INTERNATIONAL INVESTMENT

AND PORTAL

Truong Bui, managing director Roland Berger in Vietnam

Truong Bui, managing director Roland Berger in Vietnam

Drawing on global best practices identified by Roland Berger, Ho Chi Minh City’s international financial centre (IFC) plans should adopt a ‘1+3’ model.

This structure places the financial centre at the core, directly connected to three priority sectors: green manufacturing, healthcare, and education. This approach creates an integrated ecosystem where finance is not just a magnet for capital but a catalyst for growth across foundational industries.

To support this model, policy must rest on five core pillars: a transparent, flexible legal framework that protects investors and enables financial innovation; strong partnership between government, industry, research institutions, and international partners; dedicated capital targeted at high-growth and high-tech projects; an efficient, transparent, and professionally managed business environment; and skill development focused on building a talent base that meets international standards and can thrive in a complex, interconnected financial ecosystem.

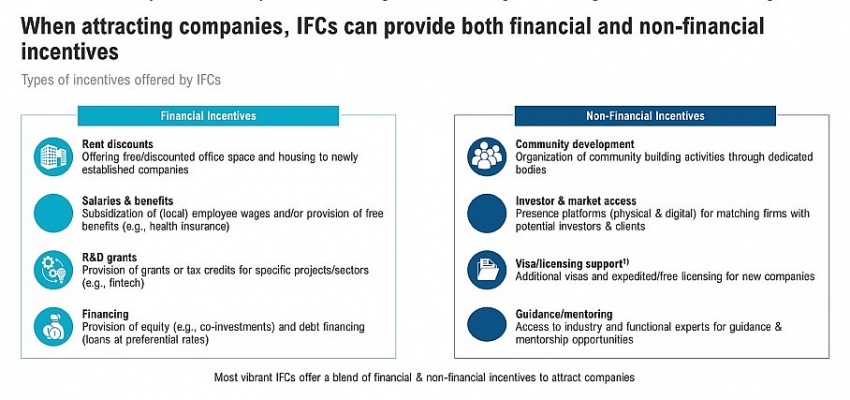

Underpinning these pillars is a dual-policy structure comprising financial and non-financial incentives. Financial measures aim to reduce operating costs and scale up enterprises through mechanisms such as rental subsidies, workforce training, or research and development (R&D) funding.

Complementing these are non-financial instruments that focus on foundational enablers, including visa facilitation, streamlined administrative processes, market access, and mentor programmes. The synergy between these streams plays a crucial role in reinforcing institutional credibility and enhancing Vietnam’s appeal in the global financial landscape.

Among these tools, a ‘golden visa’ scheme and the R&D grant fund emerge as priority instruments, positioned to serve as early catalysts in the formation of a future IFC.

Long-term visas for investors and professionals have become a standard feature of leading IFCs. As Ho Chi Minh City moves forward with its financial centre strategy, introducing a golden visa should be considered a top policy to attract both capital and high-quality talent.

Roland Berger proposes that the visa initiative should prioritise individuals who can generate lasting value for Vietnam’s integrated financial ecosystem. These include institutional investors, fintech founders, and experts in key areas outlined in the 1+3 model such as green finance, healthcare, and education.

A suitable approach would be a renewable five-year visa with family sponsorship, similar to the successful frameworks currently in place in Singapore and the UAE.

A visa investment threshold below $500,000 would be a reasonable option for Vietnam, as it remains competitive comparing to benchmarks in Europe and the Gulf while still significantly higher than Indonesia and Thailand, striking a balance between accessibility and selectivity. A streamlined and transparent application process would further enhance the programme’s competitiveness and position it as a signature policy within Vietnam’s IFC strategy.

Another common challenge facing emerging financial centres is the lack of funding for innovation, particularly in high-risk technology sectors.

To address this, several countries have proactively established targeted R&D grant initiatives. Singapore, for example, introduced the AIDA Grant to subsidise R&D costs for AI and data analytics applications in finance.

In the Middle East, Abu Dhabi launched the $500 million Hub71 Fund to support high-tech industries, while Dubai established a $100 million fintech fund to back early-stage financial startups.

Drawing on these experiences, Vietnam could consider establishing a financial innovation fund based on a public-private co-investment model.

The fund should be governed by an independent review board and operate under a transparent selection process. Eligible recipients could include startups, research institutions, and experimental product developers working within the priority sectors of the 1+3 model. Support could take the form of non-refundable grants or proportional co-investment, based on criteria such as technological merit, social impact, and commercial potential.

Roland Berger believes these two initiatives reflect Vietnam’s open, proactive, and strategically grounded approach in the global race for capital and talent. With well-timed deployment and thoughtful implementation, they could deliver the catalytic impact needed for Vietnam’s IFC to assert a firm position in the regional and global financial landscape.