INTERNATIONAL INVESTMENT

AND PORTAL

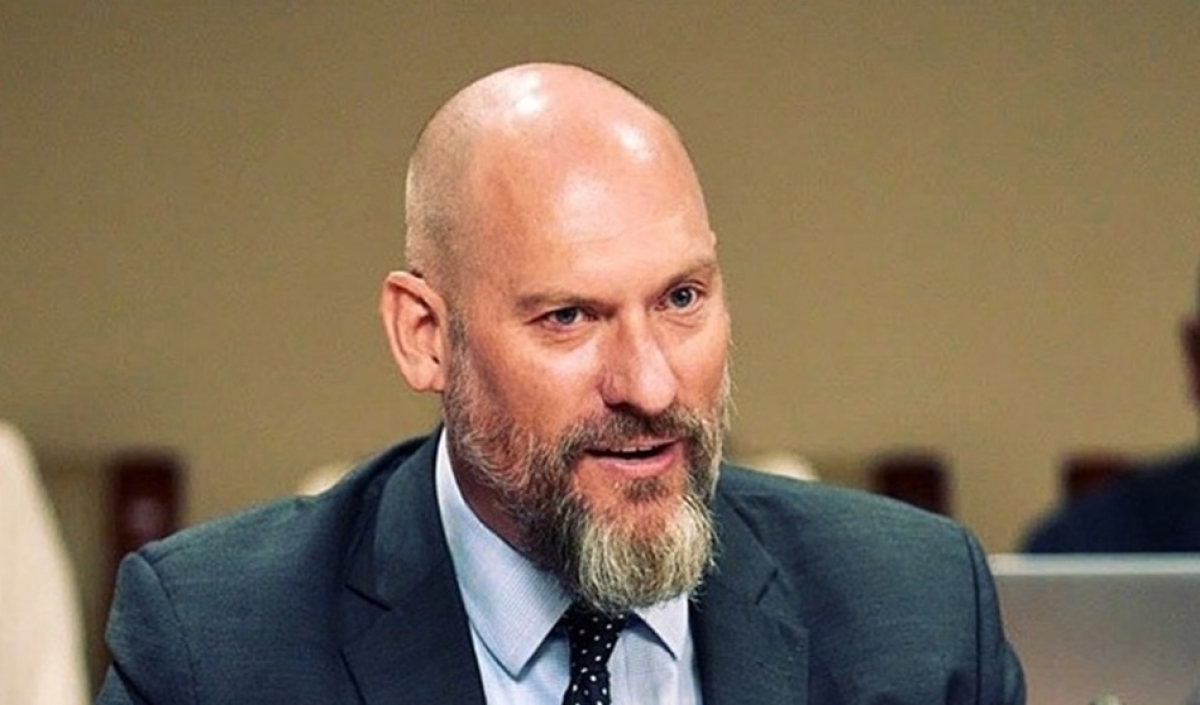

Choosing an effective investment channel in the context of economic fluctuations is a complex issue. Hoang Quoc Anh, investment director of GHGInvest and VP of the Investment Banking Club at the Vietnam Association of Securities Business, told VIR’s Thu Trang about asset class outlook and risk allocation.

How do you evaluate stock market prospects in 2025?

The local stock market and the domestic economy will see a positive 2025. The US consumer price index in November increased by 0.3 per cent on-month and increased by 2.7 per cent on-year. The core index, excluding energy and food prices, increased by 0.3 per cent on-month and increased by 3.3 per cent compared to November 2023.

This is the preferred inflation measure of the US Federal Reserve, and the figures were released ahead of its policy meeting on December 17-18. The market expects the Fed to cut interest rates by 0.25 percentage points at this meeting.

Secondly, China is likely to loosen monetary and fiscal policies to stimulate the economy and promote domestic investment and consumption.

There is a high possibility towards the end of 2025 that the Vietnamese stock market will be recognised as an emerging one, and when it is, there will certainly be about $5-6 billion US dollars or more capital flowing into the country on the back of that.

Hoang Quoc Anh, investment director of GHGInvest and VP of the Investment Banking Club at the Vietnam Association of Securities Business

Hoang Quoc Anh, investment director of GHGInvest and VP of the Investment Banking Club at the Vietnam Association of Securities Business

Are there likely to be major adjustments or sudden changes in investment trends in the coming year, and what strategies should investors consider to protect and optimise profits?

Regarding US stocks, although all the macro information is good, since the beginning of the year, the US stock market has increased by 30 per cent, so it is likely to decline in the first half of 2025.

Global inflation has cooled down, and the Fed has also announced a gradual reduction in interest rates. The pressures seem to have eased, but global investors still do not seem to have a truly positive view of the stock markets. Domestically, Vietnam has many positive factors, such as inflation being under control, low interest rates supporting businesses, and stable exchange rates, but many investors are still wondering how these factors will affect the market. At the same time, if the US stock market adjusts, it will certainly have a high possibility of affecting Vietnam.

However, my advice is to invest long-term over several years, and not look at the short term. You should invest from small savings to avoid other problems that may affect the investment. It can be seen that the longer the investment, the lower the risk will be compared to doing so for just a few months to a year.

The correct mindset is essential. Everyone must start from there first and then think about what they should invest in. When getting involved in the stock market, everyone needs to know how to read financial reports, learn about companies and what they do, as well as their financial reports.

How will asset classes such as real estate, gold, or bitcoin be affected by global events in the coming year?

Real estate in the Vietnamese economy is still an important investment channel. Besides that and gold, now there is also bitcoin, but of course, in everyone’s investment portfolio, there should be certain proportions.

For example, Bitcoin’s growth fluctuates a lot, while gold can be very stable and real estate is the same, so most of the investment portfolio should be for assets that do not fluctuate much to make people feel secure.

Investors navigate unpredictable landscape in 2025

Investors navigate unpredictable landscape in 2025

VIR hosted a conference on December 12 themed 'Investing 2025: Decoding Variables - Embracing Opportunities' to help upcoming investors identify economic trends and investment opportunities.

Careful prep to ensure 2025 growth success

Careful prep to ensure 2025 growth success

Investors are deciphering both new and old variables to identify opportunities in 2025, while being wary of risks from the global political and economic environment.

By Thu Trang