INTERNATIONAL INVESTMENT

AND PORTAL

The draft amendments to the law, which is now under debate and scheduled to be adopted on November 26, stipulates that a 5 per cent rate shall be applied to many types of items including fertiliser and iron used for fertiliser production.

Impacts on VAT fertiliser rate rise considered for farmers, Source: freepik.com

Impacts on VAT fertiliser rate rise considered for farmers, Source: freepik.com

In the existing law, fertiliser is free from any VAT, which, according to the National Assembly Standing Committee, has been causing difficulties for fertiliser producers. This is because they are not allowed to declare and deduct VAT for their input goods and services, including activities involving investment and fixed assets purchase in service for their own performance.

Instead, VAT payment is made for costs of products, leading to a rise in selling prices and a reduction in profits, meaning the products are less competitive than imported similar items. As they are not allowed to deduct VAT for input goods and services, enterprises do not want to expand investment, goods purchase, repair, and grade fixed assets to create high-quality products.

However, a 5 per cent VAT rate was given the thumbs-down from many lawmakers last week. National Assembly (NA) deputy Le Huu Tri, representing the south-central province of Khanh Hoa, commented that he understands why the law compilation board wants to apply the rate on fertilisers.

“However, it is very necessary to thoroughly consider this and make comprehensive assessment about how it will impact millions of farmers and domestic agricultural production,” Tri said.

At present, farmers account for more than one-third of the country’s population, and are responsible for nearly half of rural households, with over 9.1 million farming households.

“If fertilisers are subject to a 5 per cent VAT rate, farmers and agricultural production will suffer from negative impacts because of the fertiliser prices. This will surely increase the prices of agricultural products, which will then reduce their competitiveness,” Tri explained.

“Meanwhile, farmers are also always facing massive issues such as natural disasters or epidemics. The 5 per cent VAT rate would mean their production and livelihoods will become more difficult.”

NA deputy Le Thi Song An, representing the Mekong Delta province of Long An, said that it is not necessary to apply the VAT rate on fertiliser.

“I suggest that the drafting board should consider and move fertilisers to the category of non-VAT. It is because VAT is an indirect tax and in the end, those who has to bear the tax are consumers, and in this case, farmers,” An stressed.

An cited calculations as revealing that applying a 5 per cent rate on fertilisers will help increase the budget by about $175 million a year, which can contribute to increasing resources for socioeconomic development activities. At the same time, the deduction of input VAT is an advantage that helps domestic enterprises reduce product costs and raise competitiveness against imported fertilisers.

“However, like many other deputies, what I am concerned about is that farmers will have to bear the high price of fertilisers and when fertiliser prices increase, agricultural production costs will follow suit, raising the prices of products,” An said. “Thus, if a 5 per cent tax rate is applied to fertilisers, it may benefit the state and enterprises, but farmers, who are the most important part of the agricultural sector, will suffer the most.”

Figures from the Ministry of Agriculture and Rural Development showed that Vietnam’s agro-forestry-fishery exports reached over $53 billion in 2023, posting a record trade surplus of $11 billion, or over 42.5 per cent of the country’s total trade surplus.

This year, agro-forestry-fishery exports are expected to fetch a record high of $61 billion. The figure hit $46.28 billion in the first nine months of the year.

According to NA deputy Thach Phuoc Binh, representing the Mekong Delta province of Tra Vinh, it is extremely necessary to introduce policies to support the industry, and keeping fertilisers VAT-free can bring many benefits to farmers and the economy in general.

“Vietnamese farmers, especially small-scale producers, often face many difficulties from market price fluctuations and extreme weather to increasing input costs,” Binh said. “Fertilisers account for a large part of farmers’ production costs, thus we must help keep their financial burden down.”

Figures from the General Department of Vietnam Customs say about eight million tonnes of fertilisers are produced in Vietnam annually, while the total demand in the domestic market sits at 10.5-11 million tonnes, meaning millions of tonnes must be imported.

In 2023, Vietnam exported around 1.55 million tonnes of fertilisers, with a turnover of $649 million. The figure hit 1.3 million tonnes in the first nine months of this year, worth $530.7 million and up 8.5 per cent in volume and 8 per cent in turnover as compared to the same period last year.

There are concerns that when fertilisers take on a 5 per cent VAT rate, farmers will be directly affected, domestic enterprises will collude with traders to sell imported goods, fertiliser prices will increase, and then general agricultural production costs will rise.

As many NA deputies have said, imported fertilisers when sold may have their prices increased corresponding to the VAT payable. However, the proportion of imported fertilisers currently accounts for only 27 per cent of the domestic market share. Thus, the selling price of imported fertilisers must also be adjusted according to the market developments when domestically produced fertilisers’ prices are reduced, due to input VAT deduction or refund, which will result in cut costs and lower production costs.

Moreover, fertilisers are currently a commodity whose prices are controlled by the government, so authorised agencies can use market management measures, and strictly punish violations in which domestic fertiliser producers collude with traders to commit acts of profiteering and cause large fluctuations in prices in the market.

