INTERNATIONAL INVESTMENT

AND PORTAL

The Ministry of Industry and Trade's recent figures related to the top export earners in the first 10 months show that the processing industry brought in $270 billion, equaling 86 per cent of Vietnam’s total export value during the period, in which the chemical and fertiliser sectors took the pole position in terms of export value.

The fertiliser export value shot up by 153 per cent on-year, while that of chemicals gained 40.8 per cent.

The rosy export picture has been reflected in the third-quarter and nine-month business performances of units in the sector.

DGC has already surpassed its full-year profit target after nine months

DGC has already surpassed its full-year profit target after nine months

In Q3, Duc Giang Chemicals Group JSC (DGC) raked in more than $160.6 million in revenue and $65.7 million in post-tax profit, showing a 75 per cent and over 300 per cent jump on-year respectively.

In the year to date, DGC has eyed revenue touching $492.7 million and $213.7 million in post-tax profit, equalling 86 per cent and 342 per cent jumps on-year.

This year, DGC aimed to reach $526.8 million in revenue and $152.1 million in post-tax profit, meaning that after nine months, the group has already surpassed its full-year profit target.

The situation is even better for the Vietnam National Chemical Group, as after three quarters, the company’s estimated consolidated profit reached $234.7 million, tripling its full-year projection.

Besides fertiliser and chemical companies, several firms in the oil and gas sector have also surpassed their full-year profit targets.

According to PetroVietnam Fertiliser and Chemicals Corporation (DPM), in the first nine months of this year, the company exported 155,000 tonnes, triple its full-year plan, and counted $652 million in revenue and $186.9 million in pre-tax profit.

This year, the company aims to post $749.5 million in revenue and $179.5 million in pre-tax profit, meaning that after the third quarter, DPM has reached 87 per cent of its revenue and 128 per cent of its full-year profit plan.

Besides fertiliser and chemical companies, several firms in the oil and gas sector have also surpassed their full-year profit targets.

In the first three quarters, the Binh Son Refining and Petrochemical JSC (BSR) posted revenue of $5.5 billion, up 1.9-fold on-year, and post-tax profit of $560.8 million, a 3.2-fold rise compared to one year ago.

This year, BSR aims to achieve $3.98 billion in cumulative revenue and $56.3 million in post-tax profit, meaning the company has already surpassed its full-year revenue and profit targets, even exceeding the full-year profit target by nearly 10 times.

Another unit in the petroleum sector, PetroVietnam Oil Corporation (PV OIL), also reported very impressive business results in the first three quarters.

PV OIL eyed $3.46 billion in revenue and more than $18.73 million in post-tax profit, equaling 93.5 per cent of its full-year revenue and 140 per cent of its full-year profit target.

Vietnam’s economy has exhibited a strong rebound after a long period of battling the impacts of the pandemic. Businesses have availed of opportunities to bring their operations back to a normal orbit.

At this point in time, Hang Xanh Motors Service JSC (HAX) has far surpassed its full-year plan.

By the end of Q3, HAX reaped $225 million in revenue, up 52 per cent on-year, and $10.4 million in pre-tax profit, up 445 per cent on-year. With such a result, the company has surpassed its full-year profit target by 13 per cent after nine months.

For firms that have beaten their full-year profit targets, the fourth quarter is a time to embrace preparations for their next year's business plan.

The leadership at BSR unveiled that in 2023, it will continue operating the Dung Quat Oil Refinery while safely and stably leveraging radical product structure to optimise production and business efficiency.

Meanwhile, HAX chairman Do Tien Dung said that in 2023, the company is confident to work on fresh business plans in which it will pioneer in distributing Mercedes-Benz electric cars in the northern region. Next year, the company aims to make dividend payments reaching 20-30 per cent of its charter capital.

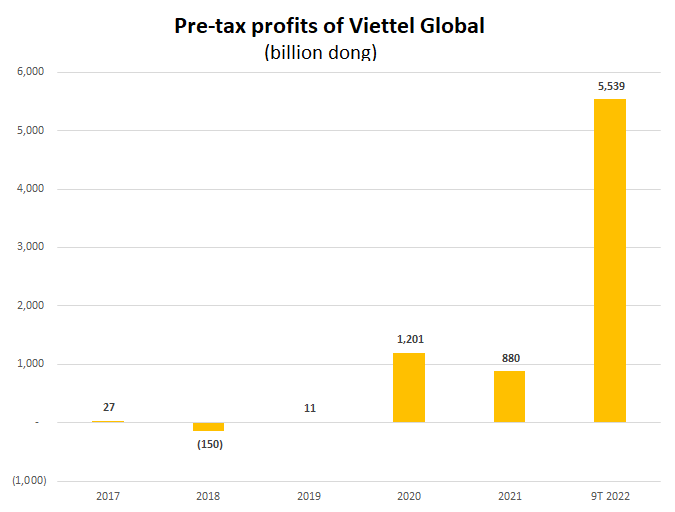

Viettel Global posts pre-tax profit of nearly $96.6 million in Q3

Viettel Global posts pre-tax profit of nearly $96.6 million in Q3

Following the growth momentum of the first two quarters of 2022, Viettel Global continued to record its best third-quarter business results ever in terms of both revenue and profit.

Weighing stock market opportunities in Q3

Weighing stock market opportunities in Q3

Several business sectors are expected to leverage favourable market conditions and achieve high growth in the third quarter.