INTERNATIONAL INVESTMENT

AND PORTAL

Over the last 10 years, Vietnam has quickly become one of Southeast Asia's booming economies, with an average annual GDP growth of about 7 per cent. This impressive growth has increased the number of wealthy individuals and high-net-worth individuals.

Dinh Thi Thu Nga, head of Internal Audit at Techcom Securities

Dinh Thi Thu Nga, head of Internal Audit at Techcom Securities

Several factors contribute to this upward trend. Firstly, Vietnam's openness to the global economy has attracted significant foreign direct investment (FDI), encouraging entrepreneurship and generating wealth. A growing middle class has increased the demand for advanced financial services, including wealth management.

Secondly, the Vietnamese government has implemented policies to enhance the financial sector, like expanding the stock market and introducing investor-friendly regulations. The establishment of the Vietnam Association of Financial Investors and the country's integration with the ASEAN Economic Community have significantly boosted investor confidence.

Thirdly, digital technologies have transformed financial services, including wealth management. With more people using the internet and smartphones, digital platforms have made it easier to get financial advice, manage portfolios, and find investment opportunities.

This growth in the wealth management sector benefits the broader economy by boosting financial literacy, encouraging savings and investments, and directing resources into productive areas, which stimulates economic activity. It also attracts foreign investments, enhancing Vietnam’s integration into the global financial system.

The wealth management sector is attracting more players. Have you seen increasing competition in the local market?As the wealth management sector grows, competition has increased significantly. The Vietnamese market now has many local and international players, including banks, investment firms, and independent financial advisors. Major global banks like HSBC, Citibank, and Standard Chartered have a strong presence and offer advanced wealth management services tailored to local needs.

Local banks such as Vietcombank, BIDV, and Techcombank have enhanced their wealth management offerings, utilizing their broad branch networks and deep understanding of the local market. Additionally, boutique firms and fintech startups are entering the sector, providing innovative, technology-driven solutions to meet the changing needs of affluent clients.

This competitive environment is great for consumers, giving them more options and access to high-quality financial advice, diversified portfolios, and strategies for preserving wealth. However, it also means that service providers need to continuously innovate and improve their offerings to stay competitive.

Digital transformation is an inevitable trend. How important is the balancing financial and technological knowledge to manage potential risks?Technology plays a crucial role in transforming Vietnam’s wealth management sector. Advanced technologies such as AI, machine learning, big data analytics, and blockchain are being used to improve services and client experiences.

AI and machine learning algorithms offer personalised financial advice by analysing large amounts of client data to make tailored investment recommendations. Big data analytics provide insights into market trends and client behaviour, helping with more informed decisions. Blockchain technology ensures secure and transparent transactions, building trust and ensuring compliance.

Moreover, digital platforms and mobile apps have become essential for delivering wealth management services, allowing clients to manage their investments, track portfolios, and access financial advice anytime, anywhere.

While these technological advancements bring many benefits, they also come with risks that need to be managed carefully. Balancing financial expertise and technology understanding is crucial for mitigating these risks.

For fraud prevention, as reliance on digital platforms grows, the risk of cyber fraud and hacking increases. Financial institutions need to invest in strong cybersecurity measures, like encryption, firewalls, and multifactor authentication, to protect client data and transactions. Regular security audits and employee training on best cybersecurity practices are also vital in preventing fraud.

For compliance, navigating the complex and changing regulatory landscape is essential. Adhering to local and international regulations, like anti-money laundering laws, requires an in-depth understanding of compliance and the use of compliance management solutions. Technologies like RegTech can automate compliance processes, monitor transactions for suspicious activities, and ensure legal adherence.

For capital management, effective capital management ensures optimal portfolio performance and risk mitigation. Financial professionals should use advanced analytics to evaluate the risk-reward profiles of different investments accurately. Stress testing, portfolio simulations, and risk assessment tools can identify vulnerabilities and prepare for adverse market conditions. Using technology to gain real-time insights into market dynamics and portfolio performance is vital for making well-informed decisions.

