INTERNATIONAL INVESTMENT

AND PORTAL

This strategic collaboration marks a significant step in the latter (NAVICO)’s environmental, social, and governance (ESG) transformation and affirms the former (UOB Vietnam)’s role as a key financial enabler, helping businesses adapt to global sustainability standards and maintain long-term competitiveness.

Photo: UOB Vietnam

Photo: UOB Vietnam

Sustainability as the next growth catalyst for Vietnam’s seafood industry

Vietnam is the world’s third-largest seafood exporter, with annual exports reaching $10 billion in 2024, up 12.7 per cent on-year. Among key export products, pangasius remains a cornerstone of the industry, contributing $2 billion and maintaining strong global demand.

Beyond its economic impact, the seafood sector is a major source of employment, supporting millions of workers, especially in rural and coastal areas. However, as global markets tighten sustainability requirements, businesses must rethink their growth strategies to align with ESG standards.

In this shift, green finance is emerging as a key enabler, empowering businesses to integrate sustainability into their operations while strengthening long-term resilience. The agreement between UOB Vietnam and NAVICO reinforces the integration of ESG principles in aquaculture while enabling NAVICO to advance its green production standards.

Lim Dyi Chang, country head of Commercial Banking, UOB Vietnam

Lim Dyi Chang, country head of Commercial Banking, UOB Vietnam

“Vietnam is positioning itself as a key player in the global sustainable food supply chain. We believe that businesses with a strong ESG vision will emerge as strong industry leaders in the years to come. This collaboration with NAVICO reflects our shared commitment to sustainability,” said Lim Dyi Chang, country head of commercial banking, UOB Vietnam.

“Green finance plays a critical role in building long-term resilience and supporting industry-wide transformation, ensuring that businesses can thrive in an increasingly ESG-driven market,” he noted.

Through this facility, UOB Vietnam provides financial support while also enabling NAVICO to strengthen its ESG strategy, optimise supply chain efficiency, and accelerate its circular economy initiatives.

Moreover, the facility underpins NAVICO’s five-year net zero carbon roadmap, developed in partnership with the Vietnam Fisheries Department, ensuring compliance with international sustainability requirements in key export markets such as the EU and the US, while reinforcing its position as a sustainability leader in the aquaculture industry.

ESG commitment and net zero roadmap

NAVICO has long embraced sustainability as a core business strategy, integrating responsible farming practices, renewable energy adoption, and a circular economy approach.

With over 1,100 hectares of farming area, including 600 ha of high-tech aquaculture, the company operates one of Vietnam’s largest integrated pangasius supply chains, ensuring full control over quality from hatchery to export-ready products.

To secure this green financing, NAVICO underwent a stringent ESG assessment, demonstrating full compliance with the Asia Pacific Loan Market Association (APLMA) Green Loan Principles and maintaining internationally recognised sustainability certifications, including Best Aquaculture Practices (BAP) and Aquaculture Stewardship Council (ASC) – both prerequisites for loan disbursement.

“At NAVICO, sustainability is at the heart of everything we do. This partnership with UOB Vietnam enables us to strengthen our ESG practices and pursue critical investments in renewable energy and green supply chain optimisation. By leveraging UOB’s green finance expertise, we are accelerating our Net Zero roadmap and reinforcing our position as a leader in sustainable aquaculture,” said Doan Toi, CEO of NAVICO.

Since 2021, UOB Vietnam has supported NAVICO’s green transition, including financing rooftop solar projects to reduce costs and emissions.

With this partnership, NAVICO is expanding ESG-compliant market access while enhancing efficiency and competitiveness in global markets. NAVICO exports to more than 200 countries worldwide, supplying key markets across Asia, Europe, the Americas, the Middle East, and beyond.

Photo: NAVICO

Photo: NAVICO

The green financing for NAVICO is part of UOB Vietnam’s long-term commitment to expanding green finance solutions across industries with high sustainability potential, including aquaculture, agriculture, renewable energy, and sustainable manufacturing.

By the end of 2024, UOB Vietnam had successfully financed 19 green projects, further solidifying its position as a trusted financial partner for businesses committed to ESG excellence.

In 2025, the bank will focus on providing green finance support to businesses in the mid-sized customer segment, particularly local enterprises with a strong demand for a green transition, aiming to allocate at least 30 per cent of new credit facilities to this segment to fund sustainable development initiatives.

At the group level, UOB’s sustainable financing portfolio had surpassed $41 billion by the end of 2024, reflecting the bank’s strong regional commitment to driving the sustainability agenda.

Beyond financing, UOB Vietnam works closely with businesses to integrate sustainable production practices, leveraging its deep sector expertise and regional capabilities to support long-term business resilience and sustainable growth.

A defining partnership for sustainable aquacultureThis agreement is a strategic collaboration reflecting a long-term commitment to advancing ESG excellence in Vietnam’s aquaculture sector. As Vietnam deepens its participation in the global sustainable supply chain, partnerships like this will be essential in shaping the industry’s future.

With major export markets increasingly enforcing ESG requirements, the ability to demonstrate sustainability credentials is becoming a critical factor in global trade. UOB Vietnam’s green financing, combined with NAVICO’s strong sustainability commitment, ensures that Vietnam’s seafood remains competitive on the world stage, setting a new benchmark for responsible aquaculture.

Green finance to be unlocked

Green finance to be unlocked

As Vietnam progresses towards sustainability, integrating green finance is key to balancing economic growth with environmental preservation. The country’s unique social, political, economic, and environmental context presents both pros and cons for leveraging green finance solutions that align with global best practices while addressing local realities.

UOB maintains positive outlook for Vietnam but risks lie ahead

UOB maintains positive outlook for Vietnam but risks lie ahead

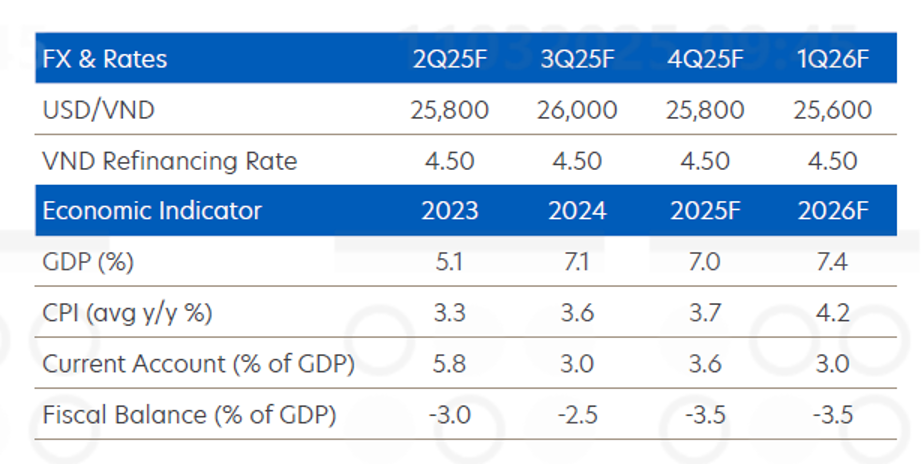

The United Overseas Bank (UOB) has maintained its full-year growth forecast for Vietnam at 7 per cent in 2025, assuming first quarter growth of 7.1 per cent.

Leveraging technology for ESG reporting and green finance management

Leveraging technology for ESG reporting and green finance management

In a rapidly integrating global economy, embracing digital tools and green finance will be instrumental in securing long-term business resilience.