INTERNATIONAL INVESTMENT

AND PORTAL

Despite the slowdown, there are promising signs of economic recovery. Firstly, external demand has strengthened. Local producers are witnessing an increase in new overseas orders, driven by the normalisation of retail spending on goods in the US and the recovery of the global semiconductor industry.

Wanwisa May Vorranikulkij, senior economist ASEAN +3 Macroeconomic Research Office

Wanwisa May Vorranikulkij, senior economist ASEAN +3 Macroeconomic Research Office

Local factories, particularly in key sectors such as electronics, textiles, footwear, and machinery, have increased their imports of production materials. Additionally, merchandise exports have shown steady growth since September 2023.

Secondly, investment has been growing steadily in the post-pandemic period, largely due to sustained foreign direct investment and greater public investment. A myriad of free trade agreements, close geographical proximity with China and ASEAN, as well as a low-wage and young workforce, have helped position Vietnam as a top destination for foreign investors. The government’s ongoing investment in public infrastructure has not only supported Vietnam’s economic growth over the past year but has also strengthened the country’s appeal to investors in the future.

Construction activity in the country as picked up recently, buoyed by improving sentiment after the enactment of three real-estate related laws.

So far, the economic recovery remains uneven and is driven mainly by foreign companies and large local corporates. Smaller enterprises are lagging in the recovery. Concerned about employment and economic prospects, Vietnamese households have adopted a cautious attitude and tightened their budgets during the Lunar New Year in February. Consequently, wholesale and retail trade, as well as arts, entertainment, and recreation sectors, experienced a softening in the first quarter of this year.

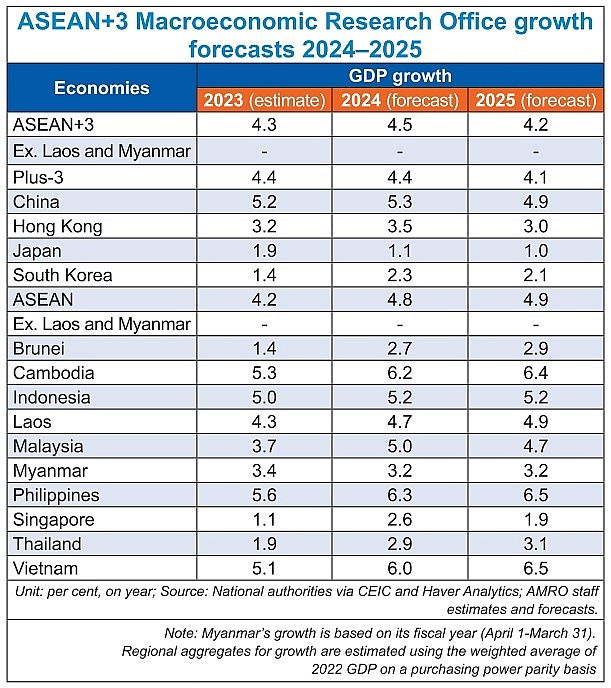

Looking ahead, while the economic outlook appears favourable, there are potential challenges on the horizon. The ASEAN+3 Macroeconomic Research Office recently forecast Vietnam’s economy to grow at 6 per cent in 2024 and 6.5 per cent in 2025. Growth is expected to gather pace in the remainder of the year, driven by increasing external demand for manufactured goods, and amplified by the upcycle of the global semiconductor industry.

A steady inflow of foreign investment, coupled with the government’s pledge to boost public investment, would bolster economic recovery. Real estate is expected to rebound gradually, particularly if the government implements amended laws governing the real estate sector. This action would alleviate the challenges posed by lingering legal hurdles and shortages in housing supply.

In terms of consumption, the projected rise in tourist arrivals could cushion the service sector against the cautious local household spendings.

However, the recovery of domestic consumption may still face challenges from higher global oil and food prices. Vietnam’s consumer price inflation in 2024 is forecast to increase to 3.6 per cent in 2024 from 3.3 per cent last year. Furthermore, Vietnam’s economic outlook could tilt towards the downside due to risks associated with slower-than-expected growth in major export destinations such as the US, EU, and China. The conflict in the Middle East could lead to disruption in shipping and higher oil prices, imposing additional cost pressures on manufacturers.

Besides external headwinds, the country faces structural challenges in nurturing micro, small, and medium-sized enterprises (MSMEs), which continue to face difficulties in securing capital to scale up their production and a lack of highly skilled workers. Perennial risks arising from climate change tend to escalate in both magnitude and frequency.

Considering the uncertainty over its growth prospects, Vietnam should employ a policy mix which supports the ongoing recovery while fostering sustainable and inclusive growth in the long term. Fiscal policy should take a leading role in boosting the economy. Additional measures, such as the introduction of tax deductions and tax credits, and the strengthening of the social protection system, can be considered to provide targeted support to households and MSMEs.

Existing support measures should be recalibrated to ensure adequate assistance for vulnerable groups, especially micro firms, and low-income households. Accommodative monetary policy would contribute to alleviating financial burdens on micro and small enterprises and heavily indebted households. Enhancing credit guarantee schemes could be explored to increase financial access for MSMEs and underprivileged borrowers who are presently ineligible for commercial bank lending.

Considering the shortage of skilled labour, greater efforts and financial support should be directed towards raising the availability and quality of vocational training and educational programmes. To enhance the country’s resilience to climate change, both mitigation and adaptation measures will be needed to minimise risks associated with the transition towards a low carbon economy.

Vietnam’s economy has exhibited solid improvement, though the recovery is not yet broad-based and is confronted with various challenges. In this context, targeted policy support remains vital to navigate the economy through uncertainties.

Temporary slowdown projected for general economy

Temporary slowdown projected for general economy

Despite the Vietnamese government making its great efforts to reach 6.5 per cent in economic growth this year, it will be an uphill struggle. Wanwisa May Vorranikulkij, senior economist from the ASEAN+3 Macroeconomic Research Office, talked to Khoi Nguyen about the outlook for the Southeast Asian economy.