Integrating these technological solutions into wealth management necessitates a profound understanding of both finance and technology. Financial advisors and wealth managers must be literate in technological tools and trends to harness their full potential, while also maintaining a solid grounding in traditional financial principles to provide holistic advice to clients.

Moreover, ongoing education and training are paramount to staying abreast of technological advancements. Financial institutions should invest in continuous professional development programmes for their staff and foster a culture of innovation and adaptability.

The wealth management sector in Vietnam is evolving at a remarkable pace, driven by economic growth, regulatory support, and technological advancements. This growth has led to increased competition, higher service standards, and greater consumer benefits. However, with these advancements come significant risks that must be managed through a comprehensive understanding of both financial and technological domains. As Vietnam continues to integrate into the global financial framework, the ability to navigate these complexities will be crucial for sustaining growth and maintaining investor confidence.

Developing a wealth management answer for affluent clients

Developing a wealth management answer for affluent clients

Vietnam has been among the top 10 fastest-growing economies in the world over the last 30 years, and the country will continue to be one of the fastest in the next two decades. As such, the wealthy population is rapidly growing too.

Generali Group toasts first-half performance with solid capital position

Generali Group toasts first-half performance with solid capital position

On September 13, Generali Vietnam announced the latest financial statement of parent company Generali Group which reflects the group’s continued growth in the operating results in the first half of this year, with a solid capital position.

Lessons in wealth management and suitable directions for Vietnam

Lessons in wealth management and suitable directions for Vietnam

Vietnam boasts great potential in financial service development. Finance lecturers Dr. Devmali Perera and Dr. Le Hong Hanh from RMIT University Vietnam touch on what the country can learn from the successful lessons of dynamic hubs in the region such as Singapore and Hong Kong.

Profound shift being felt in nation’s wealth management

Profound shift being felt in nation’s wealth management

Global asset management is experiencing a significant shift from traditional to emerging markets, with Vietnam poised to become a new goldmine for the industry.

Next generation of Vietnamese sees AI as powerful business tool

Next generation of Vietnamese sees AI as powerful business tool

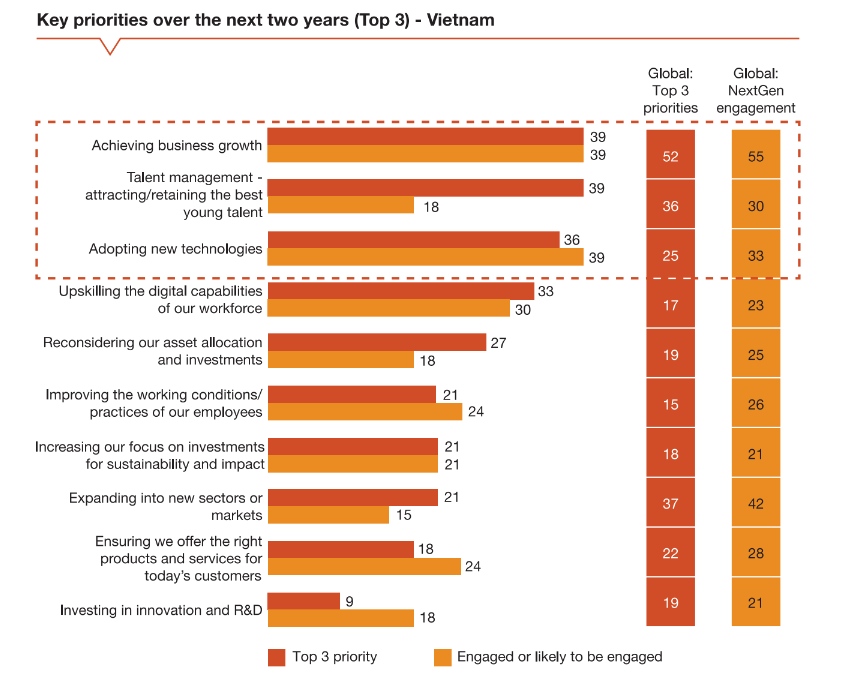

The next generation of Vietnamese business leaders (NextGen) see AI not merely as a technological innovation, but as a catalyst for redefining business operations, strategies and customer experience, according to a recent report.