INTERNATIONAL INVESTMENT

AND PORTAL

The State Bank of Vietnam (SBV) has reduced the ceiling interest rate for savings under six months to 4.75 per cent a year, the second reduction in less than a month.

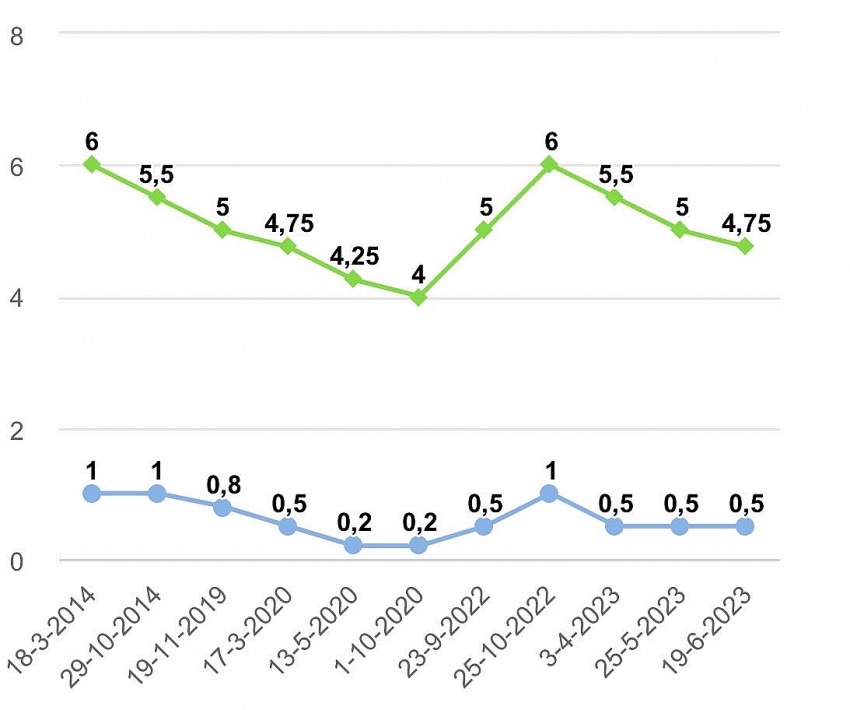

Savings interest rate ceiling being adjusted three times in the first half of 2023 (unit: per cent). Image source: vnexpress.net

Savings interest rate ceiling being adjusted three times in the first half of 2023 (unit: per cent). Image source: vnexpress.net

The interest rates will be reduced from June 19. Specifically, the maximum interest rate for deposits with a term of 1 month to less than 6 months will be reduced to 4.75 per cent a year (from 5 per cent). The maximum interest rate for deposits with terms of less than 1 month remains at 0.5 per cent per year.

Interest rates on overnight loans in interbank e-payments and loans to cover capital shortfalls with credit institutions also fell by 0.5 to 5 per cent a year. The refinance rate fell by 0.5 to 4.5 per cent a year. The discount rate fell from 3.5 to 3 per cent a year. The ceiling of short-term lending rates in Vietnamese VND for priority sectors was also adjusted from 4.5 to 4 per cent a year.

Thus, in the first half of this year, the SBV has reduced the deposit interest rate ceiling three times. The first time at the beginning of April, the ceiling interest rate from 1 month to less than 6 months decreased from 6 to 5.5 per cent a year. At the end of May, it went down by 0.5 per cent to 5 per cent a year.

Reducing the ceiling of deposit and operating interest rates "is an important step, orienting the market's interest rate reduction trend going forward," the bank said. This is a signal to guide banks to reduce lending rates.

This decision was made in accordance with the policy of the National Assembly and the direction of the government to reduce interest rates, support people and businesses to access to capital, and contribute to the recovery of production and business. The move is also supported by a number of factors, such as controlled inflation and guaranteed liquidity of credit institutions.

On June 16, the Government Standing Committee requested the SBV to immediately take measures to reduce interest rates, including lowering the operating interest rate in June. Commercial banks should cut costs to lower interest rates to support businesses and people resuming production, contributing to the economic growth.

Policy interest rate expected to further reduce in H2 2023

Policy interest rate expected to further reduce in H2 2023

The analysts also expect the average 12-month deposit interest rate will drop to 7 per cent per year in 2023.

Vested interests doing damage in banking

Vested interests doing damage in banking

Concerns are being raised by various stakeholders in Vietnam’s banking sector regarding the risks of cross-ownership, emphasising the need for regulatory reforms to enhance transparency, mitigate the dominance of major shareholders, and propose measures such as reducing ownership ratios and expanding information disclosure.

Further fall projected for interest rates

Further fall projected for interest rates

Several banks have followed the State Bank of Vietnam’s (SBV) lead by lowering their base interest rates, aiming to encourage and facilitate increased credit demand within the market.

By Nguyen Huong