INTERNATIONAL INVESTMENT

AND PORTAL

Foreign investment in the electronics sector has been a key engine in Vietnam’s economic growth and job creation. Between 2014 and 2023, Vietnam accounted for 10 per cent of electronics foreign direct investment (FDI) in Asia, just behind India and China. The semiconductor industry in Vietnam has experienced remarkable growth lately, transforming the country from a traditional manufacturing hub to a global player.

Manager Ly Nguyen (left) and associate Tu Nguyen of the Tony Blair Institute Vietnam

Manager Ly Nguyen (left) and associate Tu Nguyen of the Tony Blair Institute Vietnam

Major industry giants have recognised this potential: Samsung has committed to a $1 billion annual investment in Vietnam; Amkor has pledged $1.6 billion in chip assembly and testing in the Bac Ninh province; and Foxconn is set to invest an additional $550 million in Quang Ninh province.

Vietnam’s strategic advantages make it a compelling destination for FDI. Its location as a gateway to Southeast Asia and proximity to China position it as a regional trade and investment hub. The country’s robust economic growth and swift recovery from the pandemic, with GDP growth reaching 6.93 per cent in Q2/2024, further bolster its appeal. The International Monetary Fund projects Vietnam to be among the top 10 fastest-growing countries over the next five years, underscoring its potential for investors.

Vietnam’s participation in various free trade agreements and its membership in ASEAN have made the country more attractive as a manufacturing destination. Recent comprehensive strategic partnerships with the United States, Japan, and Australia will also facilitate Vietnam’s trade with these markets moving forward.

The Vietnamese government’s prioritisation of high-tech industries is evident in the establishment of numerous industrial parks (IPs) and high-tech zones, such as Saigon High-Tech Park and Hoa Lac High-Tech Park. Investors coming to these parks are offered incentives such as tax breaks and land use fee reductions.

Furthermore, an increasing number of non-specialised complexes, including Yen Phong IP in Bac Ninh and Yen Binh IP in Bac Giang province, are increasingly catering to the needs of high-tech enterprises, enhancing Vietnam’s attractiveness as a destination for high-tech FDI.

Addressing limitations

However, the impressive figures in the number of registered projects or jobs created do not necessarily reflect the level of complexity and value creation in Vietnam.

In the semiconductor industry, which is one of the most strategic and competitive industries globally, the number and size of registered projects in Vietnam are still modest, not just compared to established markets such as South Korea, Japan, and Taiwan, but also to neighbouring markets such as Singapore and Malaysia, followed by Indonesia and Thailand.

Vietnam’s semiconductor sector is still at a nascent stage, with the industry’s revenue expected to reach $18.23 billion in 2024, with a compound annual growth rate of 11.48 per cent between now and 2029.

While the growth potential is there, the country’s market size remains minuscule compared to that of the global market, which is projected to reach $607.4 billion in 2024. This is because most investments in Vietnam currently focus on semiconductor downstream activities of assembly, testing, and packaging (ATP), the lower-margin end of the semiconductor value chain.

Challenges remain to be addressed if Vietnam wants to draw in more specialised and sophisticated investments. Firstly, while Vietnam is emerging as an export hub for high-tech products, its supplier network remains limited, focusing primarily on lower-value components. IPs often cannot facilitate supplier matchmaking or identify export markets, which is crucial for ensuring a reliable component supply for large-scale manufacturers. This limitation hinders the development of a comprehensive high-tech supply chain.

Another concern investors have is the quantity and quality of high-tech engineers in Vietnam. The current number of chip engineers in Vietnam is estimated at some 5,000, and training programmes often do not align with market needs. This underscores the necessity for enhanced coordination among stakeholders, including industry players, academia, and governments, to develop targeted training programmes to meet industry needs.

While there have been efforts by the government to provide incentives for investors in high-tech, these incentives are still modest compared to other markets. Competing countries such as Malaysia offer significant incentive packages consisting of tax breaks, subsidies, visa exemption fees, and streamlined processes. Vietnam can use mechanisms such as the upcoming Investment Support Fund to provide additional incentives for high-tech investors.

