INTERNATIONAL INVESTMENT

AND PORTAL

Over the past seven years, VIB has grown its credit card base tenfold, rising to first place in Mastercard’s credit card spending and third in overall nationwide credit card spending. The bank is also among only three banks in the country to partner with the trinity of major international card organisations – Visa, Mastercard, and American Express.

Since embarking on a major transformation in 2019, VIB has identified credit card business as an essential pillar aligned with long-term strategy to gain distinctive & competitive advantages in the fast-growing digital economy. The bank has pursued a comprehensive strategy built on significant investment, cutting-edge technology, and ongoing customer engagement to strengthen its offering.

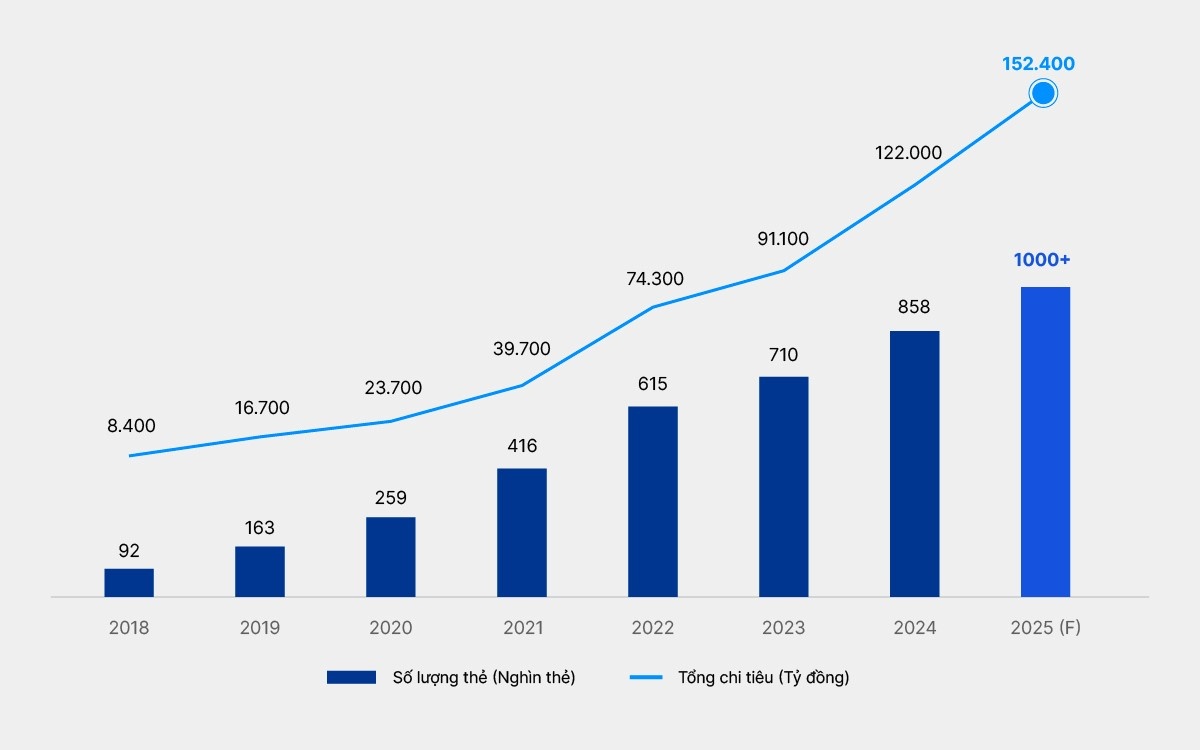

As a result, VIB’s credit card portfolio has grown tenfold in just seven years, from 92,000 cards in 2018 to 1 million today. This achievement gives the bank close to 7 per cent of both the total credit cards in circulation and the market share of newly issued cards across the industry, according to data from the Vietnam Bank Card Association as of December 31, 2024.

Number of cards and total spending via VIB credit cards from 2018 to August 2025

Number of cards and total spending via VIB credit cards from 2018 to August 2025

In the year to date, VIB’s total credit card spending has surged 80 per cent and is 18 times higher than in 2018, with 31 million transactions recorded since the end of 2024. Average monthly spending per card reached VND15.2 million ($576), doubling from VND7.6 million ($288) in 2018.

