INTERNATIONAL INVESTMENT

AND PORTAL

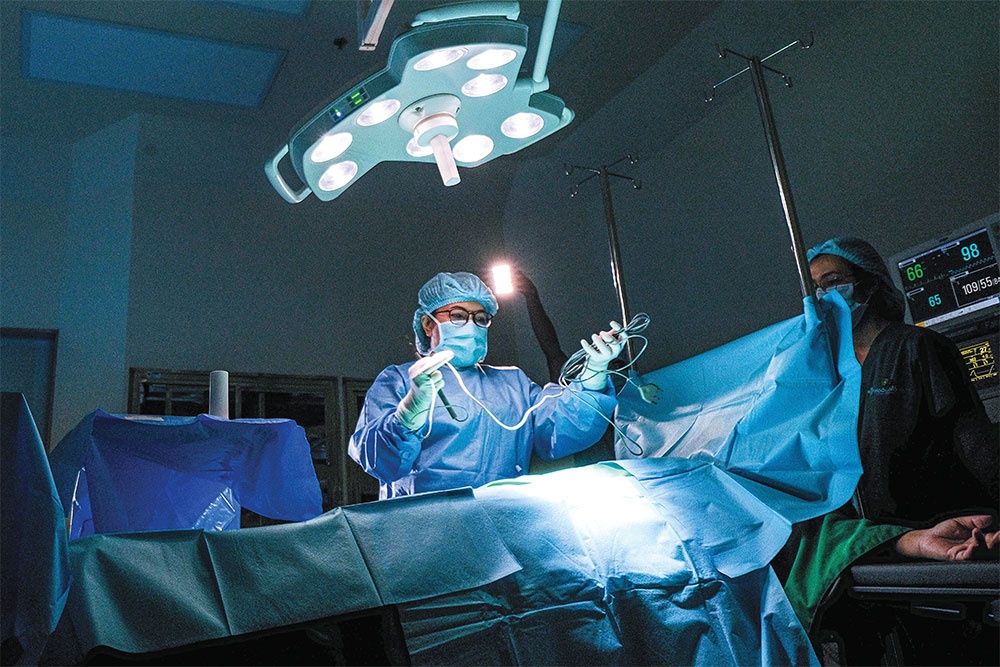

Some hospitals need more legal streamlining in terms of private funding engagement, Photo: Le Toan

Some hospitals need more legal streamlining in terms of private funding engagement, Photo: Le Toan

The Presidential Office on February 3 announced the promulgation of the amended law, adopted by the National Assembly at its extraordinary session. One of the new key changes in the law is the legalisation of joint venture and private investment engagement in hospitals, making it the first-time adjustment in the field. This is a long-waited solution among not only hospitals, but also businesses because a lack of fully legal framework for this activity has caused many difficulties for them.

Dr. Nguyen Trong Khoa, deputy head of the Ministry of Health’s (MoH) Department of Medical Examination and Treatment said, “We have not had a fully legal framework for private investment engagement in medical devices and machines. We have not taken into account depreciation of equipment during the building of services fees, so machines at hospitals have been under the placement model, or borrowed from contractors winning chemical bids, thus causing many difficulties for them.”

The amended law includes the hiring, borrowing, and buying in instalments of medical devices. This is a very important solution to facilitate upcoming exam and treatment activities, he explained. “Because of the legal barrier, Vietnam Social Security has not agreed to make payment for machines hired, borrowed, or under placement model by hospitals.”

The doctor elaborated that the amended law makes a change in the structure of service costs that will include four factors: direct cost of medicines and bioproducts, staff salaries, management costs, and depreciation of equipment.

“With the inclusion of the depreciation of medical equipment, health facilities can decide whether they borrow, or hire, or buy in instalments to better serve patients,” Khoa noted.

State-owned hospitals and businesses are waiting for the changes to be fully come into effect from early 2024 to get out of the impasse.

Cho Ray Hospital in Ho Chi Minh City, one of top state-owned hospitals in Vietnam having over 3,200 sickbeds caring for thousands of outpatients each day now has most of its testing system being under the placement model, or borrowed from winning chemical contractors.

Tran Thanh Vinh, head of Biochemistry Department of this hospital, said, “We order 3-4 years of chemicals winning in bidding and use them with the machines included. If we carry out this process annually, it will cause difficulty. In other countries, they do it every three or five years to use a package of winning chemicals and machines included.”

Elsewhere, Le Thuy General Hospital in the central province of Quang Binh is facing similar situation. It has used borrowed urine testing machine and pharmaceutical biochemistry machine for years. Dr. Nguyen Cong Dung, head of General Surgery of the hospital, said, “COVID-19 is now under control and hospital is on the recovery way. And it still does not have enough capital for investment in medical devices.”

Cho Ray and Le Thuy are among those facing a lack of legal frameworks in private investment engagement activities in such devices. According to statistics from Vietnam Social Security, in state-owned health facilities in 45 cities and provinces, more than 2,000 medical devices being used are borrowed or those under the placement model of winning contractors of chemicals and bioproducts.

Members of the European Chamber of Commerce’s (EuroCham) Healthcare Forum and its sector committees are interested in public-private partnerships (PPPs), including machine installation models in hospitals. Obviously, the new law is important to them because Vietnam’s medical devices and diagnostics market reports double-digit annual growth, with 90 per cent made up of imports.

EuroCham representing the voice of multinational corporations like B. Braun, Roche, Abbott and others many times proposed the government to build a more appropriate legal framework that will drive PPPs to their potential.

Earlier, Torben Minko, vice chairman of EuroCham in Vietnam, told VIR, “For members, the placement instrument model has been implemented for many years but it has not been legally regulated, although there were documents aligned between the MoH and social insurance for this kind of model.”

Now there will be one year ahead for authorised agencies to work on documents guiding the implementation of the law and soon issue them to ensure successful enforcement from early 2024.

The MoH expects that a circular on customised medical examination and treatment cost will be issued in the first or second quarter of this year, adding the third factor – management cost to the medical service cost – once it gets a green light from the government.

Dr. Khoa of the Department of Medical Examination and Treatment said the next step is for the MoH and relevant agencies to compile guiding documents. The adjustment will be made under roadmap, especially management cost, and depreciation of medical equipment from now to 2025.

Foreign investors expect enforcement of new medical examination legislation

Foreign investors expect enforcement of new medical examination legislation

Foreign-invested enterprises are expecting better performance with the enforcement of the amended Law on Medical Examination and Treatment. Vu Tu Thanh, deputy regional managing director and Vietnam chief representative at the US-ASEAN Business Council, talked to VIR’s Tung Anh about the possible impacts on its members, and the expectations ahead.

Bringing the fresh air to healthcare

Bringing the fresh air to healthcare

The amended Law on Medical Examination and Treatment to come into effect from early 2024 is expected to have a significant impact on how related establishments conduct their day-to-day business. Ngo Thanh Hai, lawyer at LNT & Partners, analyses the notable changes and market impact.