INTERNATIONAL INVESTMENT

AND PORTAL

FTSE Russell has released the plan to implement the reclassification of Vietnam from frontier to secondary emerging market status.

FTSE Russell will be reclassifying Vietnam from frontier to secondary emerging market status within the FTSE Global Equity Index Series (GEIS) and associated indices effective from the September 2026 semi-annual review, subject to an interim assessment in March 2026.

The reclassification will be implemented in multiple tranches. The deletion from the FTSE Frontier Index Series will be implemented in a single tranche in conjunction with the FTSE Frontier index annual review in September 2026, while inclusion to the FTSE Global Equity Index Series (GEIS) will commence in conjunction with the September 2026 FTSE GEIS semi-annual review, subject to an interim assessment in March 2026.

FTSE Russell also noted the March 2026 interim assessment will evaluate whether sufficient progress has been made in facilitating access to global brokers, which is an essential component for supporting effective index replication.

The global broker access model refers to an optionality to allow foreign institutional investors to face global brokers as counterparties. This initiative is expected to align Vietnam’s market practices with international standards, reduce counterparty risk, and strengthen investor confidence through established relationships with trusted intermediaries.

The inclusion of Vietnam into FTSE GEIS is expected to be implemented in multiple tranches. Details of the phased implementation will be provided in the March 2026 announcement, following consultation with FTSE Russell’s Advisory Committees and market participants and final ratification by the FTSE Russell Index Governance Board.

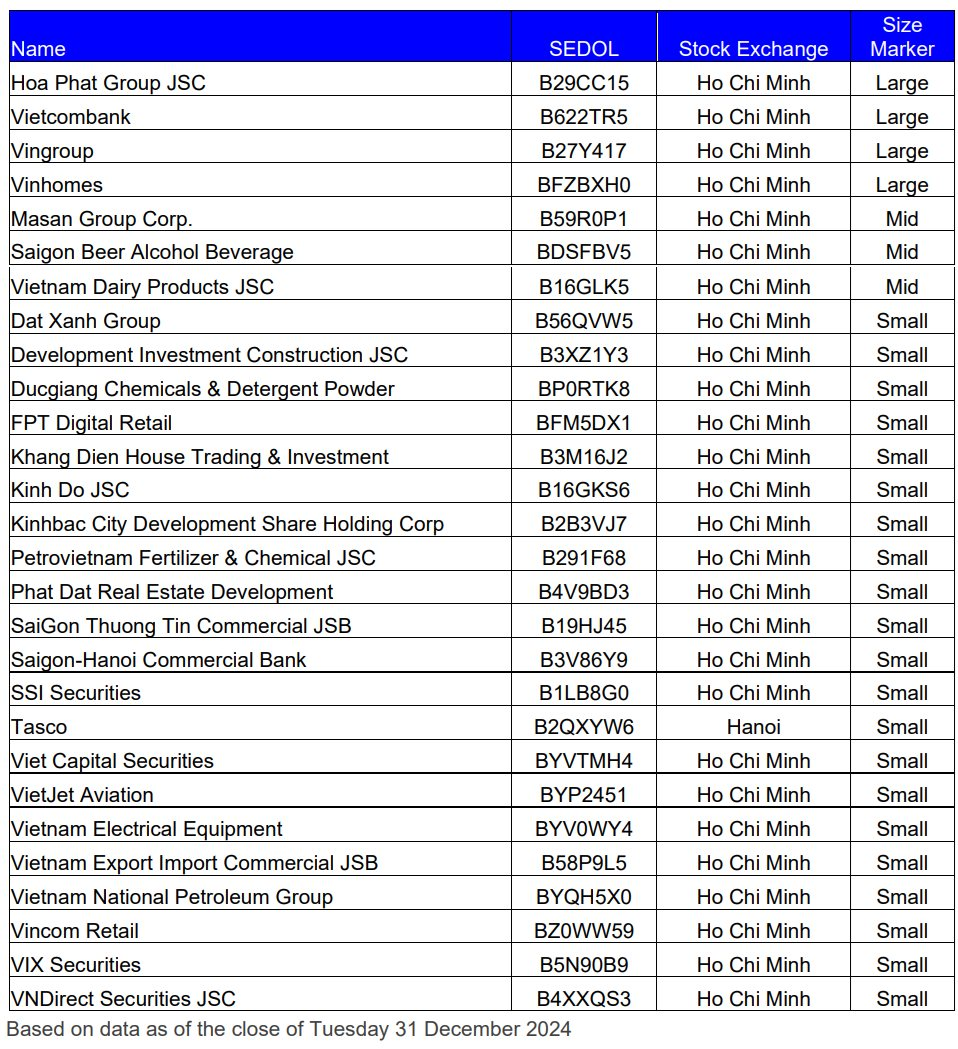

In addition, FTSE also lists the indicative Vietnamese securities that met the FTSE Global All Cap index eligibility screens based on data as of close of business on December 31, 2024.

The final confirmed list of Vietnamese securities that will be eligible for the index inclusion will be published in advance of the FTSE GEIS September 2026 semi-annual review.

According to this list, many companies’ stocks have met the eligibility criteria. Among them, four are classified as large-cap stocks (HPG, VCB, VIC, and VHM); three are mid-cap stocks (MSN, SAB, and VNM); while the rest fall into the small-cap category (such as DXG, FPT, KDC, and KBC).

FTSE Russell also points out the projected index weight of the Vietnam securities (listed in Q4) within FTSE indices based on data as of close on October 31. Specifically, Vietnam will account for 0.04 per cent in the FTSE Global All Cap Index, 0.02 per cent in the FTSE All-World Index, 0.34 per cent in the FTSE Emerging All Cap Index, and 0.22 per cent in the FTSE Emerging Index.

From the FTSE GEIS September 2026 semi-annual review onwards, Vietnamese securities will be reviewed as part of the FTSE Asia-Pacific ex-Japan ex-China region.

Vietnam eyes FTSE Emerging Market status at London event

Vietnam eyes FTSE Emerging Market status at London event

Vietnam’s emergence as ASEAN’s most dynamic equity market, underpinned by strong economic growth and surging liquidity, will be in the spotlight at the London Stock Exchange this month when international investors gather for a landmark conference.

Vietnam's stock market looking for conclusion from FTSE Russell

Vietnam's stock market looking for conclusion from FTSE Russell

The upcoming reclassification review by FTSE Russell is generating a ripple effect across Vietnam's stock market. Investor attention is now focused on the potential upgrade and the opportunities it could bring in terms of attracting foreign capital.

Vietnam to be reclassified from frontier to secondary emerging market status

Vietnam to be reclassified from frontier to secondary emerging market status

FTSE Russell, a global index provider, on October 7 announced that Vietnam will be reclassified from frontier to secondary emerging market status with an effective date of September 21, 2026, subject to an interim review in March 2026.

By Thanh Van