INTERNATIONAL INVESTMENT

AND PORTAL

The statement was made by Michael Kokalari, chief economist of VinaCapital, on October 23 as he highlighted that the situation in Vietnam’s real estate market is completely different from China’s.

Michael Kokalari, chief economist at VinaCapital

Michael Kokalari, chief economist at VinaCapital

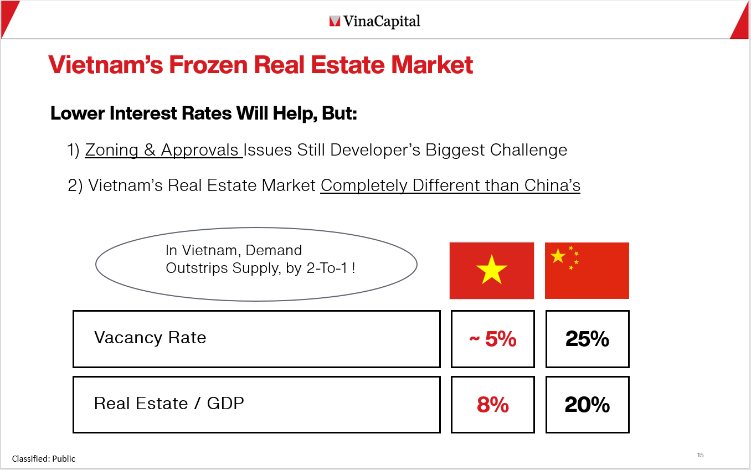

Even though Vietnam's real estate market has been frozen for the last few months with fewer transactions and decreased supply, the situation in Vietnam’s real estate market is completely different from China’s.

Unlike in China, where there is an enormous oversupply of empty housing units, Vietnam’s real estate market is fundamentally healthy, albeit suffering from severe short-term headwinds.

The number of housing units for sale in Ho Chi Minh City and Hanoi fell by about 50 per cent on-year in the first nine months, while the volume of new housing purchases in China fell by nearly 10 per cent during the same period, having plunged nearly 25 per cent last year – measured in terms of floor space.

Some investors and newspaper journalists worry that Vietnam is now experiencing the aftermath of a real estate bubble that will drag on the country’s economic growth over the next few years.

In short, China experienced a classic real estate boom and bust cycle, in which banks over-lend at the peak of the market, pushing prices into the stratosphere and leading to the development of too many housing units.

Vietnam experienced a similar real estate bubble that bottomed out around 2012, but the country has not experienced a proper real estate bubble since then. It is also certainly not in the aftermath of a bubble now, which is reflected by the fact that the country’s vacancy rate is still quite modest and far below China’s, as can be seen below.

The reality is that Vietnam is not producing nearly enough new housing units to meet the growing demand from the burgeoning middle-class population that requires affordable housing, for example, residences priced at around $1,500 per square metre that cater to the needs of ordinary consumers.

The primary bottleneck that developers are currently facing centres around Vietnam’s cumbersome zoning and approval process, which has been especially hindered recently by various dynamics within the government.

In addition, the need for developers to finance their land acquisition and construction costs also contributed to the slowdown in development activity.

The especially high level of interest rates in Vietnam, until recently, made it expensive for developers to finance the construction of their projects, and their inability to secure proper zoning and approvals from the government has made it impossible for them to borrow at any cost since because banks do not want to lend to projects without proper approvals.

Finally, we note that there have been some intensified efforts within the government to remove and reduce the obstacles developers have been facing in attaining the approvals needed to proceed with certain projects.

Those efforts by senior officials stem in part from the fact that the slowdown in Vietnam’s real estate development activity has dampened consumer sentiment in the nation, which in turn has weighed on consumption.

However, real estate development only makes a modest contribution to Vietnam’s GDP, so we should make it clear that slower real estate development activity is not the primary factor depressing Vietnam’s GDP growth this year – especially because development activity was already slow last year, and the sluggish real estate sector has had much less of an impact on Vietnam’s GDP growth than it has in China because real estate development represents a much bigger slice of that country’s economy.

Proposed land law amendments seek to spur Vietnam tourism

Proposed land law amendments seek to spur Vietnam tourism

Some proposed changes aim to create a dedicated land fund for tourism development, improve land requisition rules, and strike a balance between national interests and the growing tourism sector, promoting infrastructure investments.

Realty demand gains strength amid economic recovery

Realty demand gains strength amid economic recovery

The real estate sector is finally emerging from its slumber as the economic recovery in the third quarter of the year has triggered a resurgence of demand for realty properties.

Hanoi average property prices almost double since 2018

Hanoi average property prices almost double since 2018

According to the Cushman & Wakefield report, the average primary property price in Hanoi in Q3/2023 nearly doubled compared to 2018. The price reached $2,141 per square metre, reflecting a 5 per cent quarterly increase and an almost 12 per cent annual rise.

Land space shake-up mooted for tourism

Land space shake-up mooted for tourism

The legal inclusion of tourism projects in the list of land that can be repossessed by the state and assigned to investors for socioeconomic development was among the key issues experts discussed at a seminar organised by VIR last week in Hanoi.

By Bich Ngoc

VinaCapital