INTERNATIONAL INVESTMENT

AND PORTAL

The return of Donald Trump to the US presidency signals a renewed focus on trade imbalances that could impact Vietnam’s booming trade relationship with the US. Last year, Vietnam enjoyed a trade surplus of nearly $100 billion with the US, making it America’s third-largest trade partner after China and Mexico.

While this relationship has propelled Vietnam’s economic growth, it may also place Vietnam under closer scrutiny, with Trump’s administration keen on correcting significant trade deficits.

Michael Kokalari, chief economist of VinaCapital, emphasised Vietnam’s unique role in helping the US reduce its reliance on China, particularly for low-cost goods.

"Vietnam can be seen as a useful partner for the US, helping reduce dependency on low-cost Chinese goods," he explained, noting that Vietnam’s high wages and limited skilled factory labour make it less competitive for low-value production.

Kokalari suggested that the US may begin to focus on high-value imports from Vietnam, such as liquefied natural gas and aircraft engines, that could offset the trade imbalance, ultimately reducing the likelihood of severe tariffs targeting Vietnamese goods.

Staying resilient in the face of tariffs

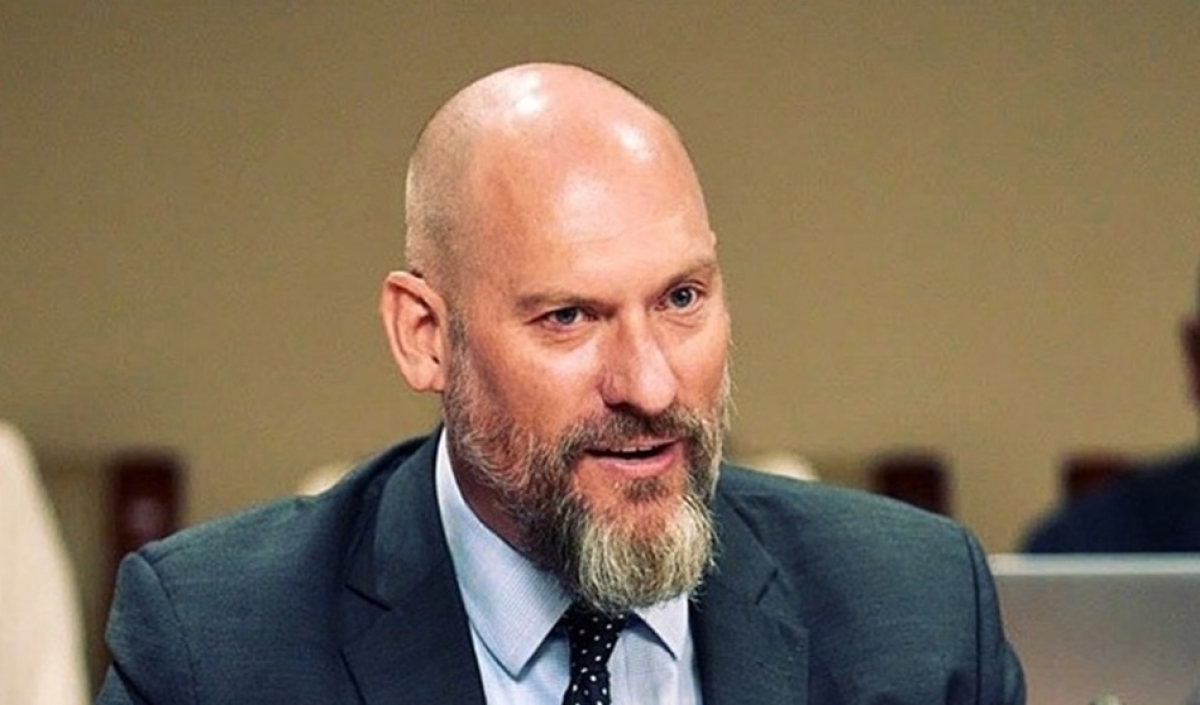

Koh Eng Meng, deputy director of Investment and Asset Management of KTG Industrial

Koh Eng Meng, deputy director of Investment and Asset Management of KTG Industrial Although Trump’s administration has a history of tariffs, experts predict that Vietnam will remain resilient.

Koh Eng Meng, deputy director of Investment and Asset Management of KTG Industrial - a major industrial real estate developer in Vietnam, highlighted Vietnam’s strategic advantage in Southeast Asia, noting that the country has largely avoided the harshest penalties impacting Chinese exports.

"Vietnam’s minor trade deficits with the US and its favourable position in Southeast Asia make it an essential destination for foreign investment," he said.

