INTERNATIONAL INVESTMENT

AND PORTAL

For around a month Nguyen Ngoc Minh, a worker for a Japanese firm producing industrial spare parts at Hanoi’s Thang Long Industrial Park, has been working with reduced hours. “The company doesn’t want to apply a cutback of employees, and instead has reduced the official working time per worker from an average eight to seven hours. We are also not allowed to work three hours of overtime each day as before,” Minh said.

This company employs about 2,000 workers, about 1,200 of whom have suffered from the new policy induced by a reduction in export orders from Europe and the United States.

“At a recent meeting with workers, the company’s leadership said that this is only a temporary solution to cope with difficulties. However, they also said a 3 per cent rise in electricity would cost the company additional tens of thousands of US dollars a month, meaning more difficulties,” Minh said.

According to the General Statistics Office (GSO), Vietnam’s index for industrial production (IIP) in April increased 0.5 per cent compared to the same period last year, when it rose 10.7 per cent on-year.

However, poor performance of many enterprises has caused a 1.8 per cent drop in the first four months of this year. In the corresponding period last year, the rate expanded 7.8 per cent on-year.

“This is due to the world economy’s slow recovery and the tightened monetary policy in many nations, leading to a slash in consumption demands of Vietnam’s key trade partners. This has resulted in a reduction in production orders and export turnover,” the GSO said.

Vietnam’s four-month export turnover is estimated to hit $108.6 billion, down 11.8 per cent on-year. The country’s export value from all of its key markets witnessed a big drop, including in China, the US, South Korea, ASEAN, the EU, and Japan.

Meanwhile, Vietnam’s four-month imports from these markets also saw a shrink by well over 10 per cent in all these markets. “Despite some recovery in April, industrial production in the first four months still dropped on-year. Key growth momentum in areas such as investment, export, and consumption has dipped. Exports and imports in the four months also declined, while the four-month public investment disbursement and registered foreign direct investment have also fallen on-year,” said Prime Minister Pham Minh Chinh at a government meeting early this month.

In the first four months of 2023, the mining sector fell 2.8 per cent compared to the same period last, while the processing and manufacturing sector dropped 2.1 per cent on-year. The electricity production and distribution sector only grew 0.5 per cent on-year, versus a 7 per cent climb in the first four months of 2022. The reductions in these sectors have led to a big decrease in the four-month IIP. The economy grew only 3.32 per cent on-year – lower than the target of at least 6.5 per cent.

The IIP in many key sectors has narrowed, such as production of vehicles by 9.6 per cent; engined vehicles by 8.5 per cent; paper and paper-based products 7.9 per cent; clothes 7.4 per cent; furniture 6 per cent; electronics, computers, and optical products 5.1 per cent; and textiles 5 per cent.

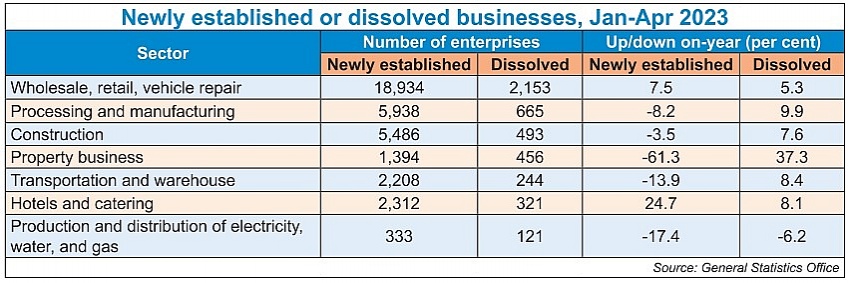

According to the GSO, in the first four months of 2023, there were about 49,900 newly established businesses registered with around $20.2 billion and employing as many as 331,400 workers – up only 0.6 per cent in the number of enterprises but down 26.8 per cent in registered capital.

If an additional $26.28 billion registered by the nearly operational 17,200 enterprises is considered, the total newly registered capital inserted into the economy in the first four months sat at $46.48 billion, down 46 per cent on-year.

Also in this period, the number of businesses with halted operations reached nearly 50,000, up 21.8 per cent on-year. Nearly 21,000 enterprises stopped operations and waited for completing dissolution procedures – up nearly 40 per cent. Some 6,100 businesses completed such procedures – up 10.1 per cent. On average, each month 19,200 enterprises left the market.

According to the latest Business Climate Index report released over a month ago by the European Chamber of Commerce in Vietnam and conducted by Decision Lab with over 1,300 member companies, foreign businesses in Vietnam continue to grapple with regulatory opacity, administrative inefficiencies, and visa and work permit issues. There has been an upward trend in respondents pointing out inadequacies in anti-corruption legislation.

The top significant regulatory obstacles for the companies when doing business in Vietnam in Q1 include unclear rules and regulations at 51 per cent; administrative issues at 41 per cent; visa and work permit issues 31 per cent; customs procedures 23 per cent; and inadequacies in anti-corruption legislation 19 per cent.

“To strengthen Vietnam’s appeal as a dynamic locale, participants reinforced the need for improvements in political stability, regulations, and tax and tariff regimes. These will go a long way in addressing the concerns of businesses and bolstering confidence in the country’s economic prospects,” the report said.

Exporters anxious over EU carbon tax implementation

Exporters anxious over EU carbon tax implementation

With the European Union to begin use of the Carbon Border Adjustment Mechanism in October, the changes will have a direct impact on four categories of industrial products exported by Vietnam to the EU.

Vietnam's exports plunge in first quarter

Vietnam's exports plunge in first quarter

Vietnam's exports are down almost 12 per cent in the first four months of the year, with some sectors reporting declines of between 6 and 19 per cent.

Breakthroughs sought in order to curb drop in export figures

Breakthroughs sought in order to curb drop in export figures

Economic headwinds have left exports and imports in the lurch in the first months of the year, with businesses thirsty for every order possible to keep themselves afloat