INTERNATIONAL INVESTMENT

AND PORTAL

The past year saw an unprecedented surge in investment funding from China, especially in the northern provinces and economic zones. This trend is expected to continue due to cause tensions between global economic powers with the need for diversification in supply chains, and rising labour costs in the world’s largest manufacturing centre.

And on the 50th anniversary of the two countries’ establishment of relations, Vietnam and Japan elevated their bilateral ties to a Comprehensive Strategic Partnership, signalling a commitment to further collaboration in a wide range of areas.

The Vietnamese and US governments also signed a long-awaited Comprehensive Strategic Partnership last September, opening up opportunities for increased cooperation in various economic areas, especially high-tech sectors such as semiconductors and renewable energy.

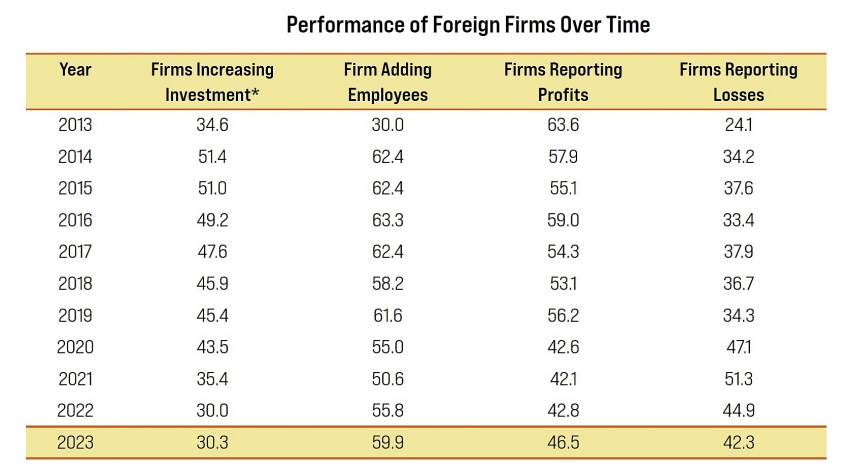

Among the thousands of foreign-invested enterprises (FIEs) from the United States, China, and Japan responding to the survey, there was a modest rise to just over 30.3 per cent in the number of firms increasing investment, up from 30 per cent in 2022, indicating a cautious commitment to growth amid uncertain economic conditions.

The percentage of firms adding employees rose from 55.8 per cent in 2022 to 59.9 per cent in 2023, signifying a significant recovery in employment activities by FIEs. Profitability rose more modestly, with 46.5 per cent of firms reporting profits in 2023 compared to 42.8 per cent in 2022.

Concurrently, the proportion of firms reporting losses decreased to 42.32 per cent in 2023, lower than the 44.9 recorded in 2022 and down significantly from the peak of 51.3 per cent in 2021. This positive trajectory suggests a sustained rebound from the pandemic’s shadow.

The business confidence among FIEs shows a marked decline in the share of firms anticipating expansion in 2023. This year, only 26 per cent of firms expect to expand, a decrease from the 33 per cent seen in the previous year and significantly lower than the post-pandemic optimism peak of 47.7 per cent in 2021.

Moreover, the current sentiment starkly contrasts the pre-pandemic era’s steadier confidence levels, where expansion expectations consistently remained above 45 per cent from 2014 to 2019. Such a downturn reflects a continued sense of caution in the business climate, which could be attributed to ongoing global economic uncertainties.

The confidence among non-exporting and exporting firms in Vietnam in 2023 expressed more pessimism, with non-exporters confidence declining slightly to 23.6 per cent and exporters’ confidence dropping sharply to 28.7 per cent.

According to the report and survey, FIEs from the US, China, and Japan express distinct concerns regarding Vietnam’s business environment. US firms frequently encounter challenges with policy and regulations, with 22 per cent highlighting these as significant hurdles. This group also struggles notably with bureaucratic procedures, impacting 16 per cent of respondents.

Japanese FIEs, meanwhile, face acute difficulties with tax-related procedures, a consistent theme in their feedback over the years. Seventy-two per cent of Japanese firms report severe issues with tax refunds, a stark contrast to the 42 per cent reported by non-Japanese investors. The challenges extend to tax finalisation, where 58 per cent of Japanese FIEs encounter problems.

FIEs from China exhibit a better ability to navigate Vietnam’s regulatory framework, with only 9 per cent reporting difficulties with policy and regulations, and a mere 5 per cent facing bureaucratic obstacles. However, these firms grapple with market-related challenges, with 38 per cent affected by market volatility and 44 per cent experiencing difficulties in customer acquisition.

In 2023, Vietnam’s investment landscape boasts 111 source countries and territories, each contributing to the nation’s foreign direct investment (FDI) profile. Singapore stood out as the top investor with an inflow of $6.9 billion, constituting 18.6 per cent of the total FDI and marking a 5.4 per cent increase from the previous year.

Japan followed as the second-largest investor, with Hong Kong also listed among the top contributors, indicating the continued strong presence from East Asia in the Vietnamese market. Investors from China boasted the highest number of new foreign-invested projects, while South Korean investors led in expanding existing ventures.

Emblematic of this growth were four substantial projects: the Japanese-funded Thai Binh liquefied natural gas thermal power plant with a capital registration of $1.99 billion, the Hong Kong-backed Jinko Solar Hai Ha Vietnam technology complex with $1.5 billion in Quang Ninh, the Taiwanese Lite-On Quang Ninh factory with an investment of $690 million, and the South Korean LG Innotek Haiphong’s additional investment of $1 billion.

Fresh approaches expected in stock market tech trends

Fresh approaches expected in stock market tech trends

Advanced technology and AI are rapidly transforming Vietnam’s stock market landscape, leading to significant changes in how firms operate and investors approach the market.

Vietnam's new tax regulations reflect global tax trends

Vietnam's new tax regulations reflect global tax trends

There have been various economic ups and downs in the post-pandemic era that have necessitated decisive measures to sustain growth. Despite an improvement in the third quarter of the year, Vietnam's economy still faces a number of obstacles to achieve its targets.

Three key trends shaping consumer industry’s journey towards digital maturity

Three key trends shaping consumer industry’s journey towards digital maturity

Deloitte's latest report reveals three key trends that encapsulate the forces shaping the consumer industry’s journey towards digital maturity.

Concerted effort to capitalise on investment trends

Concerted effort to capitalise on investment trends

Vietnam is trying to cultivate an enabling environment for chip and science development to strengthen supply chains and take advantage of opportunities under the regulations of the US CHIPS and Science Act.