INTERNATIONAL INVESTMENT

AND PORTAL

Informal microfinance has long been a practice in Vietnam, with family and friends being the sources of critical funds to establish a business, pay back other loans, or invest in an asset. Hung (Jimmy) Nguyen, researcher at Woodberry Forest School, surveyed a small group of people in Ho Chi Minh City to gain a first insight into the sparsely researched topic, suggesting that further, more structured surveys could be advantageous for the national economy.

In their survey of financial practices among low-income households, Collins et al. reported a decade ago that most financial microloans are interest-free, as most lenders are friends or family. Informal microfinance began after the Second Indochina War, specifically during the doi moi era. The market has been growing stronger due to the tight bonds between local people, and there is no sign that this tradition will fade as the economy gains more momentum and individuals build up their personal wealth.

The positive changes informal microfinance brought to the local economy seem not widely recognised by the Vietnamese government. Nicolas Lainez, a research associate at the Institute of Southeast Asian Studies wrote “In the euphoria generated by the outstanding success of the doi moi, the Vietnamese authorities have acted as if the informal sector did not exist or was bound to disappear.”

My recent survey conducted among residents of Ho Chi Minh City aimed at assessing the micro-lending history, size, performance, and effectiveness with business purposes.

My recent survey conducted among residents of Ho Chi Minh City aimed at assessing the micro-lending history, size, performance, and effectiveness with business purposes. The survey was sent to 125 Vietnamese ranging from 17 to 55 years old with various jobs in the city.

These results, of course, must be interpreted with caution, and two limitations should be borne in mind: sampling bias and insufficient sample size. Therefore, this survey is to be taken as an insight into a very specific group and cannot be considered representative of the Vietnamese population with a diversity of economic conditions.

Important findings from the surveyWhen asked about the purposes of their loan(s), I was interested in why they chose informal loans over going to a bank, which in many cases would be assumed a more trustworthy option.

A common explanation was that informal credits offer flexibility and are easily accessible for people. Those who require small loans efficiently borrow from the informal markets.

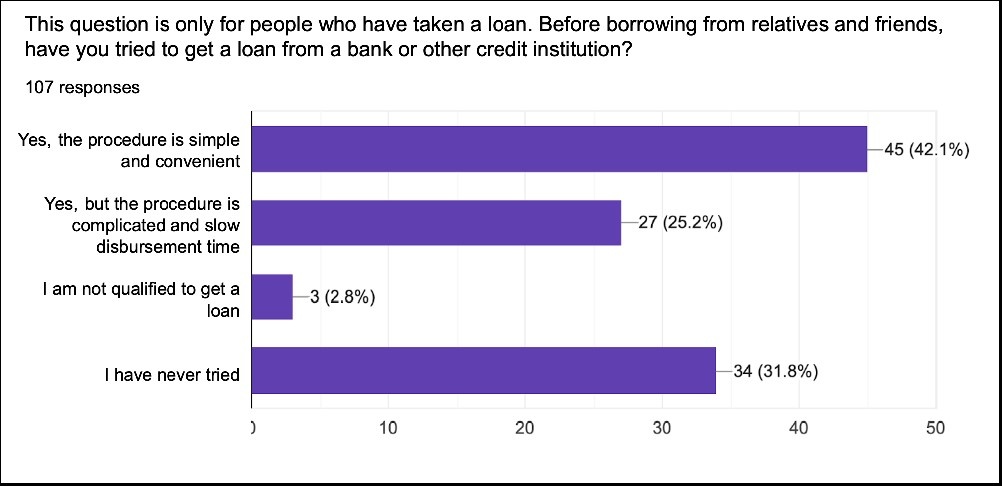

Terms and conditions are very diversified and flexible. I asked the participants whether they have tried the formal method before and 34.6 per cent answered they did not. These people have never gone to a bank to take a loan.

The inability to post collateral, lack of credit history, financial illiteracy, and insecure property titles renders many people from low-income households unable to take formal credit. This leaves interpersonal loans based on social ties as their only option.

