INTERNATIONAL INVESTMENT

AND PORTAL

The underlying motivation for increasing tariffs in the United States is to uphold its global dominance by reinforcing its dollar’s role in international trade, restoring manufacturing and employment, and shielding the US industries from competitive pressures posed by exporting countries.

Trinh Ha, a financial market analyst from Exness Investment Bank

Trinh Ha, a financial market analyst from Exness Investment Bank

Nonetheless, the primary driver was to address the federal budget imbalance. This became especially pressing as his proposed economic measures, such as corporate tax cuts, extensions to personal income tax reductions, government spending increases, and other financial support schemes, were anticipated to place significant pressure on federal finances.

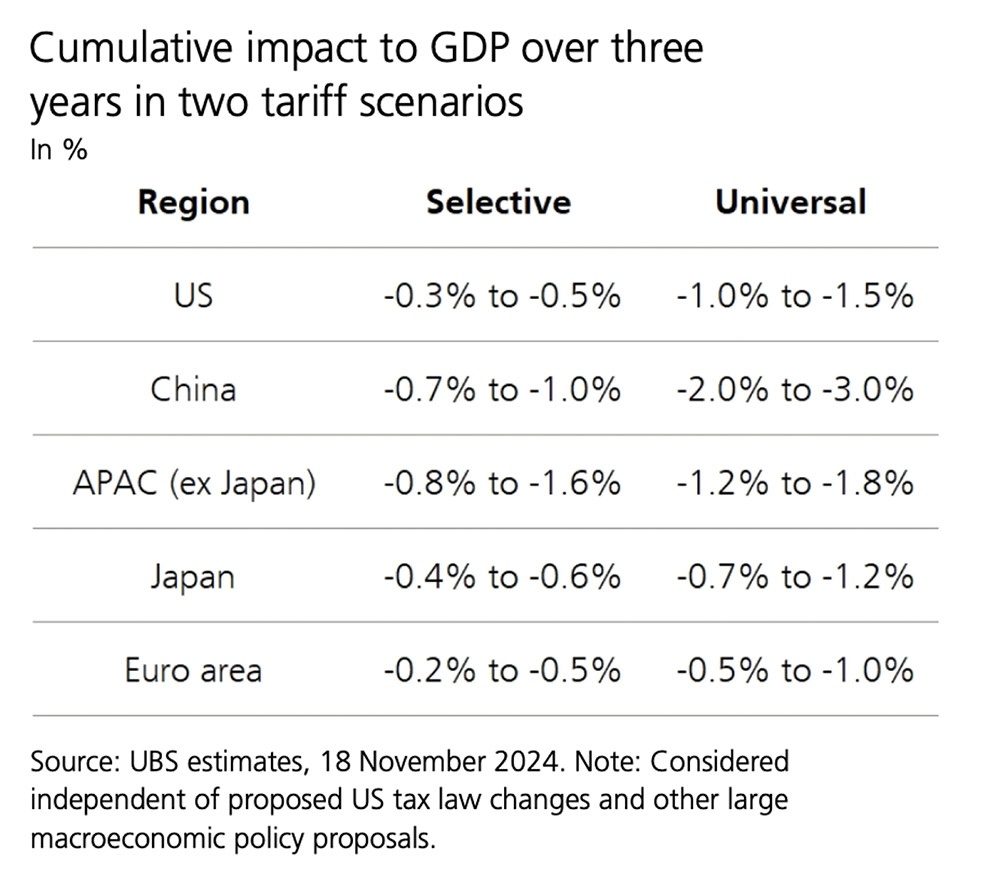

According to UBS estimates, if China were subjected to tariffs of approximately 30 per cent, the country’s GDP could contract by 0.7-1 per cent over the next three years. Meanwhile, Asia-Pacific nations, excluding Japan, could see a decline of 0.8-1.6 per cent, with Japan experiencing a smaller reduction of 0.4-0.6 per cent.

The Eurozone would be less affected, with GDP shrinking by 0.2-0.5 per cent. Even the United States would not emerge unscathed, with a potential reduction of 0.3-0.5 per cent, largely due to China’s retaliatory measures targeting certain essential US imports and exports to China.

