INTERNATIONAL INVESTMENT

AND PORTAL

A notable change from previous drafts is the Ministry of Finance’s proposal of a 10 per cent tax rate on sugary beverages. A 20 per cent tax plan was also suggested but faced considerable opposition from the public and business communities.

Nguyen Minh Da, Partner, Advisory services, Forvis Mazars in Vietnam and Nguyen Tan Tai, manager, Advisory services, Forvis Mazars in Vietnam

Nguyen Minh Da, Partner, Advisory services, Forvis Mazars in Vietnam and Nguyen Tan Tai, manager, Advisory services, Forvis Mazars in Vietnam

The draft is expected to be passed in May 2025 and will come into effect from January 2026.

Sugary drinks under the TCVN include carbonated drinks, tea and coffee-based drinks, fruit juices, energy drinks, electrolyte drinks, and sports drinks. Milk, dairy products, natural mineral water, bottled drinking water, vegetable juices and nectars, and cocoa products are exempt from this tax, as they are classified as health nutrition products and not beverages under the TCVN.

Currently, there are three methods for calculating the SCT. Firstly, the percentage-based method determines tax as a percentage of the taxable price (ex-factory or retail). Secondly, the absolute method applies a fixed tax rate per unit of goods. Thirdly, the hybrid method combines elements of both.

In our view, the absolute or hybrid method appears more suitable when regulators aim to influence consumer behaviour and health, as these methods reflect the correlation between the amount of harmful components (like sugar) in the product and the tax payable.

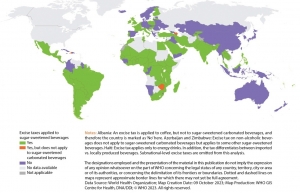

Presently, approximately 85 countries globally have implemented the SCT on sugary beverages. Within ASEAN, six out of 10 countries have already adopted the SCT. Many of these countries tax sugary beverages based on exceeding 5g of sugar per 100ml.

Specifically within ASEAN, Thailand, the Philippines, Malaysia, and Brunei predominantly utilise the hybrid method. For example, the tax percentage on the taxable price varies from 10 to 14 per cent depending on the country, with additional fixed taxes for sugar thresholds such as 8g/100ml, 10g/100ml, or 12g/100ml. This approach has also been widely embraced by EU nations.

However, it should be noted that some countries such as Japan, Singapore, New Zealand, and Germany have not yet imposed the SCT on sugary drinks, viewing it as ineffective in addressing public health issues based on current research. Instead, these countries have enacted laws to promote public health, such as mandating physical activity during school and work hours or encouraging healthy diets.

Moreover, studies in several nations implementing this tax policy indicate mixed results: while it prompts consumers to switch to alternative products, it also brings negative economic impacts and affects employment.

Since the pandemic, the beverage industry overall, and particularly the soft drinks industry, has experienced a significant decline in revenue and profits, with decreases ranging from 15 to 20 per cent. Therefore, increasing SCT in the near future could severely impact manufacturing enterprises as well as other industries and consumers.

Previously, in the initial draft of the SCT law, the Ministry of Finance proposed taxing sugary beverages, prompting many business associations and representatives to provide scientific information, international experiences, and recommendations to the policy-drafting agency, resulting in the removal of sugary beverages from the draft.

However, following public consultation on the amended SCT law draft, sugary beverages with over 5g of sugar per 100ml have been reintroduced as SCT-able.

Nevertheless, the 10 per cent tax rate must be carefully evaluated based on scientific grounds, considering its direct and indirect impacts on other sectors.

While many countries have implemented the SCT on sugary beverages, Vietnam should also consider its economic situation, tax policies, and consumption culture. We believe that thorough research and careful consideration are essential before applying the SCT to beverages and choosing an appropriate policy.

For example, applying the absolute tax method based on sugar content or adopting the hybrid method used by other countries could encourage consumers to shift away from high-sugar products, thereby altering consumption patterns.

Simultaneously, it is advisable to introduce additional regulations on commerce and food safety to encourage manufacturers to transition from high-sugar products to healthier alternatives.

Apart from tax policies, Vietnam should explore and implement non-tax measures such as restrictions on advertising, promotions, and sponsorships of unhealthy foods, or requirements related to managing physical activities in workplaces, akin to measures adopted in other countries.

In the post-pandemic era, our government has been actively supporting business recovery and growth through various policies such as VAT reduction, extension of payment deadlines for the VAT, corporate income tax, and land taxes.

However, the proposal to impose the SCT on sugary beverages raises concerns. We are also apprehensive about the potential indirect impacts on other sectors like entertainment, food services, resorts, tourism, and supply chains, which could have broader economic implications. Therefore, policies should align with the Party and government’s direction in supporting business recovery and development.

Vietnam edges towards decision on sugary drink taxes

Vietnam edges towards decision on sugary drink taxes

Proposals to tax sugary drinks continue to receive mixed opinions in the country, with Vietnam planning to submit a special consumption tax law for debate in October.

MoF proposes a 10 per cent special consumption tax on sugary drinks

MoF proposes a 10 per cent special consumption tax on sugary drinks

The Ministry of Finance (MoF) has maintained its view that sugary drinks should be subject to a special consumption tax (SCT) of 10 per cent in a message sent to the government regarding the draft revised SCT Law.

Valuable lessons can direct sugary beverage rules

Valuable lessons can direct sugary beverage rules

Tax policy is an effective financial measure to control consumption of sugar-sweetened beverages (SSBs). The significant prevalence of obesity and diet-related non-communicable diseases (NCDs) driven by increasingly unhealthy dietary patterns is of global health concern. Significant attention has been given to curbing excess sugar intake and particularly SSB consumption.

Vietnam to act on surge of sugary drinks

Vietnam to act on surge of sugary drinks

Sugar-sweetened beverages in Vietnam may begin to be subject to a special consumption tax later this year, following the potential adoption of amendments to the Law on Special Consumption Tax.