VIB currently holds 12 per cent of the total credit card spending in Vietnam. Its average card spending is 50 per cent higher than the market average, according to the Vietnam Bank Card Association.

Thanks to its strong growth, VIB was honoured by Mastercard at the end of 2024 as Vietnam’s No.1 Bank in Card Spending, receiving eight awards, including highest total card spending, highest credit card spending, fastest credit card growth, leading credit card issuer, leading debit card issuer, highest e-commerce spending via cards, and highest overseas spending via cards.

VIB currently offers 10 credit card lines, each designed with diverse features and advanced technology to meet the specific spending needs of different customer segments. The portfolio ranges from cashback cards for everyday purchases (VIB Cash Back, VIB Online Plus 2in1), unlimited rewards (VIB Rewards Unlimited), and travel benefits with miles and airport privileges (VIB Travel Élite, Premier Boundless), to personalised solutions (VIB Super Card) and business cards that help optimise cash flow (VIB Business Card).

"VIB has achieved remarkable success in the credit card segment by differentiating customer benefits and experiences," said Tuong Nguyen, deputy CEO of VIB. "We have set new trends through continuous investment in technology, digitalisation, and a profound understanding of customers' needs. Our strategy centres on three core pillars: technology leadership, experience leadership, and benefits leadership."

In terms of technology, VIB has been at the forefront of enabling customers to open cards entirely online through multiple platforms, including MyVIB, Max powered by VIB, the website, and its partner ecosystem. Applications are approved within 15–30 minutes, with a virtual card issued for immediate use before the physical card arrives.

Card management is streamlined via MyVIB, which offers comprehensive features such as tracking spending, paying debts, setting up repayments, locking and unlocking cards, and redeeming reward points. VIB has also introduced advanced card technologies such as Duo Card, EMV chip, 3D Secure, and tokenisation, while ensuring safe integration with Apple Pay, Google Pay, Samsung Pay, and Garmin Pay.

VIB also stands out for its highly personalised customer experience, allowing cardholders to customise features to suit their needs. Users can choose billing dates, payment ratios, and even design their own cards using AI. The newly launched Super Pay solution adds further flexibility, enabling customers to select payment sources (PayFlex), convert past transactions to instalment (PayEase), and proactively block online transactions without OTP validation process to reduce risk (PaySafe) – all accessible via the MyVIB app.

At the same time, the innovative Super Cash product, the first and only of its kind in the market, allows customers to flexibly manage global credit limit up to VND1 billion ($38,000) that empowers customers to instantly increase or decrease credit limits between credit cards and cash loans for usages.

On the benefits side, VIB offers attractive cashback, reward points, and air mile accumulation schemes, complemented by the VIB Privileges ecosystem of more than 150 partners across travel, dining, shopping, and transportation. Customers also gain from a zero per cent interest instalment programme (VIB PayEase) and preferential foreign currency fees on premium cards, helping them optimise their spending and financial management.

Thanks to these efforts, VIB has received prestigious awards from Mastercard, Visa, International Finance Magazine, Global Business Outlook, and others.

Commenting on the milestone of one million cards, Nguyen said, "This achievement reflects our customer-centric strategy. By leveraging technology platforms, customer insights, and an innovative spirit that is part of VIB’s DNA, we will continue to lead credit card trends, bringing more digital and premium products, services, and experiences to users. This milestone marks just the beginning of a new journey to serve even more customers in the years ahead."

VIB introduces PayFlex in first implementation of Visa VFC technology in Vietnam

VIB introduces PayFlex in first implementation of Visa VFC technology in Vietnam

Vietnam International Bank (VIB) is introducing VIB PayFlex, an innovative financial feature developed on the Visa Flexible Credential (VFC) technology, allowing VIB Visa cardholders to make flexible payments from two funding sources – credit and debit accounts – using a single credential, enabling smarter financial control and maximizing rewards.

VIB finances REE’s wind power project in Vinh Long

VIB finances REE’s wind power project in Vinh Long

VIB finalised a VND1.64 trillion ($62.7 million) credit facility agreement with Duyen Hai Wind Power JSC, a subsidiary of the Refrigeration Electrical Engineering Corporation (REE), on July 16.

VIB sees strong first half performance with profit exceeding $190 million

VIB sees strong first half performance with profit exceeding $190 million

Vietnam International Bank (VIB) continues to show steady momentum in 2025, driven by strong credit growth and a focus on asset quality.