In a more severe scenario involving global tariffs ranging from 10-20 per cent, and a 60 per cent tariff specifically on China, the impact would be significantly amplified. China’s GDP could plummet by 2-3 per cent, while the US economy could see a contraction of 1-1.5 per cent. Asia-Pacific countries, excluding Japan, would also bear the brunt, with GDP expected to decline by 1.2-1.8 per cent.

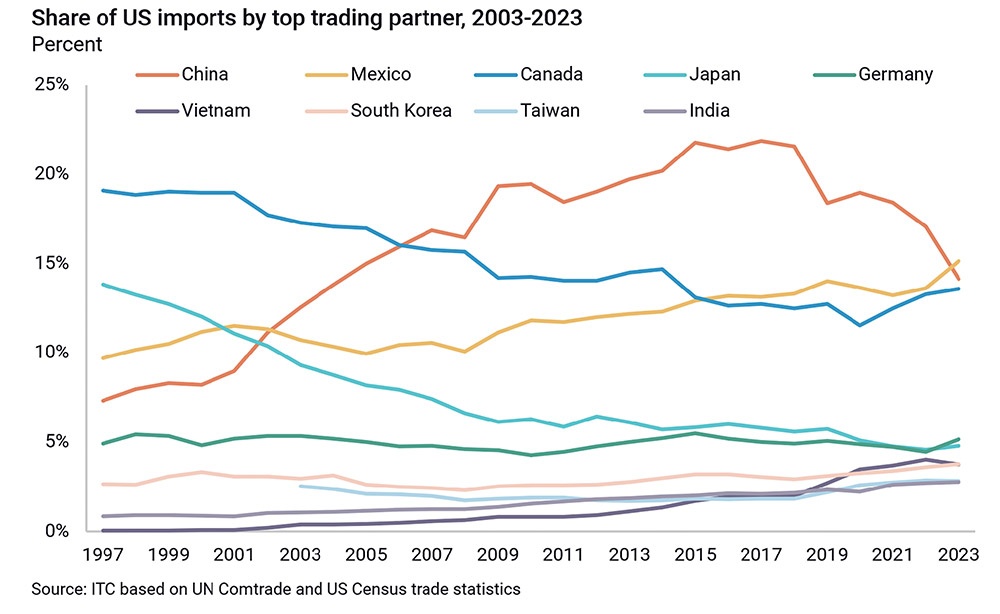

Largest trading partners with the United States such as China, Mexico, Canada, and the EU have recently faced threats of tariffs as high as 25 per cent. The stakes are even higher for China, with over 65 per cent of tariffs looming on all categories of goods.

Shifts that spur growth

China’s economy is currently undergoing a fragile recovery, hampered by a prolonged downturn in the property market. Despite a series of stimulus measures, any rebounds have proven short-lived with subsequent declines following swiftly.