Koh underscored that this resilience stems from Vietnam’s stable economic policies, which have kept foreign direct investment (FDI) flowing despite global uncertainties.

Moreover, Koh highlights Vietnam’s rising middle-class and expanding domestic consumer market as pivotal factors in its sustained appeal to investors.

"Vietnam is poised not only to become a regional manufacturing centre but also to grow as a significant consumer market," he noted.

This development aligns with the 'China + 1' strategy, where companies are diversifying production away from China to other hubs, with Vietnam emerging as a top choice.

Koh explained, "This trend strengthens Vietnam's manufacturing sector while driving consumer growth, making it an attractive destination for multinational companies looking to mitigate risk amid ongoing US-China tensions."

Adding to this optimistic outlook, the World Bank projects Vietnam’s GDP growth to reach 6.1 per cent in 2024, rising to 6.5 per cent in 2025. Similarly, UOB Bank has revised its 2024 growth forecast upward to 6.4 per cent, higher than its previous projection of 5.9 per cent.

These positive economic forecasts reinforce Vietnam’s potential to attract foreign investors and cultivate a robust and dynamic domestic market.

Government initiatives to prepare for trade uncertainties

Trump’s campaign rhetoric signals a shift towards protectionist policies, raising questions about potential tariffs on Vietnamese imports.

In its latest report, SSI Research cautions that this uncertainty may cause some foreign-invested enterprises to delay decisions, pending clearer guidance from the new administration on tariffs affecting Vietnamese imports.

"Ahead of these challenges, the Vietnamese government is implementing measures to make its economy more resilient and attractive to investors," according to SSI Research.

According to the brokerage, these initiatives include tax incentives for semiconductor manufacturing, amendments to streamline investment certification processes for new industrial zones, and infrastructure investments such as the North-South expressway and rail links with China.

The firm suggested, "These upgrades not only support Vietnam’s industrial base but also help secure FDI inflows in the face of potential US tariff measures."

KTG Industrial Yen Phong IIC Phase 2 is expected to meet high demand from manufacturing companies in Bac Ninh

KTG Industrial Yen Phong IIC Phase 2 is expected to meet high demand from manufacturing companies in Bac Ninh Frederic Neumann, chief Asia economist at HSBC, noted that Vietnam’s diversification efforts could buffer it against trade impacts from the US.

"Vietnam can deepen trade ties with other markets, just as China diversified its export destinations," he said.

"Even if Vietnam were to face certain tariffs, its strong manufacturing base and competitive advantages would allow it to pivot and deepen trade ties with other regions, including Europe and emerging markets," Neumann added.

Similar to how China adapted by diversifying its export destinations, Neumann believes that Vietnam has the potential to mitigate any negative impact by strengthening partnerships beyond the US market.

Vietnam’s position as a key regional investment hub

Despite the looming threat of trade restrictions, Vietnam continues to solidify its standing as a key investment destination.

Koh Eng Meng believes that Vietnam’s stable policies and strategic location make it an attractive choice for foreign investors across multiple high-potential industries.

"Vietnam has firmly established itself as a top investment destination, driven by its stable policies, strategic geographic location, and a proactive approach to economic diversification. The country has become a critical hub for industries such as technology, electronics, and renewable energy," said Koh.

Koh Eng Meng spoke at the Enterprise Global Exchange meeting in Shenzhen, China

Koh Eng Meng spoke at the Enterprise Global Exchange meeting in Shenzhen, China "Tech and electronics, in particular, face global scrutiny due to political sensitivities, but Vietnam’s positioning has enabled it to emerge as a leader in these sectors. Additionally, the country’s push towards green energy and sustainable production is opening doors for innovation and investment," he said, before adding that Vietnam’s potential extends beyond its traditional manufacturing strengths.

"Vietnam is increasingly tapping into emerging sectors like biotechnology, logistics, and digital transformation, which promise robust growth and opportunities for investors looking to diversify into high-value industries," Koh explained.

By leveraging its strategic policies and focus on future-ready industries, Vietnam strengthens its appeal to foreign investors, even in the face of global economic challenges.

Industrial real estate stocks benefit from US election results

Industrial real estate stocks benefit from US election results Industrial real estate stocks are forecast to benefit from a surge in factory relocations driven by increased FDI following Donald Trump's US election victory.

Trump’s second term impacts sci-tech activities and industry 4.0 technologies

Trump’s second term impacts sci-tech activities and industry 4.0 technologies RMIT's experts preview notable impacts that the second Trump administration might have on the digital and technological development and Industry 4.0 in Vietnam.