INTERNATIONAL INVESTMENT

AND PORTAL

While global deal activities remain clouded by macroeconomic volatility including recession fears, rising interest rates, a steep decline in equity valuations, geopolitical tensions, and supply chain disruptions, three-fifths of global CEOs say they are not planning to delay deals in 2023, according to our annual global CEO survey.

Ong Tiong Hooi-Partner of Transaction Services, PwC Vietnam

Ong Tiong Hooi-Partner of Transaction Services, PwC Vietnam

The global M&A market faced a challenging 2022 with volumes and values declining from record-breaking highs of 65,000 deals in 2021 – respectively by 17 and 37 per cent – although remaining above 2020 and healthy pre-pandemic levels.

In the second half of 2022, deal volumes and values declined by a greater portion by 25 and 51 per cent, respectively, compared to 2021.

However, the impact of various macroeconomic and geopolitical factors has not impacted M&A markets uniformly. India, for example, was an outlier in 2022, seeing activity rise by 16 per cent and volume by 35 per cent to an all-time high, compared to double-digit declines in the United States, China, and many other territories.

The outlook finds that M&As, and particularly portfolio optimisation, continues to represent a strategic opportunity for market players – irrespective of challenging macroeconomic and geopolitical factors – and remains a tool to help CEOs reposition their businesses, bolster growth and achieve sustained outcomes over the longer-term.

In light of the fresh outlook, global M&A activities in 2022 varied by region, with more deals in Europe, Middle East and Africa (EMEA) in 2022 than in the Americas and Asia-Pacific regions, despite higher energy costs and regional instability, highlighting a shift by investors to find opportunities and growth in other markets.

In EMEA, deal volumes and values declined by 12 and 37 per cent, respectively, between 2021 and 2022. With approximately 20,000 deals in 2022, activity in the region remained 17 per cent higher than pre-pandemic 2019 levels.

In the Americas, (approximately 18,000 deals) deal volumes and values declined by 17 and 40 per cent, respectively, between 2021 and 2022.

Deal values were particularly hard-hit, and the number of US mega-deals with a value exceeding $5 billion almost halved from 81 to 42 between 2021 and 2022, respectively.

The decline in the second half of the year was more acute, with just 16 mega-deals compared to 26 in the first half of 2022.

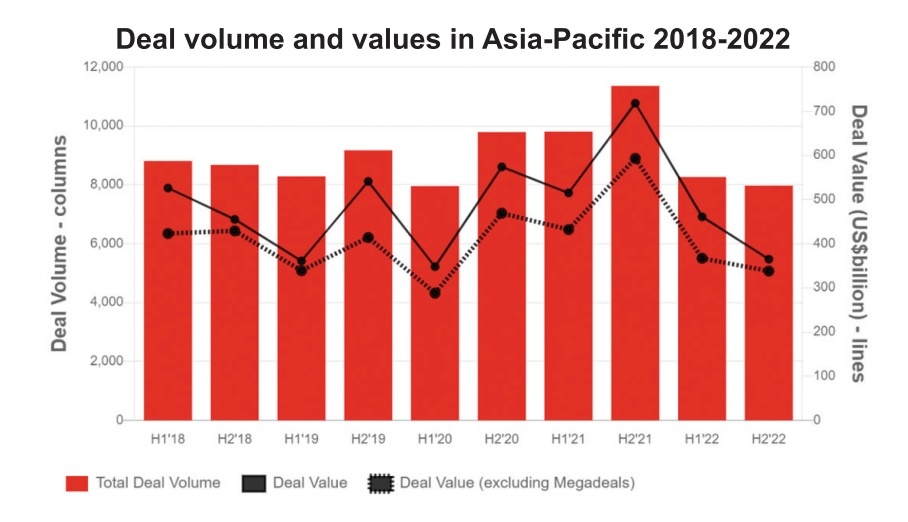

In Asia-Pacific (approximately 16,000 deals), volumes and values declined by 23 and 33 per cent, respectively, in the same period. The greatest declines were observed in China, where deal volumes and values shed 46 per cent and 35 per cent, respectively.

Companies seeking access to Asian markets are increasingly looking beyond China to India, Japan, and other countries within Southeast Asia for investment opportunities.

India has emerged as an increasingly attractive destination for investment, overtaking Japan and South Korea in deal values to rank second in the region behind China.

The global economy is presently facing countless pressures such as inflation and impending economic downturn, and Vietnam’s M&A market is not outside that general disruption.

The Asia-Pacific region, however, remains the sweet spot for global growth due to a wide range of factors, including burgeoning intergenerational wealth transfers, accelerated sector modernisations, growing intra-Asian trade flows, and a nascent focus on environmental, social, and governance.

Macroeconomic volatility and geopolitical conflict are not having a uniform impact across industries, and several industry dynamics will create opportunities for M&A.

In Industrial Manufacturing and Automotive, portfolio optimisation will drive divestitures and acquisitions, particularly those focused on sustainability and accelerating digital transformation. Disruption from platforms and fintech is driving rapid technological changes and will boost M&A as players seek to acquire digital capabilities among financial services companies.

Moving forward, the energy transition will remain a priority for investors and management teams, directing large volumes of capital to M&As and other capital project development.

While challenges remain on the consumer front in 2023, portfolio reviews and a focus on transformational transactions will create M&A chances. Macroeconomic and geopolitical volatility will also impact market players differently. For instance, strong balance sheets will present opportunities for corporates given tight financing conditions.

Meanwhile, venture capital may retreat from some riskier investments, but climate tech investing remains a potential bright spot with more than one-quarter of all venture capital funding now going to climate technologies, especially those focused on cutting emissions.

Implications of digital assets in M&A

Implications of digital assets in M&A

Digital assets have gained a lot of attention over retail investors, institutional investors, companies and policymakers in recent years. Despite the dramatic decline of the market, the potential growth for digital assets over the upcoming decade is expected to be high and reach tenths of trillions of US dollars market capitalisation according to prominent money managers like Fidelity and Ark Invest.

M&A Vietnam Forum 2022: 'Igniting new opportunities'

M&A Vietnam Forum 2022: 'Igniting new opportunities'

The 14th Vietnam M&A Forum 2022 organised by Vietnam Investment Review under the auspices of the Ministry of Planning and Investment took place in Ho Chi Minh City on November 23.

Experts look to 2023 for top M&A deals

Experts look to 2023 for top M&A deals

Although the merger and acquisition market in Vietnam has been slow going in 2022, opportunities next year should be abundant even despite concerns from prolonged global economic storms, according to various insiders.

The state of play in healthcare M&As

The state of play in healthcare M&As

Merger and acquisition moves are one of the more effective measures for foreign investors entering the Vietnamese medical and pharmaceutical industry, utilising available factories and inexpensive labour. Ngo Thanh Hai, Nguyen Dieu Quynh, and Le Anh Thu from LNT & Partners offers an overview of the factors and barriers involved when it comes to dealmaking in pharma.

Tech groups hope for boost via M&As

Tech groups hope for boost via M&As

Driven by acceleration in digital transformation, technology is emerging as a high-potential industry for merger and acquisition transactions in Vietnam.