INTERNATIONAL INVESTMENT

AND PORTAL

The Vietnamese government has specified the propellants of consumption, investment, and exports for the country’s economic growth this year. Do you think that these factors are sufficient for Vietnam to hit its desired growth target?

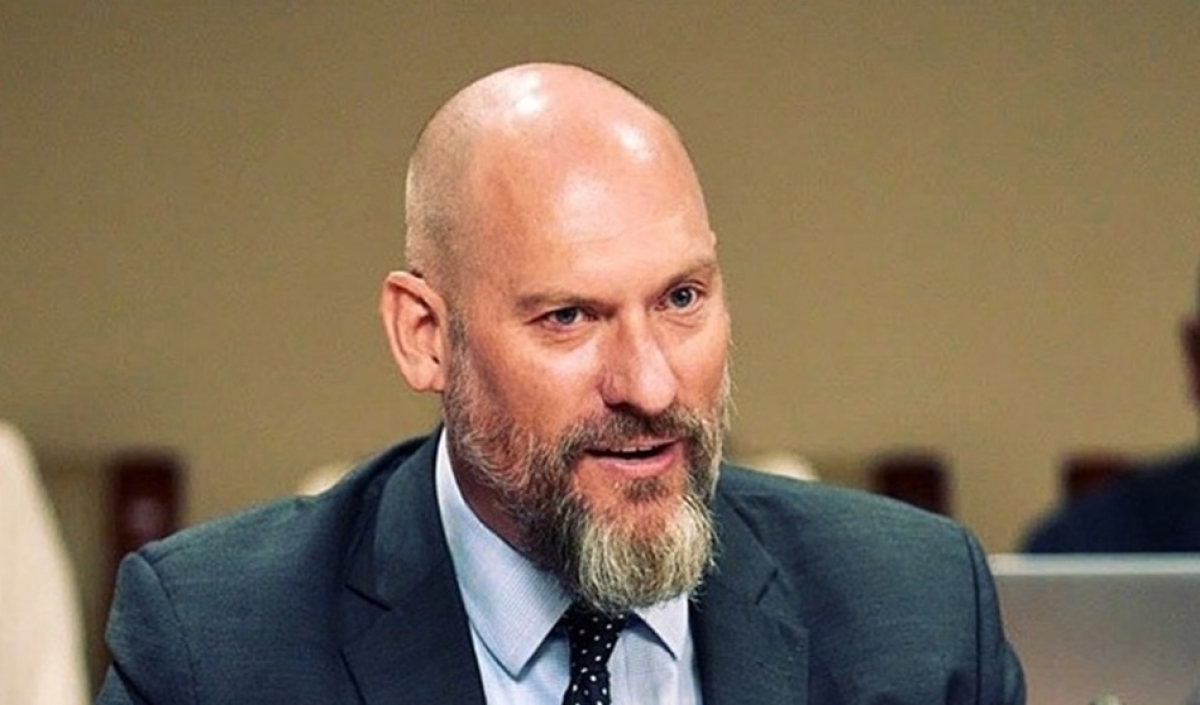

Nguyen Ba Hung, principal country economist at the Asian Development Bank (ADB) in Vietnam

Nguyen Ba Hung, principal country economist at the Asian Development Bank (ADB) in Vietnam

The demand-side of the economy consists of government spending, private investment and consumption, and net export. So far this year, export and import rates may slow due to global economic woes and they may need more time to strongly bounce back. It is worth noting that while the country maintained trade surplus, its export sector relies heavily on processing-for-export and thus suffering a significant hit when export fell by over 12 per cent, although import also dropped by a larger rate.

The economy therefore depends on domestic demand as growth drivers, in which the government still has significant fiscal space to boost public spending as a counter-cyclical measure. Currently, private consumption is facing the downside of the business cycles. Economic difficulties have forced consumers to tighten their belts and enterprises also have no opportunities to invest due to weak domestic and external demand.

Thus, the government now can help boost private demand and consumption via its fiscal policy in which public investment plays a crucial role.

In the first seven months of 2023, public investment disbursement reached about 40 per cent of the annual plan. Disbursing the remainder will be a colossal challenge and this target must be completed if the government wants to stimulate demand effectively. Accelerating public investment disbursement can create more jobs and incomes, and help boost private investments. This would accordingly help domestic businesses to increase investment and consumption.