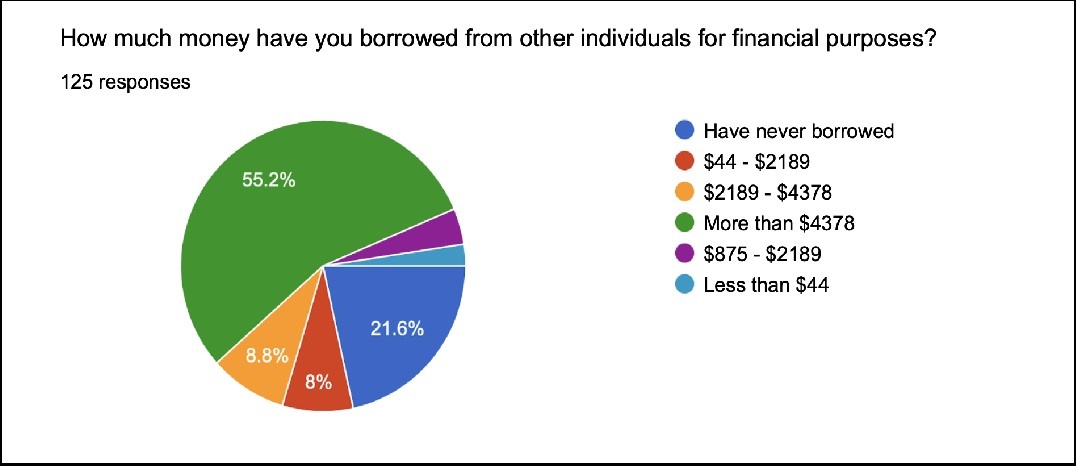

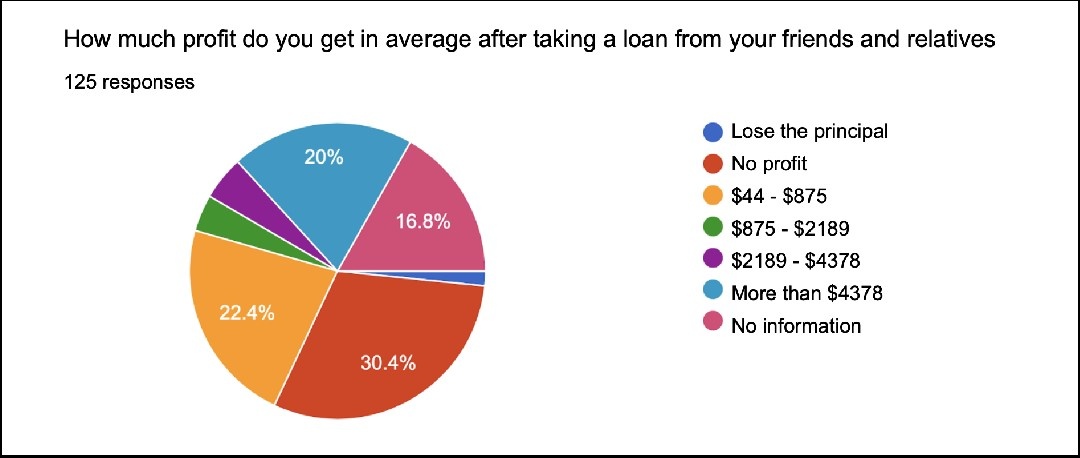

To examine the economic impact of informal microfinance, in this case, microloans, I asked for the amount of money they borrowed (chart 3) and the amount of money they profited from that loan (chart 4).

Chart 3

Chart 3  Chart 4

Chart 4

The amount of loans is not small. In fact, 68 people (55.2 per cent) borrowed more than $4,400. In chart 4, the median profit stated was $1,378.

Meanwhile, the GDP growth in this sector is 31.32 per cent. The highest official GDP growth in Vietnam’s history was 8.4 per cent in financial turbulences in Vietnam’s emerging economy. Informal microfinance grew almost four times than all other sectors combined.

SuggestionsThe shortcomings of the research could be remedied if a microfinance or research institution takes a more comprehensive approach to this topic. Their findings could reveal more about the status quo of the informal microfinance practice in Vietnam. Once arriving at reliable findings, these institutions can design viable solutions to tackle poverty more effectively, using the resources available right within these countries.

Those who have successfully lent or borrowed money could form groups and communities on social media to share tips and advice. They could share how to make the best use of the money on investments and business opportunities. In turn, the borrowers will one day end up being the lenders and continue giving out advice to the next generation.