INTERNATIONAL INVESTMENT

AND PORTAL

Asian economies could get stuck in the middle-income trap and held back from sustainable and equitable growth, unless policy action is taken to galvanise green finance, speed up digitalisation, and deliver more comprehensive regional policy coordination, according to the Asia House. However, Vietnam supposedly still has room for improvement in terms of green finance and digital transformation.

How ready are Asia's economies for a green and digital future?

How ready are Asia's economies for a green and digital future?

As in the rest of the world, policies in Asia have so far failed to provide the levels of real investment spending capable of securing a sustainable recovery from the pandemic. Low-interest rates and injections of liquidity have created financial wealth and spurred consumption – but they have only had a limited impact on real investment.

Investment, as well as cross-border trade, may well decelerate further in 2022 as the global economy stages an uneven recovery at best. The World Trade Organisation sees Asian exports growing at just 2.3 per cent this year, below pre-pandemic levels.

Many central banks, meanwhile, are not able to respond to the 2022 recovery challenge, having largely exhausted their monetary policy options by reducing interest rates significantly.

Against a backdrop of gradually rising consumer price inflation, the next moves in monetary policy in developed economies may well be tightening – the Bank of England has already moved that way – which could lead to significant declines in asset prices.

A shift would then be needed towards policies that specifically address both the immediate economic scarring of the pandemic and secure longer-term resilience and prosperity.

For the 21st century to become the Asian century, with Asia’s economies set to take a share of over half of global GDP by 2050, only a determined effort by the authorities to fill an evident policy gap will enable growth to continue at the required levels. Adopting a trio of priorities now would enable a robust economic tomorrow, namely green finance, digitalisation, and enhanced regional cooperation.

For green finance, unprecedented levels of coordinated public and private investment are required to meet the Paris Climate Agreement commitments supporting the transition to a low-carbon world.

In Asia, however, access to and the distribution of green finance remains profoundly uneven; this is a partial reflection of the variable depth and breadth of the region’s financial markets, as well as an inability to mitigate and underwrite the risks attached to inward investment.

Only by addressing these obstacles to green finance will policymakers be able to create ecosystems within which green investment can flourish and be mainstreamed. Supporting green finance allows steps to be taken towards combatting climate change, while at the same time avoiding investments that raise the risk of cascading environmental crises.

Prioritising wider digitalisation will boost economic resilience and productivity in a region that is already a leader in digital innovation. Asia can build further on digital success stories that are supporting its drive to tackle climate change and where digitalisation is increasingly being applied in agricultural, financial, and energy markets.

Source: Asia House

Source: Asia House

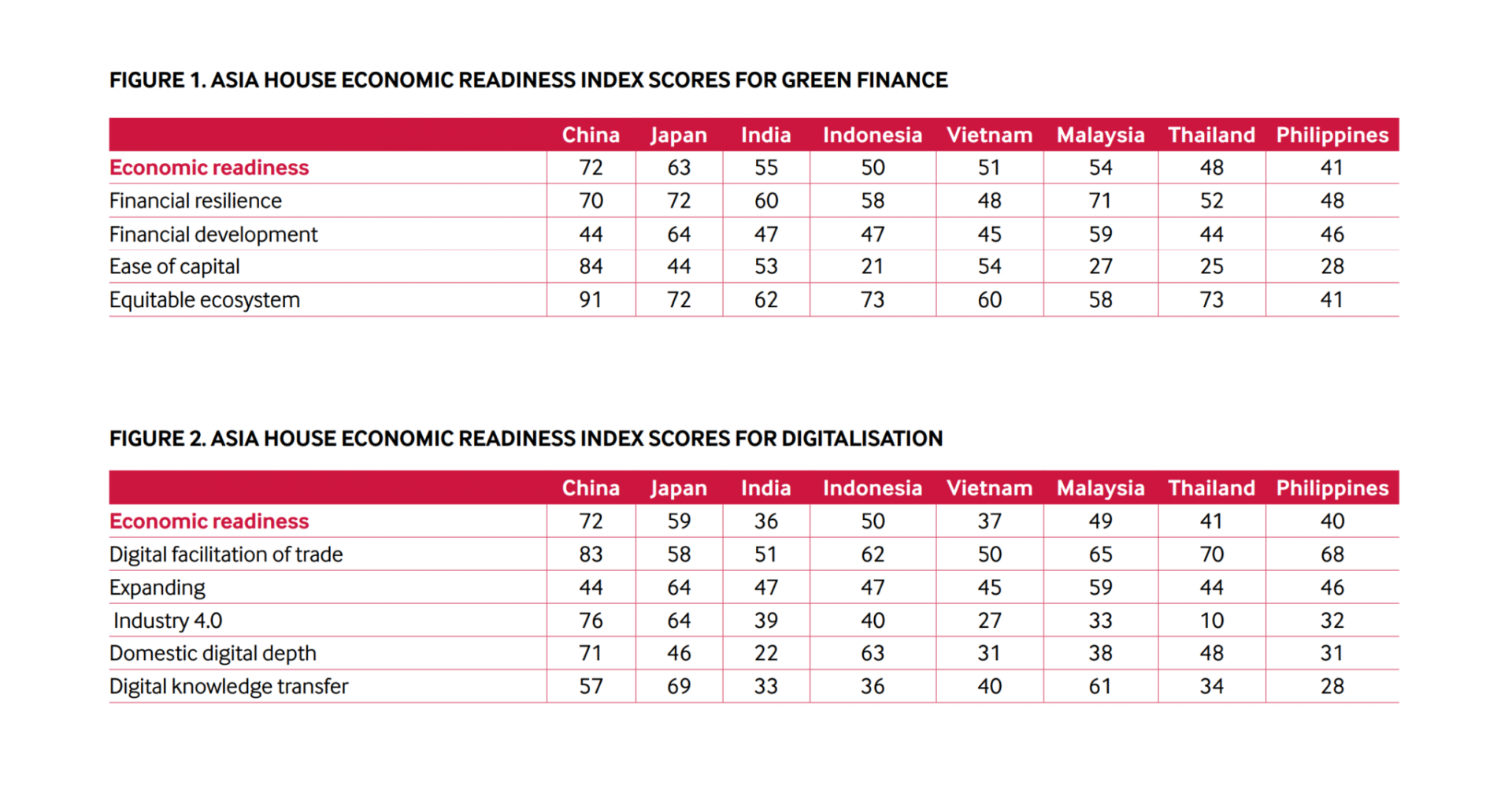

On the other hand, the London-based think tank assessed eight key economies in Asia across metrics conducive to meeting these challenges (see chart). In two new indices, Asia House analyses the performance of China, India, Indonesia, Japan, Malaysia, the Philippines, Thailand, and Vietnam in the critical areas of green finance and digitalisation readiness – areas that will unlock future productivity and enable sustainable growth.

China leads the Asia House Economic Readiness Indices but will see economic growth slow in 2022 due to the ongoing disruption of COVID-19. While India is expected to be the world’s fastest-growing economy this year, it ranks lowest for digital readiness out of the eight economies assessed. Closing its digital divide will be essential for its long-term growth.

Japan ranks second across both indices and is likely to experience a moderate acceleration in growth in 2022, but authorities must speed up digitalisation efforts, the report finds. Within Southeast Asia, Malaysia and Indonesia lead in green finance readiness and digital transformation respectively.

Meanwhile, Vietnam earned 51 points in “economic readiness for green finance” and 37 points in “economic readiness for digitalisation” indices respectively.

Asia House