INTERNATIONAL INVESTMENT

AND PORTAL

Benchmark indices lost more than 2 per cent on Monday as banking and real estate industries faced strong selling pressure, with many pillar ticker symbols hitting floor prices.

On the Ho Chi Minh Stock Exchange (HoSE), the VN-Index ended the trading day at 975.19 points, a decline of 21.96 points, or 2.2 per cent. It had plummeted by 2.94 per cent last week.

Techcombank headquarters in Ha Noi. The bank's shares dipped by 7 per cent yesterday, the biggest daily loss on HoSE, weighing on the market's risk appetite.-Photo vietnamplus.vn

Techcombank headquarters in Ha Noi. The bank's shares dipped by 7 per cent yesterday, the biggest daily loss on HoSE, weighing on the market's risk appetite.-Photo vietnamplus.vn

The market's breadth was in the negative zone as 306 stocks inched lower, of which 136 stocks registered the maximum daily loss of 7 per cent, while only 40 stocks moved higher.

Liquidity was also lower than the previous session, with trading value on the southern bourse down nearly 18.5 per cent to VND10.6 trillion (US$424.6 million), equal to a trading volume of over 646.8 million shares.

The index was dragged down by big losses in large-cap stocks, especially in banking and real estate sectors. Accordingly, the VN30-Index, which tracks the 30 biggest stocks on HoSE, plunged 25.07 points, or 2.51 per cent, to 972.85 points.

In the VN30 basket, 20 stocks closed lower with eight hitting floor prices, while only eight advanced. And two stocks stayed flat.

Leading the downtrend was Novaland (NVL), down 7 per cent. It was followed by Techcombank (TCB) and Vietinbank (CTG), down 7 per cent and nearly 4.7 per cent, respectively.

Other stocks weighing on market sentiment were Hoa Phat Group (HPG), Mobile World Investment Corporation (MWG), MBBank (MBB), Vingroup (VIC) and Vietnam Rubber Group (GVR). These stocks all posted losses in a range of 1.66-7 per cent.

After the business result season, the market is facing unfavourable news such as the central banks hiked interest rates for the second time, forcing securities companies to raise margin lending interest rates.

In general, the market is likely to enter the first stage of looking for the bottom level, said SSI Securities Corporation.

On the Ha Noi Stock Exchange (HNX), the HNX-Index slid by 6 points to 198.56 points, a 2.93 per cent decrease.

During the session, more than 68.5 million shares were traded on the northern bourse, worth VND955.01 billion.

On the other hand, foreign investors were net buyer on both main exchanges. This was also a highlight of yesterday's market. Specifically, they net bought VND521.87 billion on HoSE and VND57.94 points on HNX.

Market slumps on retail stocks

Market slumps on retail stocks

The market retreated to close lower on Monday, underlying a strong bearish sentiment.

State Bank of Vietnam alleviates market pressures

State Bank of Vietnam alleviates market pressures

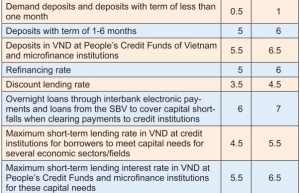

The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates.

By VNS