INTERNATIONAL INVESTMENT

AND PORTAL

BAC A BANK has received its first international credit rating, marking a new milestone in its development and transparency journey.

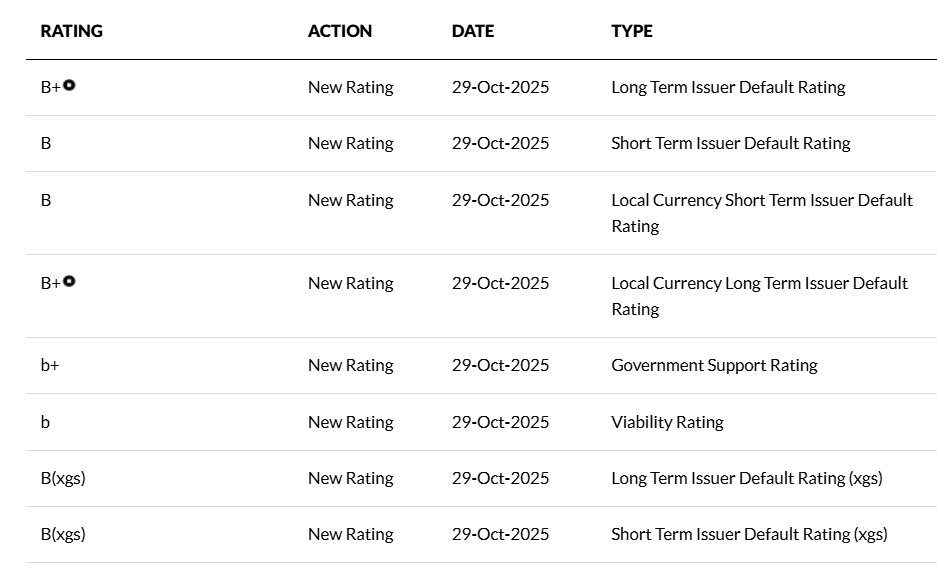

On October 29, Fitch Ratings assigned Bac A Commercial Joint Stock Bank (BAC A BANK) a Long-Term Issuer Default Rating (IDR) of B+ with a 'Stable Outlook'. As one of the world’s top three credit rating agencies, alongside Moody’s and S&P, Fitch’s evaluations serve as a key benchmark for global investors and financial institutions in assessing creditworthiness and financial stability.

Being awarded a long-term IDR of B+ marks a significant milestone for BAC A BANK, reflecting recognition of its solid financial capacity, effective risk management, and potential for sustainable growth. The rating also provides a strong foundation for the bank to expand international cooperation, diversify funding sources, enhance market credibility, and strengthen investor confidence both domestically and abroad.

Source: https://www.fitchratings.com

Source: https://www.fitchratings.com

According to the published report, Fitch Ratings also assigned BAC A BANK a Viability Rating of 'b' and a Government Support Rating of b+. These ratings highlight BAC A BANK’s operational independence, resilience, and sound financial health amid ongoing macroeconomic volatility and challenges.

“BAC A BANK's loan quality is a relative rating strength. Its non-performing loan ratio of 1.2 per cent at end-June 2025 is lower than most of its peers', helped by its more moderate risk appetite and the buoyant economy,” Fitch Ratings said. “This is offset by risks associated with its high large-borrower concentration, a trait shared by many of its small local peers, and its focus on business borrowers that tend to be smaller than those at larger banks.”

BAC A BANK has a higher proportion of lending towards agriculture (18 per cent of loans) and the rural sector relative to other private bank peers. This underscores its business strategy and close association with TH Group, a local conglomerate with business interests in sectors such as agriculture, dairy and healthcare. BAC A BANK's pricing power is constrained by its modest franchise, contributing to above-average deposit costs and a loan portfolio that is skewed towards small businesses and household borrowers.

The Stable Outlook indicates Fitch Ratings’ expectation that BAC A BANK will maintain its current credit profile, continue its prudent risk management, and further improve profitability over the next 12 to 18 months. The report highlights that the bank’s profitability metrics are more stable than those of most peers of similar size, underpinned by a consistent business strategy and effective credit cost control.

"This rating from Fitch recognises our consistent focus on prudent risk management, asset quality, and credit stability," said Chu Nguyen Binh, deputy general director of BAC A BANK. "It enhances our credibility in international capital markets, opens up new opportunities for global cooperation, and reaffirms our long-term commitment to sustainable, transparent, and efficient growth built over 31 years."

Beyond BAC A BANK’s individual assessment, Fitch Ratings also underscored that Vietnam's GDP growth picked up to 7.9 per cent in the first nine months of 2025, from 7.1 per cent in 2024.

“We believe some of the outperformance is driven by the front-loading of manufacturing and merchandise exports amid global trade tensions and economic activity is likely to moderate in the later part of 2025 and into 2026,” Fitch Ratings said. “Nevertheless, announced US tariff rates on Vietnamese exports have been reduced to 20 per cent from an initial 46 per cent, easing the risks of a much worse trade contraction. We believe Vietnam's medium-term economic prospects remain promising, providing a favourable environment for the banking system's growth.”

Earlier, in its June 2025 review, Fitch Ratings declared Vietnam’s long-term sovereign credit rating at 'BB+' with a Stable Outlook. This rating continues to reinforce international investor confidence, enabling domestic financial institutions – including BAC A BANK – to enhance access to global funding sources and strengthen their position in regional financial markets.

By Thanh Tung