Additionally, the government has introduced cuts in taxes and fees. This will help spur private consumption as with the same amount of disposable income, one can buy more goods with a tax reduction. However, any enacted policies will take some time to have effects on the market, which depends on the sentiment and psychology of consumers and businesses.

What is more, the government can also consider more assistance to workers, especially those who are forced to be unemployed or under-employed, with some form of allowance to make up for reduced income. More support could also be offered to businesses for re-skilling or up-skilling of human resources as appropriate, to prepare for the recovery when companies would need a larger quantity of highly-skilled employees.

What is your take on Vietnam’s resilience to global headwinds as compared to regional economies?

The Vietnamese economy is at a very high level of openness to the global economy, with its export turnover accounting for almost 80 per cent of GDP, and the ratio of export-import turnover to GDP is now over 150 per cent. This would mean that the economy is highly vulnerable to any shocks in the world economy.

However, I see that the country’s monetary and fiscal policies have been flexible and prudent. For example, when there is a risk of inflation, the government has increased the interest rate, and when the inflation is already controlled, the government has also adjusted the monetary policy.

But some limitations remain. For example, the policy implementation is slow and sometimes ineffective.

Currently, the Vietnamese economy’s growth to a large extent is relying on domestic consumption. In H1 of 2023, 2.5 out of 3.72 per cent of economic growth is from consumption, which has been acting as a major growth impetus. This could be a source of resilience for the economy.

If difficulties continue, consumers and businesses would tend to continue tightening their belts, meaning demand will decrease. But if counter-cyclical policies prove effective, it will help boost private consumption and consumers will expand spending.

The economy must grow 8-9 per cent in the second half of the year in order for Vietnam to reach its growth goals. Do you think this is possible?

I think that growth targets are meant to be a directional guide for policy measures. Whether they can be realised would depend on the policy responses and how effectively the policies are implemented.

At present, almost all policy directions set out by the government are quite sound, but in some cases, how their implementation to a desired effect is another story. The government has reported to the National Assembly that all efforts must be made to reach a growth target of 6-6.5 per cent for the whole year, and a series of policies have been enacted to hit the target. However, as I have said, considering that some measures were introduced after the second quarter, it would need more time to see how effective they are.

We may need to wait until late September when the official figures for the third quarter are announced, and then we will be able to see how the enacted policies have been translated into reality and how much they have benefited enterprises. And based on that, the government can make further adjustments in policies.

If the economy grows 7-8 per cent in Q3 and Q4, it will have more opportunities to bounce back strongly for the whole year, and vice versa - if it ascends only 4-5 per cent, the economy will not be able to fulfil its growth target as set earlier.

What is the ADB’s forecast on the Vietnamese economy’s outlook this year?

In its Asian Development Outlook for July, the ADB lowered its growth projection for Vietnam from 6.5 to 5.8 per cent in 2023, and from 6.8 to 6.2 per cent in 2024, as compared with its April estimates.

The forecast adjustment was based on a number of factors, most notably the impact of external conditions that the country’s export and import situation expected to continue facing difficulties. Not only Vietnam, but also many other Asian economies, are expecting a strong recovery in China’s economy. However, such Chinese recovery remained relatively low, with a growth rate of only 4.5 per cent on-year.

Additionally, Vietnam’s key export markets remain weak, indicating a slow recovery for export demand. For example, the US economy is facing high inflation, though it has yet to fall into a recession, while many European nations are facing a recession.

Also, the Russia-Ukraine conflict rumbles on, causing volatility on the global energy and food markets. These are significant uncertainties affecting the Vietnamese economy’s prospects.

Government strives to extend fiscal policy outlined by PSRD

Government strives to extend fiscal policy outlined by PSRD

Amid difficulties forecast to continue undermining the business community, a fiscal policy under Vietnam’s hallmark socioeconomic recovery initiative is expected to be lengthened next year in a bid to fuel enterprises’ performance and achieve desired economic growth.

Learning recent lessons to ensure fiscal prudence in 2023

Learning recent lessons to ensure fiscal prudence in 2023

Fiscal and monetary policies worldwide witnessed changes last year, and the same has also been true of Vietnam. Nguyen Minh Cuong, principal country economist at the Asian Development Bank in Vietnam, spoke to VIR’s Hong Dung about how it can apply relevant initiatives this year.

IMF says Vietnam's fiscal policy should support the vulnerable

IMF says Vietnam's fiscal policy should support the vulnerable

An International Monetary Fund (IMF) team led by Paulo Medas completed discussions for the 2023 Article IV consultation with Vietnam from June 14-29.