INTERNATIONAL INVESTMENT

AND PORTAL

Last week the State Bank of Vietnam continued reducing diverse regulatory interest rates in a bid to help remove impediments for borrowers, as well as support credit institution efforts to drive down input costs, and from there be able to reduce lending rates.

Latest figures from the central bank show that in late February the on-balance sheet non-performing ratio of the banking system stood at 2.91 per cent, an increase compared to 2.46 per cent in late 2016, 1.49 per cent in late 2021 and most recently, 2 per cent in late 2022.

However, according to a State Bank of Vietnam (SBV) assessment, several sorts of debts have the potential to be turned into bad debts in the future, such as investment into corporate bonds for debt restructuring, hard-to-collect receivables, among others.

“If such debts were considered, the non-performing loans (NPLs) ratio of the system might reach 5 per cent of total outstanding balances,” said SBV Governor Nguyen Thi Hong.

One positive point is that credit institutions have been taking practical measures to ensure operational safety through boosting their loan loss reserve (LLR) funds for their bad debts.

Accordingly, credit institutions have maintained a fairly high LLR ratio approximating 125 per cent in late 2022, which is well above the five-year average level at 109.4 per cent, and double that a decade ago, 61 per cent in late 2012.

By the end of last year, the LLR ratio at leading state lender Vietcombank touched 317 per cent, at MB 238 per cent and at BIDV 215 per cent, for instance.

Le Thanh Quy Ngoc, Risk Management director at Ho Chi Minh City-based commercial lender OCB, noted that dealing with bad debts and collaterals was a constant requirement of credit institutions particularly and the banking sector generally, alongside developing credit scale and lending products.

Recent vulnerabilities economically and socially at home and abroad are posing fresh challenges when it comes to tackling bad debts of the banking system.

Hence, it urgently needs more active support from management authorities at all levels and relevant management agencies to remove difficulties, and from there create the necessary legal corridor to aid credit institutions’ efforts in dealing with bad debts in a substantial and efficient manner.

A leader at major private lender Eximbank opined that bad debts is one of the factors casting big impacts on the operation of banks, as credit still holds the highest proportion in banks’ total asset value.

Credit brings the largest income source, yet it is the most risky business for banks. Hence, for efficient operation, banks need to pay top attention to the credit and service quality, and bad debt management.

Nguyen Hung, CEO at tech-driven TPBank said, “The mobilising rate from economic organisations and the community fetches high in the past months. Banks are scaling up efforts to save on cost and expenses to be able to lower lending rate. The capital cost is decisive to lending rate move. With lower capital cost, banks can significantly reduce the lending rate.”

Can Van Luc, chief economist at BDIV, said that although the government, the SBV, ministries and sectors are very proactive and taking radical measures to support businesses, including issuing fiscal policies on reduction, exemption and payment extension of taxes and fees, the banking system’s bad debt might be further swelled in 2023.

“Legalising regulations on bad debt and collateral handling is crucial to create a sustainable legal corridor to deal with bad debts and ensuring safety to the operation of credit institutions,” said Luc.

Senior economist Le Xuan Nghia said, “Amid rising bad debts, banks must put more into their provisioning funds, leading to augmenting credit costs and lesser room to soften the lending rate.”

Industrial developers eye the effects of upcoming tax regime

Industrial developers eye the effects of upcoming tax regime

Industrial real estate developers must be more proactive in responding to the upcoming global minimum tax policy by improving the quality of industrial zone infrastructure and providing more utilities for their tenants.

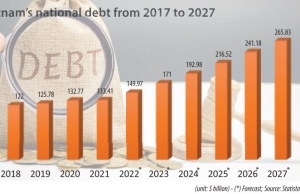

Public debt management picture clears towards 2025

Public debt management picture clears towards 2025

Vietnam’s plan for borrowing and paying public debt has been revealed, and the budget landscape finalised for this year, with public debt set to stay within the permissible limit.

Rising bad debt threat looms large

Rising bad debt threat looms large

Despite a bright business outlook, non-performing loans are causing significant concerns to banks amid a challenging environment in both the domestic and global market, according to industry experts.

Growing bond market illustrating bad debt snags

Growing bond market illustrating bad debt snags

While the bad debt market in Vietnam is still in its infancy and positive conditions have converged, stronger steps need to be taken.

By Hong Thuy