INTERNATIONAL INVESTMENT

AND PORTAL

As a rapidly growing business segment, the appearance of a raft of ready-built warehouses and factories pose challenges in maintaining occupancy rates as well as optimising rental performance.

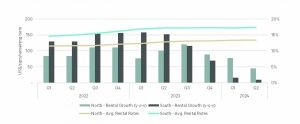

A report from JLL Vietnam pointed out that in 2024, the ready-built factory and warehouse market in both the south and north regions recorded high absorption and increased rental prices.

The southern ready-built warehouses and factories segment in Q4 last year recorded a positive net absorption rate, reaching nearly 19,600sq.m.

Leasing activities improved significantly thanks to demand from tenant groups serving the domestic consumer market, which is often vibrant at the end of the year. Accordingly, the net absorption rate for the whole year reaches about 199,500 sq.m, 40 per cent higher than in 2023.

Ready-built business sees advances, Photo Le Toan

Ready-built business sees advances, Photo Le Toan

The segment did not receive new supply, maintaining the same size of two million sq.m but still increasing by 5.2 per cent over the same period last year. The largest market share still belongs to investors BW Industrial Development and Mapletree, accounting for 30 and 20 per cent of total existing supply, respectively.

The southern market is preparing for scale expansion in 2025, with approximately 684,000sq.m of new ready-built factories and warehouses being built across key provinces.

The northern market remained stable in Q4 of 2024 with net absorption reaching 41,000sq.m, lower than the previous quarter but still maintaining a stable level.

New projects in 2024 were mainly concentrated in Yen Phong and Thuan Thanh districts in the northern province of Bac Ninh. This trend is expected to continue this year with prominent projects under construction, JLL said. Accordingly, Bac Ninh continues to lead the supply in the region. The Hung Yen and Haiphong markets are also expected to become more vibrant thanks to the participation of new investors entering the market.

In addition to projects of current large investors such as BW Industrial Development, LOGOS, SLP, and KCN Vietnam, the market expects to welcome completed projects of two new investors of MEA with Logicross Haiphong and Daiwa House-WHA Group cooperation with DPL Vietnam Minh Quang.

According to Le Trang, newly appointed country head of JLL Vietnam, many investors have converted functions or integrated diverse business models, from factories to manufacturing plants or combining factories with distribution centres and warehouses.

“The goal is to make the most of the space and meet diverse needs, while maintaining an advantage in the market. This is expected to be an effective solution to improve rental performance and maintain the attractiveness of ready-built factory projects in the medium term,” Trang said.

In addition, increased investment in ready-built warehouses and factories also boosts demand for supporting infrastructure services such as logistics, transportation and related services. “This means that Vietnam not only attracts large investments in the industrial real estate industry but also creates a strong support ecosystem, creating opportunities for domestic and foreign businesses to exploit maximum development potential,” said Trang.

Truong An Duong, general manager North Vietnam and Residential Frasers Property Vietnam

In the context of increasingly fierce competition in the real estate market, especially in the industrial real estate segment with strong growth rates, investors need to constantly innovate and adapt to attract large manufacturers.

Frasers Property Vietnam has been implementing pioneering solutions to meet the increasing needs of the market. One of our significant solutions is to develop a high-end industrial real estate model called the Premium Estates concept.

This model not only focuses on building modern infrastructure but also providing comprehensive business support services, life-cycle support, creating maximum conditions for customers during the operation process.

A special feature of the design model of industrial projects is the diverse and flexible design, meeting the needs of many customers, from small- and medium-sized enterprises to large industry-leading enterprises with a build-to-suit solution that allows customers to customise the space and functions of the factory. We also pay special attention to sustainability and social responsibility, with the goal of all projects achieving green building certification.

Hardy Diec, COO, KCN Vietnam

After achieving significant progress in market supply, Vietnam’s industrial property sector must now prioritise higher-quality and sustainable developments to bolster growth momentum and position the country as a leading manufacturing hub in the region.

To achieve this, industrial developers should focus on several key factors. Sustainability is no longer just a trend, it has become a fundamental requirement for industrial developers. Implementing green building standards such as LEED and EDGE is essential to ensuring long-term viability and enhancing their competitiveness.

Developers should integrate energy-efficient solutions to optimise operations, reduce environmental impact, and align with global sustainability trends.

Secondly, investors demand a diverse range of industrial solutions in terms of size and also product types. The ready-built model is increasingly preferred, particularly among foreign investors, as it enables a faster setup process, reduced initial risks, and quicker operational readiness.

Simultaneously, adopting the eco-industrial park model and offering comprehensive support and consulting services can further enhance the competitiveness of industrial real estate developers, providing investors with sustainable and well-integrated solutions.

Ready-built factory market on the up

Ready-built factory market on the up

In the first half of 2024, the industrial real estate market continued to show positive developments.

Multidimensional benefits created with KCN Vietnam

Multidimensional benefits created with KCN Vietnam

KCN Vietnam Group, a developer in ready-built warehouses and factories for rent, is currently managing 10 high-quality industrial projects across Vietnam. Company COO Hardy Diec talked to VIR’s Binh An about the factors for the group to achieve important achievements after four years of development.

Industrial property rental prices set to rise

Industrial property rental prices set to rise

CBRE Vietnam forecasts that industrial land rental prices are expected to increase by 4-8 per cent per year in the north and 3-7 per cent per year in the south in the next three years.

Vietnam's industrial property is key to global supply chain

Vietnam's industrial property is key to global supply chain

Vietnam's industrial real estate sector is no longer an emerging player but a cornerstone of the global supply chain. Lance Li, CEO of BW Industrial, expands on the development of the ready-built factory industry, from basic facilities to modern industrial assets.

By Bich Ngoc