INTERNATIONAL INVESTMENT

AND PORTAL

The southeast continues to take the lead in attracting overseas investment despite the increasing problem of land availability.

Despite gloomy forecasts about global economic prospects, the southeast of the country continues to welcome an influx of foreign direct investment (FDI). Ho Chi Minh City and Binh Duong were the top two regions for attracting foreign investors, enticing $3.94 billion and $3.14 billion from overseas in 2022 respectively.

The volume of FDI for other localities in the region, such as Dong Nai, Ba Ria-Vung Tau, Tay Ninh, and Binh Phuoc also showed a slight increase on-year.

An increasingly apparent challenge to attracting future FDI to the region is ensuring that the amount of quality land reserved for industrial development remains significant. Dao Xuan Duc, from Ho Chi Minh City Industrial and Export Processing Zones Management Authority, noted that the city has only 46 hectares of clear space for investors to lease in 2023 and that this sum is distributed over several districts rather than in a single zone.

Duc added that the city has several other land funds, such as a 320ha space in Hiep Phuoc Industrial Zone (IZ) and more than 100ha in the Northeast Cu Chi, but they have so far been unable to sign land lease contracts with the state.

The southeast has established major industrial centres, hosting the most extensive industrial and export processing zones in the country.

Duc voiced concerns that amid an investment wave into Vietnam, Ho Chi Minh City may be unable to entice large investors with such meagre land availability.

Similarly, Dong Nai is facing obstacles in expanding its land fund to attract more overseas finance.

According to Pham Van Cuong, deputy head of Dong Nai Industrial Zones Management Authority, the province’s available land for FDI has reached capacity and five new intended IZs comprising more than 7,100ha are yet to commence development.

“Due to a lack of land for industrial development, Dong Nai has been missing opportunities to entice huge foreign-led projects with capital touching billions of dollars over the past two years,” said Cuong.

Binh Duong, Binh Phuoc, Tay Ninh, and Ba Ria-Vung Tau currently have an advantage in the southeast as they accommodate parks for attracting investment. For instance, Binh Duong has attracted Lego Group to invest in a $1.3 billion factory covering more than 40ha.

Despite the available land, location remains a challenge for these provinces as they are some distance from the major seaports and airports and much of the infrastructure requires upgrading. Construction projects are underway to improve the connectivity of several routes in the region such as the Ring Road 3 in Ho Chi Minh City, Bien Hoa-Vung Tau Expressway, and a number of other planned improvements.

While these projects will do much to alleviate the challenges associated with the lack of connectivity in some parts of the region, they are not expected to be open until 2025.

The southeast has established some major industrial centres, hosting the most extensive IZs in the country. The region's private sector has also witnessed vibrant development, accommodating the greatest number of enterprises in the country and taking the pole position for attracting FDI with over 40 per cent of Vietnam’s total volume. In particular, Ho Chi Minh City has been growing into a science and IT innovation hub for the region and beyond.

The advantages and challenges of joint real estate investment in Vietnam

The advantages and challenges of joint real estate investment in Vietnam

Vietnam’s real estate market outlook remains positive, driven by strong domestic and foreign demand for housing and investment. However, high initial investment value and low liquidity are major barriers preventing individual and institutional investors from participating in large-scale projects with stable cash flow in Vietnam. Therefore, residential real estate is always a sought-after property for individual investors.

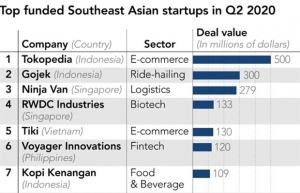

Start-up investment in Southeast Asia doubles despite COVID-19

Start-up investment in Southeast Asia doubles despite COVID-19

Investment in start-ups in Southeast Asia soared in the second quarter of this year despite the COVID-19 pandemic, led by e-commerce and fintech companies.

By Quan Thuy