INTERNATIONAL INVESTMENT

AND PORTAL

The retail sector helped banks make huge profits in 2022. What has led to the thriving of this sector?

Nguyen Chien Thang, director of the BIDV Digital Banking Development Centre

Nguyen Chien Thang, director of the BIDV Digital Banking Development Centre

With a population of nearly 100 million people, the penetration rate of financial services products is not high. This is a fertile market that any financial institution wants to exploit. In recent years, many banks have invested heavily in their strategy of shifting to retail services, and business results in 2022 further proved this as the right strategy.

An important factor for any bank to succeed in the retail segment is to put customers at the centre of all its activities. From the strategy of providing products and services, distribution channels, and ecosystems, to strategies for using technology and internal management as the foundation for all retail support activities, it is necessary to aim at and improve the customer experience.

Comprehensive digital transformation is seen as a decisive pillar to the success of the retail-oriented strategy. Being instant and safe are decisive keywords in the customer experience when using banking services in cyberspace. And banks that have achieved success in the retail segment know how to exploit and best meet these needs.

It is believed that digital transformation in the retail segment still has gaps with efficiency. What’s your view on this?

Digital transformation from the top leads to serious negative consequences, especially in the banking and retail segment. Some banks even immediately suffer to gain customer experiences in the short term, which reveal gaps in their systems, so they will not be able to retain customer loyalty and create new customers in the long term.

“Rewards are only for the last person standing” is an accurate explanation of the race to digitalise retail operations of banks. Some banks have succeeded by choosing the harder path with a synchronous and comprehensive strategy, changing both quality and quantity in their digital transformation plan.

A culture of governance and making the most of talents, both internally and in society as a whole, are long-term steps to successfully implement digital transformation.

It is more vital to craft ecosystems or super apps, or design the most diverse products?

In the context of rapidly evolving technology, imitating ideas has become more common and easier than ever, especially in the digital space.

Digitalisation in retail is no exception. The competition to win loyalty and attract customers in cyberspace in the retail banking sector is becoming increasingly fierce. A single mistake in the use of technology or the digital customer interface can force a retail bank back. The past year has witnessed the decline of at least one leading retail bank in Vietnam because of its failure to provide a new experience for customers through its digital channels.

The digital ecosystem and super apps are essentially trying to keep customers in their ecosystem, so banks are trying to find all technology solutions to quickly achieve this. However, this is a double-edged sword. If that ecosystem or super app is not designed correctly, it will become counterproductive for banks to achieve their goals.

To successfully implement digital transformation, banks may not have many options when human resources are limited domestically. Is working with foreign businesses an effective option for both sides?

Human resources in digital transformation is a hot topic not only on the agenda of banks but perhaps in all sectors of the Vietnamese economy, even globally. Harnessing the power of society is the secret to any success, especially in the current context of domestic digital transformation resources being exhausted, due to global digital transformation campaigns nationally and in all areas of society.

The resources of IT in Vietnam are also being fully exploited by other countries. The explosion of technology companies with thousands of programmers in Vietnam was only to supply IT personnel to countries and regions such as Japan, South Korea, Europe, and the US.

Tech developments have made the world flatter. Today’s developed countries do not necessarily have an outstanding advantage to develop and apply modern technology. In the field of banking and finance, even financial institutions that are considered giants have not kept up with the rapid development of technology. Goldman Sachs has almost failed in its pursuit of a technology-led retail strategy.

Taking advantage and expanding resources from abroad to meet the digital needs for Vietnamese banks is necessary. However, we need to seriously look at whether Vietnamese banks have really created a market for Vietnamese technology companies to be willing to invest and cooperate for development.

Digital transformation is said to be expensive. How can we find a balance between goals and costs and still bring revenue efficiency?

Digital transformation is a process, not a destination. If banks operate their strategy as a project with a beginning and an end, it will certainly be difficult to succeed. They may even fail miserably.

Digital transformation and retail banking services are two categories in a dialectical relationship with each other, which cannot be separated. The harmony and synchronisation between these two factors will help banks develop significantly.

There is still a lot of room left, there are still many abandoned lands that have not been intensively cultivated, but only banks with wise strategies, strength and vision for a long-term roadmap can reap the best results.

AI in insurance - The inevitable trend in digital transformation

AI in insurance - The inevitable trend in digital transformation

With digital transformation being an inevitable movement, partnering with insurtech companies is an effective way for insurance companies in Vietnam go faster and smarter in the digital race.

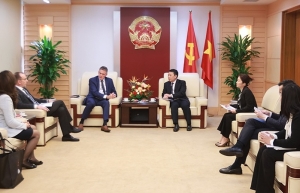

Ericsson’s commitment to supporting the digital transformation of Vietnam

Ericsson’s commitment to supporting the digital transformation of Vietnam

Ericsson has been contributing its technology leadership to digital transformation in Vietnam over the past 30 years. Denis Brunetti, president of Ericsson in Vietnam, Myanmar, Cambodia, and Laos, talked to VIR’s Bich Thuy about his own journey and the plans ahead for the company in Vietnam.

National Australia Bank seeks opportunities in digital transformation

National Australia Bank seeks opportunities in digital transformation

National Australia Bank (NAB) is seeking opportunities related to digital transformation in Vietnam to tap into the growing local demand.