INTERNATIONAL INVESTMENT

AND PORTAL

A sought-after stock market upgrade will help Vietnam pull in more capital from elsewhere, Photo Dung Minh

A sought-after stock market upgrade will help Vietnam pull in more capital from elsewhere, Photo Dung Minh

Vietnam’s Minister of Finance Ho Duc Phoc, addressed over 300 investors at an investment promotion conference in Singapore over a week ago, underscoring the increasing significance of Vietnam’s stock market as a key medium- to long-term capital channel for the economy.

Phoc noted that by July, Vietnam’s stock market had expanded to over 1,600 listed stocks and fund certificates, with a market capitalisation of approximately $278 billion, representing 65 per cent of the nation’s GDP in 2023. The number of investor accounts has also surged to 8 million, accounting for more than 10 per cent of the adult population.

“Vietnam’s stock market is vibrant, with daily liquidity reaching $1 billion, comparable to Singapore within the ASEAN region,” Phoc said, emphasising the country’s commitment to developing a transparent and open market that protects the rights and interests of all participants.

A key priority for Vietnam, according to Phoc, is upgrading its stock market from frontier to emerging status, a move he believes is crucial to attracting more global capital.

Currently classified as a frontier market by MSCI and FTSE Russell, Vietnam is on FTSE Russell’s watch list for a potential upgrade to secondary emerging market status, a milestone the country aims to achieve by 2025. The World Bank estimates that this upgrade could draw in an additional $25 billion in foreign capital by 2030.

Phoc also highlighted Singapore’s strategic importance as a financial powerhouse in Asia, with significant potential for further collaboration and investment, particularly in capital markets and also securities.

Supporting Phoc’s vision, Vu Thi Chan Phuong, chairwoman of the State Securities Commission of Vietnam (SSC), outlined the government’s efforts to upgrade the stock market.

“Upgrading Vietnam’s stock market is one of the government’s key objectives, and the Ministry of Finance (MoF) and the SSC have been actively engaging with stakeholders to implement measures that align with the criteria for this upgrade,” Phuong said.

The ministry has drafted amendments to four key circulars concerning trading, registration, custody and clearing, securities company operations, and information disclosure. These drafts have been widely circulated for feedback from market participants, experts, and academics, and the final draft will be published online before issuance.

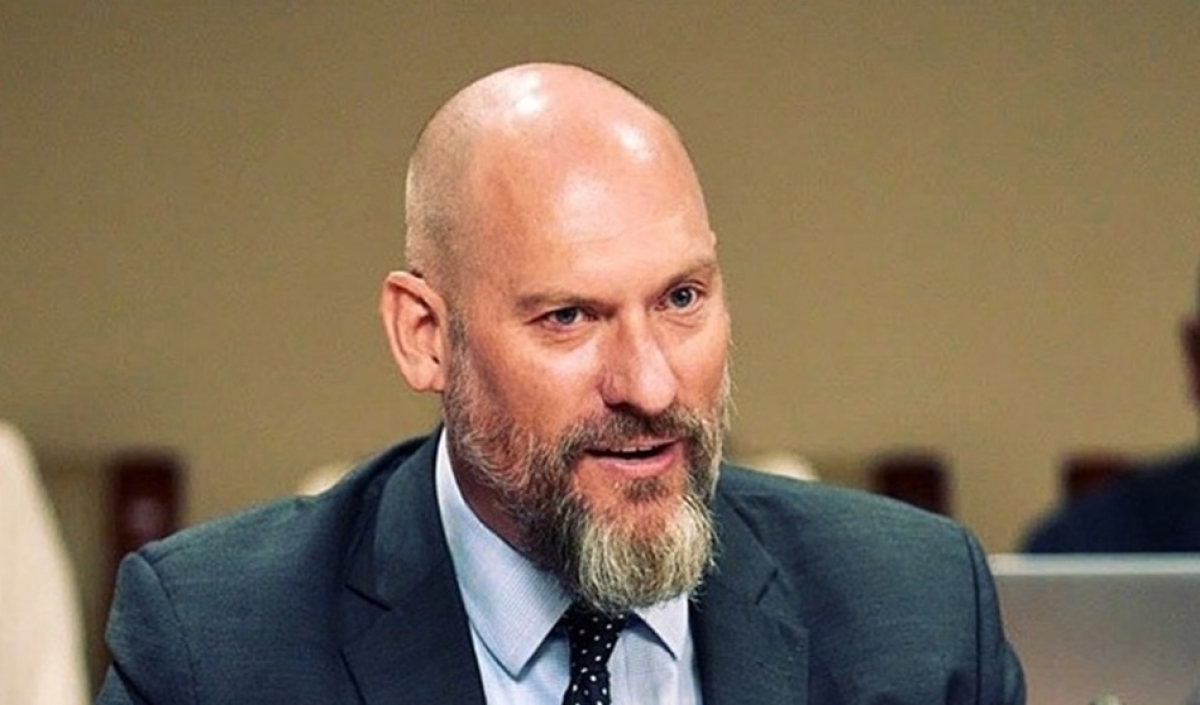

Alfred Chia, CEO of SingCapital, highlighted the substantial investment opportunities in Vietnam, driven by the country’s dynamic economy and significant growth potential within the ASEAN bloc.

“Enhanced regulatory support for securities companies, asset management firms, and fund management companies would enable greater collaboration with partners in Singapore and the region,” Chia said. “Clear, comprehensive information about Vietnam’s economy and investment opportunities will encourage foreign investors to increase their capital investments in the market.”

Meanwhile, Vu Quang Dong, who is deputy head of Capital Markets at Vietcombank, stressed the importance of upgrading Vietnam’s stock market status for the investor community.

“The early elevation of the market will bring numerous opportunities, including increased scale and liquidity,” Dong said. “A successful upgrade would benefit businesses by diversifying listed products and enhancing the quality and quantity of both domestic and international investors.”

Lyndon Chao, managing director of the Equities and Post Trade Division at the Asia Securities Industry & Financial Markets Association, also highlighted Vietnam’s appeal as an investment destination.

“To attract more global capital, it is essential to upgrade the stock market to emerging status. We will collaborate with the SSC and the Vietnam Securities Depository Centre to enhance policies supporting this upgrade,” Chao said.

Nguyen Duc Hung Linh, founder and managing director of Think Future Consultancy, identified two major challenges that must be addressed to optimise Vietnam’s stock market upgrade. The first challenge is the availability of assets.

“Both quality and quantity are crucial for the upgrade process. In 2017, only a few Vietnamese stocks made it into the MSCI Emerging Markets Index (EMI) due to their high free float. With over 1,000 stocks in the index globally, Vietnam’s share was negligible, limiting our access to the $1 trillion tracked by the index,” Linh said.

He pointed out missed opportunities, such as Thaco’s delayed listing, which could have attracted more foreign investors. “The lack of assets is tied to broader issues like economic restructuring and privatisation strategies,” he added.

The second challenge, according to Linh, is the risk of being downgraded after achieving emerging market status, as seen with Pakistan.

“The key factor is how foreign investors perceive Vietnam. We strive to meet all criteria, but some markets, despite not fully meeting standards, still make it into the EMI due to their attractiveness,” Linh said. “What does Vietnam offer to attract such attention? Despite efforts, the quality of our assets hasn’t significantly improved over the past 5-7 years.”

Shift to advanced trading a crucial step for stock market

Shift to advanced trading a crucial step for stock market

Many investment funds believe that Vietnam’s stock market is advancing its trading mechanisms and settlement cycles to align with more developed markets, enhancing its competitiveness and appeal.