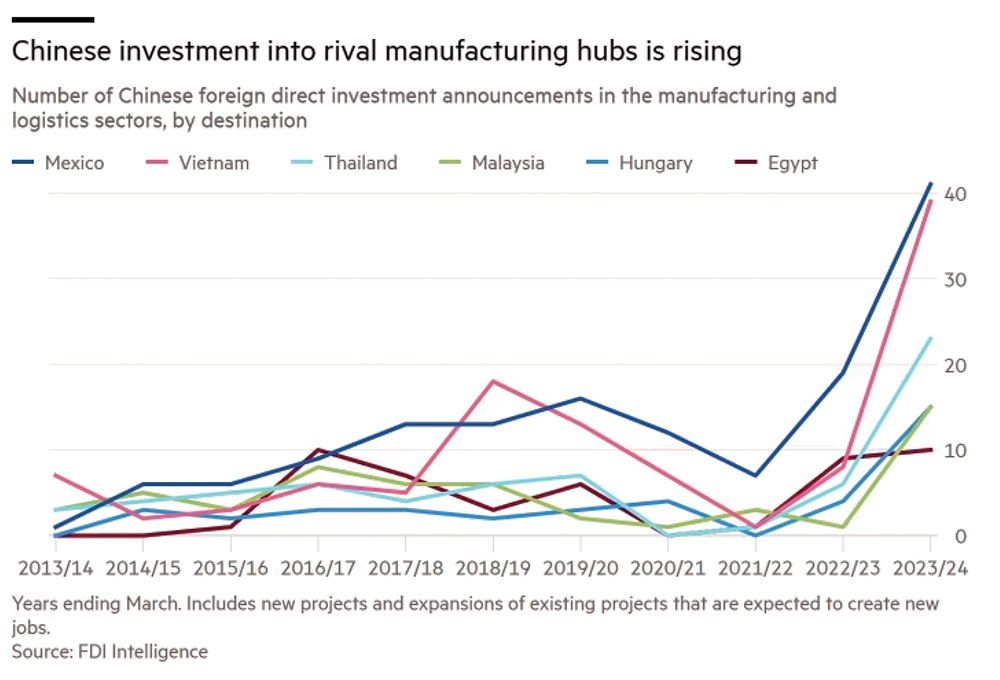

The current heightened risks in China, coupled with lessons learned from the 2018 US-China trade war, have prompted Chinese businesses to shift investment and production to third countries to circumvent tariffs.

During that dispute, nations like Mexico, Canada, and Vietnam became key hubs for transshipment and intermediary production of Chinese goods destined for the US under lower tariffs. These countries experienced substantial growth in exports to the US and saw a significant influx of foreign investment from China as a result.

Vietnam has emerged as a major destination for foreign direct investment, alongside Mexico. The wave of investment relocation from China has gained significant momentum since 2017, witnessing only a temporary slowdown during the pandemic before rebounding strongly.

Sectors with higher technological content, such as electrical and electronic products, solar panels, and biotechnology, are also expected to see promising growth.

The shift in production has spurred growth in industries supporting this transition, including industrial estate, logistics, seaports, consumer goods, real estate, and energy. These sectors are set to benefit most in regions attracting significant investment inflows, particularly northern Vietnam, which has witnessed remarkable activity in recent years.

Optimise profitable gains

With the policy of supporting digital currencies and the plan to establish a Bitcoin reserve, in early December, Paul Atkins was appointed as the new chairman of the US Securities and Exchange Commission, who is very friendly to digital assets. It is expected that shortly, there will be policies supporting digital currencies and a Bitcoin reserve that can become a reality, making this asset more widely recognised and blockchain technology can also be applied more widely shortly. Therefore, BTC surpassing $100,000 on December 5 may not be the end point.

For gold, the next US president’s intention to end geopolitical conflicts by possibly cutting funding for Ukraine and ending the current conflicts in the Middle East will ease the geopolitical situation and reduce a reason for investors to seek safe havens and reduce the previous upward momentum of gold.

However, with the unpredictability of future policies, especially the plan to impose tariffs on countries that could worsen the global economic situation, this is a long-term bullish driver for gold prices.

For stocks, the policy of reducing corporate income tax from 21 to 16 per cent will continue to support businesses to maintain good growth momentum, a factor that has boosted US stock indexes in recent times, with estimated earnings per share growth of 5-10 per cent.

At the same time, AI technology is increasingly penetrating into life, which can stimulate productivity growth and change the structure of the economy. Accordingly, it can reduce the current valuation of the market, which is higher than the historical average.

With a strong US economy, inflation may increase again, causing the US Fed to slow down interest rate cuts. Cash flow will remain in the States, and investing in risky assets in the US with strong growth potential and high government bond yields will lead to a slow recovery of capital in frontier and developing markets, or even continued net withdrawals.

At the same time, the long-term equilibrium interest rate is expected to be higher with the US economy expected to have a soft landing, which will cause the value of the dollar to remain high. This makes these markets lack a significant price increase momentum, especially the Vietnamese market.

However, if Vietnam takes advantage of these opportunities, and reduces the trade surplus with the US by purchasing large-value items such as aircraft and liquefied natural gas, it can avoid high tariffs. Accordingly, it can be an ideal place for capital flows from other countries, including the US, and the opportunity to access higher technology to change the structure of the economy. This would also help avoid losing advantages as incomes and labour costs increase in the coming time.

Meanwhile, with the policy of supporting development of oil and gas exploitation, supply is expected to remain at a surplus level compared to demand. This is especially so in China, the world’s largest oil importer, which may recover slowly when the economy still has problems, such as the possibility of high taxes.

Supporting oil and gas exploitation is also one of the strategies to maintain the strength of the dollar, especially in the BRICS-based nations, where the US has become the world’s largest oil producer in the past two years.