Therefore, in order to solve the policy shortcomings for the fertiliser production industry, the NA Standing Committee shall keep [the 5 per cent VAT rate] in the draft law as it was submitted at the seventh session [in May-June].Source: National Assembly Standing Committee

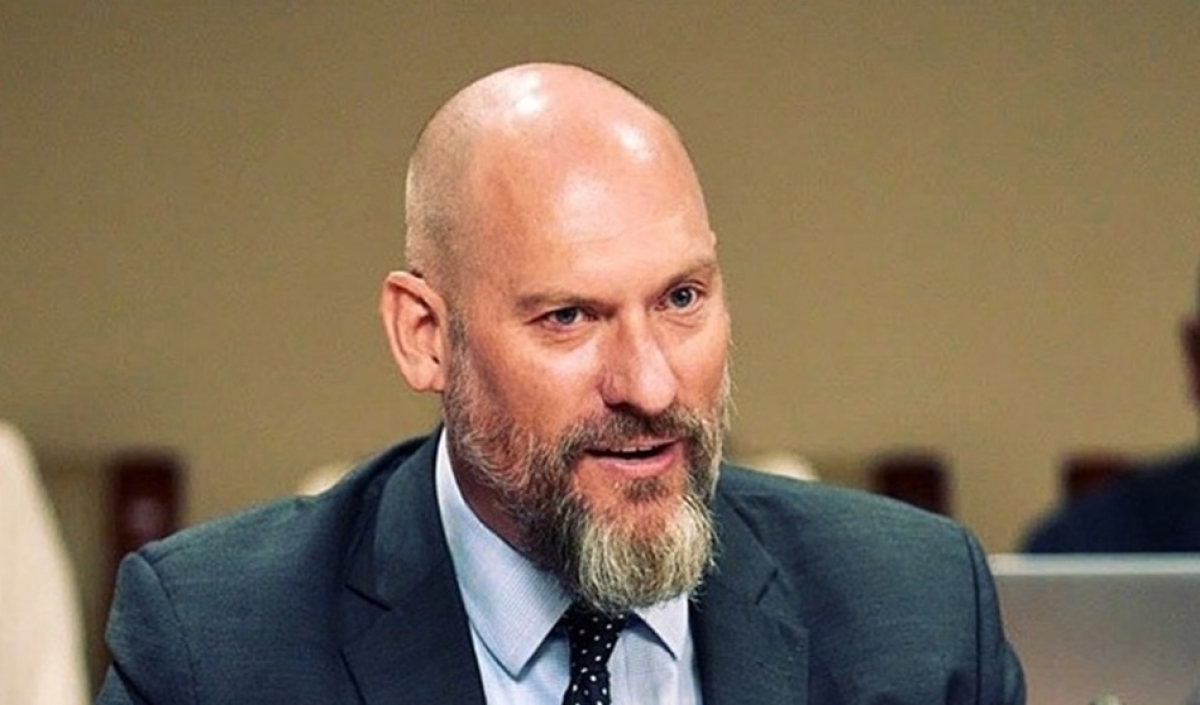

Ho Duc Phoc, deputy Prime Minister Minister of Finance

Before 2015, the fertiliser VAT was 5 per cent. After that, the 14th National Assembly issued a law under which fertilisers were not subject to VAT. Currently, the Ministry of Agriculture and Rural Development, the State Audit Office of Vietnam, the Vietnam Fertiliser Association, and the NA delegations of many provinces and cities have proposed to amend the 5 per cent VAT rate.

This is being reviewed; therefore we would like to explain why the 5 per cent tax is included, what benefits businesses will get, and how it will benefit farmers if the rate is applied.

Fertiliser prices do not only depend on the issue of tax increase or decrease, but they depend on production costs, the market, and supply and demand. In fact, production costs depend on science and technology, labour productivity, individual workers, modernisation, and especially supply and demand.

When we did not collect VAT from fertilisers in 2018-2022, the price of urea fertiliser still increased by 19.7 to 43.6 per cent. This meant that the prices depended on the market, meaning on supply and demand. But in 2023, the price of urea rose by 6.3-6.4 per cent because of the conflict between Russia and Ukraine.

So, the question is where the benefits are for businesses and farmers. When we introduce the VAT, it is true that prices will increase. The increase in prices is mainly found in import prices, and import prices mean that domestic businesses will benefit.

When prices increase, taxes will be applied to both imported and domestically produced products. Therefore, when import prices increase, domestic businesses will have conditions to compete.

Thus, under the 5 per cent VAT scheme, foreign businesses have to pay $62.5 million a year because of the large number of imported goods, while domestic businesses only have to pay an additional $8.33 million. Thus, NA deputies can see that there will be big benefits for domestic businesses – they will help them apply modern technology and reduce product prices. This will also help reduce the selling price for farmers and Vietnam can produce more fertiliser.

Businesses anticipate green light for fertiliser VAT switch

Businesses anticipate green light for fertiliser VAT switch

Domestic fertiliser producers will have opportunities to capture market share if the proposal to apply a new VAT rate on fertiliser is approved.

Conclusion nears for VAT fertiliser issue

Conclusion nears for VAT fertiliser issue

Lawmakers have assessed that if fertilisers were included in the VAT tax group at a rate of 5 per cent, it could create a fairer market but would certainly increase product prices.