INTERNATIONAL INVESTMENT

AND PORTAL

According to Kokalari, this surge was driven by fast-tracked approvals of projects amid provincial mergers, legal reforms granting provinces more decision-making authority over project approvals, and the streamlining of disbursement processes.

“In addition, going forward, the government is revamping many investment laws to boost private investment, relaxing public-private partnership (PPP) and build-operate-transfer (BOT) conditions, increasing state contributions, and expanding eligible project types,” Kokalari added in a statement released on July 8 in Ho Chi Minh City.

Vietnam is embarking on sweeping reforms across both the public and private sectors that some are calling “Doi Moi 2.0.”

These initiatives aim to boost the country’s GDP growth potential by increasing the (already highly significant) role of the private sector in the economy, streamlining the government’s own operations, and addressing other sources of inefficiency in the economy.

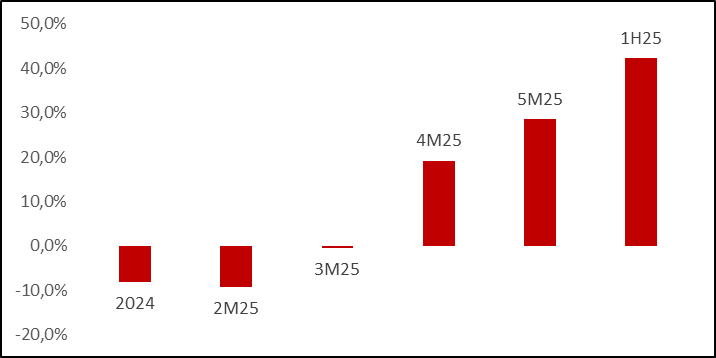

“The first signs that these reforms are working are already emerging: there has been an impressive 40 per cent surge in infrastructure spending in H1 (according to the Ministry of Finance), which in turn reflects progress on streamlining the approval processes that impeded spending in recent years,” Kokalari said.

Vietnam’s infrastructure spending actually declined in 2024, despite a dire need for increased investment in this rapidly industrialising country.

The Q2 spending rise that can also be seen below was driven both by a heightened sense of urgency across government agencies and newly expanded authority for local governments to fast-track and execute major projects.

Specifically, spending is increasing at the local level, where disbursement is up by more than 40 per cent on-year.

Several provinces in Vietnam are undergoing mergers as part of the broader, sweeping reforms across both the public sector and in the private sector.

“Provincial mergers, plus other internal government initiatives, have promoted a sense of urgency among both local and central government officials, which is one factor prompting local authorities to fast-track project approvals, especially those that are “shovel ready”, such as expanding existing roads/highways,” he added.

Surging infrastructure disbursement in H1. Source: MoF, VinaCapital

In addition to increased urgency, recent legal reforms are essentially delegating a lot more authority in public projects to the local level.

The National Assembly recently approved a series of measures that enable local authorities to approve major projects (such as airports and urban area developments larger than 50ha) that previously required prime minister-level approval.

In addition, the approvals process for local and national public projects is being streamlined, and the government is actively encouraging more PPPs, including both a resumption of build-transfer (BT) projects, which had been stalled for the last few years, and a potential widening of the definition of “PPP” projects to well beyond roads, bridges, and tunnels to potentially include data centres and other components of high-tech infrastructure.

For example, the merger of 63 province-level treasury offices into 20 regional offices cut the number of required interactions between contractors and state treasuries by about half, and contractors can now submit documents online to regional state treasury offices.

“The net result is a dramatic drop in the time it takes for financial disbursements to reach contractors, to just 1-3 days, much faster than the previous process, which required multiple in-person interactions and an abundant amount of manual paperwork,” he added.

In short, the confluence of provincial mergers, regulatory relaxation, and an overall heightened focus on economic growth in the government is helping to drive this increase in infrastructure spending, which is considered a key driver of GDP growth.

Finally, progress on larger scale national projects is also accelerating, and the completion timelines on several major projects such as the $13 billion Long Thanh International Airport, $13 billion Hanoi and Ho Chi Minh City ring roads, and $8.4 billion Lao Cai–Hanoi–Haiphong railway has been shortened by as much as three years.

Vietnam’s government is working on modifying several laws related to infrastructure investments with the aim of increasing private sector involvement in projects that are aligned with national infrastructure objectives and to further streamline the disbursement of public funds.

According to Kokalari, Vietnam is well-positioned to sustain its strong momentum in disbursements of infrastructure investments as government debt is below 40 per cent of GDP, the budget surplus was over 5 per cent over GDP in the first five months, and it has over $45 billion in undisbursed funds earmarked for infrastructure spending.

“The primary impediment to faster infrastructure disbursement in the past has been legal and regulatory bottlenecks, which the measures listed above will help alleviate,” he added.

Despite higher infrastructure investment in Vietnam, investment options in listed infrastructure-related stocks in Vietnam remain somewhat limited, although some “second derivative” stock plays such as construction materials firms can give investors good indirect exposure to the nascent boom.

Vietnam and Japan seek to strengthen transport infrastructure cooperation

Vietnam and Japan seek to strengthen transport infrastructure cooperation

Vietnamese and Japanese policymakers, businesses, and experts gathered at a conference on December 18 to share their experience in transport development and discuss cooperation opportunities.

Thailand, Vietnam to boost cooperation in trade, investment, tourism, and infrastructure

Thailand, Vietnam to boost cooperation in trade, investment, tourism, and infrastructure

Thailand and Vietnam are seeking ways to promote trade and investment, tourism, and infrastructure.

Deputy PM calls on Chinese firm to boost infrastructure cooperation with Vietnam

Deputy PM calls on Chinese firm to boost infrastructure cooperation with Vietnam

Deputy Prime Minister Tran Hong Ha received Executive Director of the China Communications Construction Company (CCCC) Wang Haihuai in Hanoi on August 28, asking the firm to make practical proposals for infrastructure, construction, transport, and agricultural cooperation to help realise the high-level agreements between the two Parties and countries.

AD Ports Group seeks to develop logistics and maritime infrastructure in Vietnam

AD Ports Group seeks to develop logistics and maritime infrastructure in Vietnam

AD Ports Group, a diversified, global integrated trade, transport and logistics group, signed an MoU with Vingroup JSC on October 29 to explore developing and modernising ports, logistics, and maritime infrastructure in Vietnam.