INTERNATIONAL INVESTMENT

AND PORTAL

The Business Agility Summit 2025, the first international Agile conference dedicated to organisations in Vietnam, was held in Hanoi on May 28 to share digital transformation experiences, attracting the participation of experts and businesses leaders from at home and abroad.

According to Vani Vangala, global product business manager at Infosys Finacle, 2025 has seen a strong rise of new trends in the finance and banking industry. A typical example of this is embedded finance, from which financial services are directly integrated into daily life and business activities. This field is forecast to grow 148 per cent in the next three years, reaching $228 billion in 2028.

She said, “The banking business model is changing profoundly. As the world enters the digital age, a small startup can compete on par with large banks thanks to technology. Digital-only banking is developing strongly, opening up a new playing field where speed and adaptability are decisive factors.”

In addition, new technologies such as generative AI and agentic AI are also attracting special attention globally, with an expected market value of up to $340 billion.

The Business Agility Summit 2025 in Hanoi. Photo: Bich Thuy

The Business Agility Summit 2025 in Hanoi. Photo: Bich Thuy

Echoing Vani Vangala’s view, Dr. Phan Thanh Duc, head of IT and the digital economy department at the Banking Academy of Vietnam, added that the banking and finance industry is undergoing an unprecedented transformation. Previously, financial services mainly revolved around three traditional operations: capital mobilisation, lending, and payments. Technology then played a supporting role, following behind business operations.

“Technology is advancing too fast these days, and some banks often cannot keep up. Some organisations may follow the latest technology as a trend, but in reality, it’s important to answer the question: what problem does that technology solve in a specific business operation?”

He cited a survey showing that about 60 per cent of units do not have appropriate technology infrastructure for digital transformation, which makes it difficult for them to effectively apply new technologies.

Duc pointed out that many banks today are even in a state of being “too big to change”. Meanwhile, more and more new competitors are entering the market, especially fintech companies, so the opportunities for traditional banks are increasingly narrowing.

Agile trends in banking digital transformationAccording to experts, to adapt and maintain their position, banks need to become flexible, not only helping increase internal cohesion and enhance customer satisfaction but also improving operational efficiency, thereby improving financial efficiency sustainably.

Pham Anh Doi, chairman of Agile Academy Asia, said that in its broadest definition, “Agile” is a way of working that embraces and welcomes change as an opportunity, rather than feeling uncomfortable with it or trying to control it. The goal is to tap into new business opportunities and create value for organisations.

“In terms of business thinking, flexibility or Agile requires a change from the traditional “win-lose” mindset where customers gain, businesses lose, and vice versa, to a win-win mindset. When we help customers achieve their goals, businesses also have opportunities to develop. In the Vietnamese banking and finance industry, this mindset is gradually taking shape, but needs to be promoted more strongly to make the most of the opportunities from change,” he added.

In particular, in the AI era, the relationship between AI and Agile in organisations is not only close but also inevitable. AI is no longer simply a technology trend, it is becoming a powerful wave that forces both businesses and individuals to adapt and change to survive and develop.

Dennis Khoo, former head of TMRW Digital Group, UOB, shared the Agile approach in banking digitalisation. Photo: Bich Thuy

Dennis Khoo, former head of TMRW Digital Group, UOB, shared the Agile approach in banking digitalisation. Photo: Bich Thuy

Speaking at the conference, Dennis Khoo, former head of TMRW Digital Group, UOB, and the author of the best-selling book Driving Digital Transformation, said that agility is extremely important to the success of any digital transformation process in large organisations. However, agility is not just a method but also a cultural factor.

“Through my work with companies in Vietnam, I have noticed a prominent issue: the power gap in Vietnamese culture is considerable. Vietnamese people tend to believe that the boss is always right. Meanwhile, flexibility requires a different mindset: the boss is not always right, and is even often wrong,” Khoo added.

He shared that Agile is not just a buzzword, it needs to be accompanied by a cultural change that encourages challenge and debate. Agile is not just about collaboration, it requires bottom-up change, rather than just top-down change like traditional management.

“The success of a digital solution does not depend on agility alone, but requires a harmonious combination of all factors, from strategy, data, and technology, to people and leadership. Only when these connections are well managed can banks measure success comprehensively,” he emphasised.

An agile approach to data analytics

An agile approach to data analytics

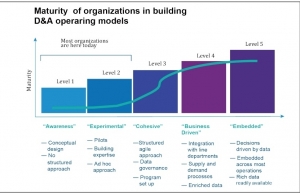

For the past few years, data analysis has been a central factor used in business decisions, specifically aimed at generating new growth (based on deep customer insights, and by creating new experiences), enhancing productivity, and managing risk. Especially in the financial industry, to support business decisions, organisations adopt various forms of analytics, from traditional ways to those based on real-time, machine learning or other cutting-edge techniques.

Business leaders meet to discuss the changing nature of finance

Business leaders meet to discuss the changing nature of finance

A conference was held on April 6 at Lotte Hotel, Saigon to discuss the transformation journeys of organisations, the need to be more forward-thinking, and how to focus on value-added activities to remain relevant in a changing world.

Futurise Lead RegTalk 2024: Agile Regulations Crucial to Fulfilling NIMP Target

Futurise Lead RegTalk 2024: Agile Regulations Crucial to Fulfilling NIMP Target

In a Regulatory Talk 2024 by Futurise Sdn Bhd through the National Regulatory Sandbox gave its commitment to support Malaysia's New Industrial Master Plan (NIMP) 2030 vision.