INTERNATIONAL INVESTMENT

AND PORTAL

Mcredit has swiftly managed to take advantage of its parent groups and their business ecosystems to develop and grow.

The average age in Vietnam is about 32 years old, which shows a great similarity with China, Thailand, and South Korea during their periods of strong development in the 1990s and early 2000s.

The youth make up the largest proportion of Vietnam’s population and most of them are highly adaptive to new technologies, attracting consumer finance companies to make forays into the Vietnamese market.

The local youth not only have a strong demand for high-speed and convenient financial products and services, but are also keen on service-linked products with the simultaneous use of credit, payments, insurance and securities on the same application.

In anticipation of the above demand, a slew of financial companies in partnership with fintech firms and commercial banks have built and launched diversified payment service products.

Of note, MB Shinsei Finance Co., Ltd. (Mcredit), with 49 per cent of its shares held by Shinsei Bank (Japan) and 50 per cent by the Military Commercial Joint Stock Bank - MB (Vietnam), has swiftly managed to take advantage of the parent groups and their business ecosystems to develop and grow.

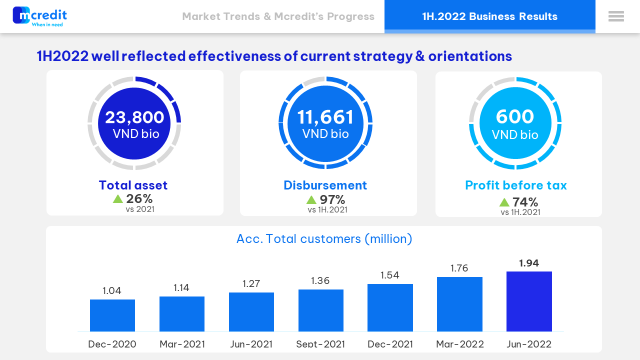

By June 30, Mcredit’s total assets had reached just over $1 billion, an increase of 26 per cent compared to the end of 2021, while its total disbursement during the first half of 2022 nearly doubled to around $504 million, thus bringing its interest revenue up to nearly $128 million.

Mcredit raked in $34.3 million in non-interest revenue during the reviewed period, contributing to the financial institution’s pre-tax profit of $26 million, a surge of 74 per cent on-year.

The above non-interest revenue of Mcredit came to 16 per cent in 2020 – up from 15 per cent in 2019 – before jumping in 2021 and the first half of 2022 to account for 21 per cent of its total revenue.

The consumer finance market’s interest-biased revenue structure has changed and Mcredit has been leading this trend with its non-interest proportion of 21 per cent – higher than the average of 18 per cent.

It can be seen that Mcredit has managed to take advantage of the comprehensive financial ecosystem of MB Group while exclusively and successfully harnessing and cross-selling many other products in the ecosystem, thus enabling the firm to secure such impressive revenue.

While having the closely linked and exploitable advantages of the parent banks, Mcredit has made significant contributions to the mutual development of both banks.

In addition, Mcredit’s customer base has grown steadily despite volatile market conditions, particularly during and after the pandemic. Its customer size totalled nearly 2 million in June 2022, almost double compared to the end of 2020.

More than 89 per cent of its customers had been or are using various products and services from MB Group, particularly those related to payments, insurance, and securities, among others.

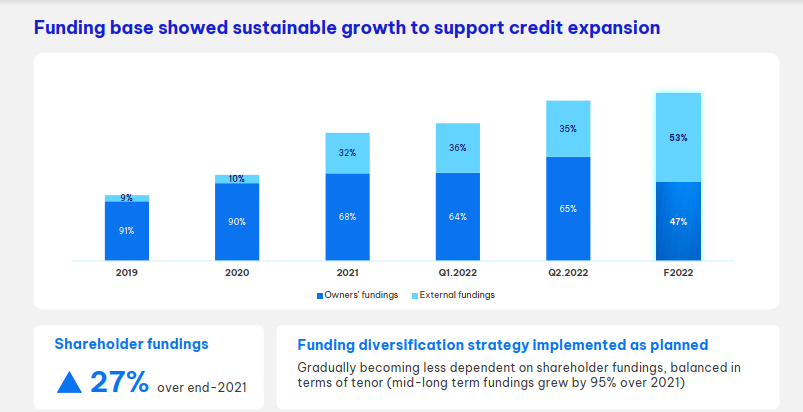

Mcredit receives funding from its two parent banks, which normally accounts for over 64 per cent of the company’s funding structure.

The funding from the two parent banks is mainly short term – less than one year – and is highly competitive across the whole market in terms of interest rate.

That, together with a 100 per cent roll-over commitment, help ease all liquidity pressure in the short and medium term.

While having the closely linked and exploitable advantages of the parent banks, Mcredit has made significant contributions to the mutual development of both banks.

In addition to contributing to stable annual growth in the parent banks’ profits, Mcredit also plays an important role in attracting customers to MB Group’s product ecosystems.

For instance, the OneID Strategy that MB has been deploying is expected to enable customers to tap into quick and convenient access to other products provided by the bank.

Fitch Ratings has assigned Mcredit a first-time, long-term issuer default rating of B as the outlook is stable thanks to the company’s impressive growth.

This is Fitch's highest rating assigned for the circle of financial companies in Vietnam. Fitch also noted that Mcredit has inherited outstanding group synergy from MB Group.

Mcredit affirms reputation as effective consumer finance brand

Mcredit affirms reputation as effective consumer finance brand

Since the end of last year, the market has witnessed a number of moves by management agencies to promote the development of consumer finance and limit black credit to protect customers' rights. For their part, non-bank credit institutions have also taken different solutions for sustainable development, contributing to the formation of a healthier market. Hoang Minh Tuan, CEO of MB Shinsei Finance Limited Liability Company (Mcredit), talked with VIR about the company’s digital future.

Decoding the change of position in the consumer finance market

Decoding the change of position in the consumer finance market

Mcredit's spectacular growth in 2021, as difficulties for the banking industry reached their peak due to the pandemic, surprised the market.

By Ha Thuy