Stable energy supplies are critical for energy-intensive activities such as high-tech assembly and manufacturing, but this has been a challenge, particularly in the north. Investors are increasingly prioritising clean energy sources to meet their global sustainability commitments. Recent initiatives, such as the direct power purchase agreement, aim to facilitate the use of renewable energy. Initiatives such as this highlight the role of IPs in ensuring a stable and clean energy supply.

While Vietnam is emerging as an export hub for high-tech products, its supplier network remains limited in places

While Vietnam is emerging as an export hub for high-tech products, its supplier network remains limited in places

Long-term building

Realising the tremendous opportunities that the semiconductor industry has to offer, the Vietnamese government has commenced the development of a strategy for the industry. Given finite resources, the country should develop its semiconductor industry in a targeted and phased manner by focusing on segments that are attractive to investors while also bringing sustainable socioeconomic benefits to Vietnam. Based on these criteria, the most immediate priority should be leveraging its capacities in semiconductor ATP to target potential investors in this segment. Another segment wherein Vietnam has the potential to excel in the short term is semiconductor research and development (R&D).

In the long term, Vietnam should invest in building up its capacities in wafer fabrication, the most capital-intensive segment in the semiconductor value chain. This would involve investing in highly qualified chip engineers, a strong regulatory environment with streamlined business procedures and intellectual property protection, and reliable and clean sources of energy.

Besides existing incentives for high-tech park investments, such as corporate income tax and tax holidays, global investors are increasingly looking for IPs that offer facilities for circular economy development to meet their environmental, social, and governance commitments. Specifically, the renewable energy directive adopted in 2023 raised the EU’s binding renewable target for 2030 to a minimum of 42.5 per cent, up from the previous 32 per cent target, almost double the existing share of renewables.

As a result, investors are encouraged to seek opportunities where their investments can make a significant impact on the renewable energy transition. To increase their competitiveness, the government, and IP developers must integrate waste and wastewater management facilities, provide options for clean and renewable energies in existing and future IPs, and consider incentives for companies utilising or developing alternative energy options.

In an increasingly competitive landscape, it is paramount that Vietnam develops a more streamlined business process to entice foreign investments. This requires simplifying administrative procedures, taking a customer service mindset when working with foreign investors by providing timely responses to their requests, and being responsive to investor queries.

Investors looking for manufacturing locations will be increasingly interested in the presence of a robust supply chain and proximity to local talents, R&D centres, and academia to support innovation and synergies. Therefore, it is crucial that Vietnam consider these factors when developing electronics and semiconductor clusters across the country.

Vietnam’s electronics clusters exist in Bac Ninh, Bac Giang, Thai Nguyen, and Ho Chi Minh City, primarily attributable to major players such as Samsung in the north and Intel in the south. More can be done to develop these clusters into vibrant, high-tech ecosystems.

Vietnam is strategically poised to engage foreign investment in semiconductors. However, the window of opportunity will only be available for so long.

If it does not act quickly, it will lose out to neighbouring countries such as Malaysia or Singapore, which have a solid line-up of local chip talents, a history of up to five decades in semiconductor supply chains, and established infrastructure and investment attraction capacity.

Prime Minister Pham Minh Chinh has issued directives in July for two ministries, focusing on developing the semiconductor sector’s workforce.

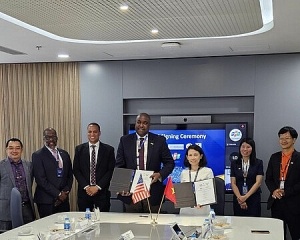

Vietnamese and US partners sign deals to propel semiconductor and IT sectors

Vietnamese and US partners sign deals to propel semiconductor and IT sectors

A groundbreaking MoU was signed between a leading Vietnamese entity and multiple companies in the United States on July 18, marking a significant milestone in the semiconductor industry.

Appetite for high-growth stocks linked to semiconductors, AI and digital assets

Appetite for high-growth stocks linked to semiconductors, AI and digital assets

Investors are scouting for high-growth stocks related to semiconductors and AI as well as acquiring digital assets, heard a recent panel discussion about investment opportunities in H2.

With its strategic location and advantages, Hanoi is moving to attract resources for the development of the semiconductor industry.