centre that can support such rapid development.

However, this does not imply a hasty or careless approach to its creation and implementation. Vietnam is known for making thoughtful, strategic decisions. The focus should be on the centre’s ability to swiftly adapt to market changes, embrace innovation, and foster a continuous process of improvement.

Another aspect is the connection to Singapore and the Middle East. As a key economic player in Southeast Asia and the world, Vietnam is well-positioned to serve as a leading gateway for trade, investment, and finance within the ASEAN region. This strategic position makes Vietnam an ideal location for an international financial hub.

Vietnam should collaborate with Singapore and Middle Eastern IFCs to develop its financial centre infrastructure, arbitraging each other’s strengths, resources, and opportunities via passporting mechanisms.

Implementing common law is also essential for competing on the global stage. IFCs that establish their legal frameworks on common law principles gain significant advantages. Dubai serves as a prime example, where despite its initial inclination towards civil law, it adopted a common law framework for Dubai’s IFC.

Common law offers several key advantages for investors, including predictability and stability, flexibility and adaptability, enforcement of contracts, investor confidence, legal innovation and others. Such systems rely on precedents, providing a consistent and stable legal environment. This predictability is appealing to international investors and businesses, as they can anticipate how laws will be applied in specific situations.

Financial markets and institutions thrive in jurisdictions with strong legal protections and transparent judicial systems. Common law’s reputation for safeguarding property rights and ensuring fair treatment of parties fosters investor confidence.

Equally important elements for IFC development include strengthening regulatory and legal framework, which includes of modernising financial regulations, improving legal protections for businesses, and supporting financial innovations such as fintech and cryptocurrency on the back of a robust blockchain system.

To improve infrastructure, Vietnam must invest in both digital and physical infrastructure to support online banking, fintech solutions, and efficient transportation networks. The nation must develop programmes to train skilled financial professionals, attract international talent, and encourage fintech education.

Vietnam must develop capital markets, introduce innovative financial products, and work on enhancing the transparency of financial data to enhance market liquidity. Environmental, social, and governance criteria also must be focused on to promote green finance and develop relevant regulations to draw in sustainable investors.

Financial inclusion should also be improved by supporting the growth of digital banking and microfinance, especially in rural areas, to enhance financial inclusion for small and medium-sized enterprises.

Focal points for progress

Vietnam must prioritise innovation in fintech, digital assets, and green finance to ensure its financial centres remain at the forefront of technological advancements and sustainability. Vietnam’s IFCs must be adaptable to where the market is going, not where it is today.

Cross-border financial services and corporate service providers are also key. Vietnam must court best-in-class banks to set up in the IFCs will help them expand their presence in Vietnam, offering services such as corporate banking, trade financing, and wealth management.

By collaborating with financial hubs such as Singapore and leveraging private market partnerships, Vietnam can enhance trade finance and capital flows. The nation must focus on growth of green finance, which involves investments in sustainable and environmentally friendly projects and develop green bonds, sustainable investment frameworks, and environmentally focused financial products.

In terms of service providers, it is essential to develop support mechanisms that enable technical service providers, including fund administrators, capital market advisors, private credit facilitators, and family office support. Global investors and asset managers require sophisticated support systems, and the creation of a robust ecosystem to ensure they can access specialised local services is essential to the establishment.

Vietnam’s ambition to establish a global financial hub is rooted in its dynamic economy, modernising infrastructure, and rich cultural heritage of hard work and constancy of purpose. By leveraging its strengths and implementing strategic policies, the country is poised to build financial centres that attract investment, foster innovation, and contribute to long-term economic development.

This journey towards becoming a global financial hub will not only enhance Vietnam’s financial sector but also support its broader goal of building a strong, prosperous nation.

Ho Chi Minh City urged to explore financial hub options

Ho Chi Minh City urged to explore financial hub options

Ho Chi Minh City is embarking on an ambitious endeavour to transform into an international financial centre, facing complex challenges while exploring global demand and collaborative opportunities as a flourishing financial hub.

Vietnam sets sights on Ho Chi Minh City's transformation into a global financial hub by 2030

Vietnam sets sights on Ho Chi Minh City's transformation into a global financial hub by 2030

Vietnam established a steering committee, led by Deputy Prime Minister Le Minh Khai, on October 6 to guide the development of a new international financial hub, underscoring its ambition to elevate its global financial stature.

Standard Chartered to aid development of Ho Chi Minh City financial hub

Standard Chartered to aid development of Ho Chi Minh City financial hub

During a meeting with Deputy Prime Minister Le Minh Khai on June 27, group chairman of Standard Chartered Jose Vinals announced the bank’s commitment to supporting the development of an international financial centre in Ho Chi Minh City.

The ideal time for a new financial hub

The ideal time for a new financial hub

The establishment of an international financial centre in Ho Chi Minh City is a vital step amid Vietnam’s rapidly evolving economy. Truong Bui, managing director for Roland Berger in Vietnam, analyses the city’s role as the nation’s premier economic and financial hub.

Financial hub plans expand in scope

Financial hub plans expand in scope

A major move from the National Assembly will facilitate Vietnam to develop its own regional and international financial centres, with special tax incentives for investors and businesses.