INTERNATIONAL INVESTMENT

AND PORTAL

Vietnam’s economy recovered strongly in 2022 with a rebound in consumer spending and robust export growth. Many international economic organisations expected GDP growth would reach 6-7 per cent. The economy has in fact grown 8.02 per cent for the whole year, exceeding all previous forecasts. The average inflation has increased by 3.15 per cent on-year but still met the annual target, which is below 4 per cent per year.

"As global circumstances change, authorities must stay watchful and rapidly amend fiscal and monetary policy accordingly. With an aim of mitigating adverse risks and cutting down on policy trade-offs, especially between growth and inflation, policies need to be precisely calibrated." - Le Khanh Lam Chairman, RSM Vietnam

"As global circumstances change, authorities must stay watchful and rapidly amend fiscal and monetary policy accordingly. With an aim of mitigating adverse risks and cutting down on policy trade-offs, especially between growth and inflation, policies need to be precisely calibrated." - Le Khanh Lam Chairman, RSM Vietnam

Exports increased as business activity picked back up after a two-year lull. In 2022, the country’s total import-export turnover is estimated at $732.5 billion – up 9.5 per cent on-year. With these, the country recorded a trade surplus of $11.2 billion in the period. The United States is still the largest export market of Vietnam with an estimated turnover of $109.1 billion, while China is the largest import market of Vietnam, with an estimated turnover of $119.3 billion.

Despite the fact that Vietnam is being impacted by several factors, the economy is still regarded as an appealing investment destination. In 2022, it attracted investment capital from 107 different countries and territories, with Singapore providing the largest single investment at $5.78 billion (about 23 per cent of the total).

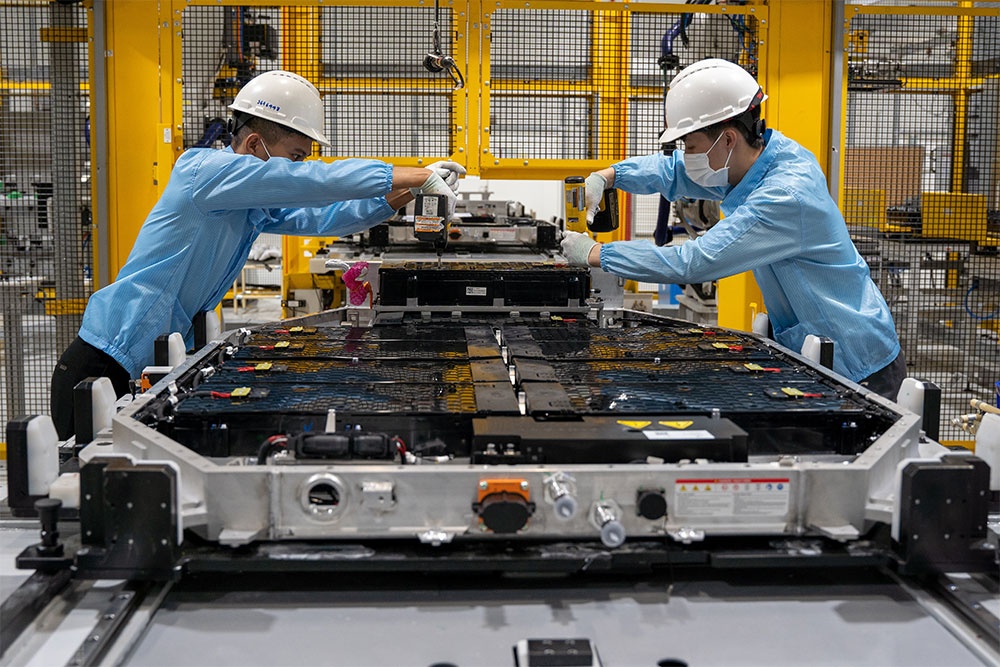

The production and processing industry dominated foreign investment with a total of $14.96 billion, followed by the real estate sector and the generation and distribution of energy.

The performance of the economy may be attributed primarily to three factors. Firstly, the pandemic in Vietnam was brought under control by a successful vaccination effort, which also enabled the economy to adjust more efficiently to the new normal. Secondly, the government’s recovery policies flexibly and efficiently created socioeconomic stability and controlled inflation.

Finally, the nation can be seen as a dynamic participant in global trade by leveraging free trade agreements with countries around the world and various investor-friendly policies.

Turbulent year

Despite the impressive advancements that have been made, the Vietnamese economy is nevertheless undergone a number of problematic drawbacks. Significantly, the stock market went through turmoil in 2022. The VN-Index, a key measure of the performance of the domestic stock market, had a turbulent year as a result of both external and internal factors. The market began the year on a good note, with the VN-Index reaching a new peak in early January.

Then, it dropped to new lows due to Russia-Ukraine tensions, disruptions in the global supply chain, soaring inflation in major economies, and various other scandals. Fear of the Russia-Ukraine conflict and inflation drove stock investors to hunt for assets that are less risky and to turn to property as a safe haven asset as they anticipated demand for real estate to grow.

The rosy profit picture, on the other hand, began to dissolve in the second half of the year when property developers had a difficult time obtaining loans from banks since their credit limits for the year were almost maxed out. Additionally, industry experts anticipate that the property market slump would remain.

The government defined the overarching goals for the economy in 2023. These goals include continuing to prioritise preserving macroeconomic stability, controlling inflation, boosting growth, and guaranteeing major balances within the economy. Key highlighted indicators include a 6.5 per cent rise in GDP and a per capita GDP of $4,400. The processing and manufacturing sector accounts for around 25.5-25.8 per cent of GDP The consumer price index grew on average by 4.5 per cent.

According to the forecast of international economic insiders, the economy in Vietnam will enter 2023 in a better financial form than it was, as a result of its vigorous recovery efforts. But the country should not be complacent as the road ahead is still paved with risks and challenges.

It is anticipated that the global economy will fall into a recession. When this occurs, export markets would be impacted since consumers will have less discretionary income to spend, and demand will drop. As a result, export growth might decline owing to the economic downturn of key import partners such as the United States, the EU, and China, while export remains a vital driver of prosperity in Vietnam.

As a highly open economy, the country is facing pressure to control prices, interest rates and exchange rates in the face of rising global inflation and the tightening monetary policy of the United States and Europe (the two main export markets account for 41 per cent of Vietnam’s export market share). Hence, one of the top priorities of the government is to defend financial stability.

External strife

As global circumstances change, authorities must stay watchful and rapidly amend fiscal and monetary policy accordingly. With an aim of mitigating adverse risks and cutting down on policy trade-offs, especially between growth and inflation, policies need to be precisely calibrated, coordinated, and communicated. In the current circumstances, monetary policy should prioritise price stability and contemplate a stricter stance if inflationary pressures intensify.

Although most headwinds are external, domestic risks exist as well. Particularly in the banking and bond markets, which are vulnerable to quickly shifting conditions in the real estate industry. Public investment is still a serious roadblock. The disbursement of public investment capital was deemed inadequate late in the year compared to expectations. There have been signs of progress in the battle against corruption, but along with those accomplishments has come a fear of doing wrong that has slowed things down and caused congestion.

It is suggested that businesses and investors should also restructure, accelerate digital transformation, save costs, enhance openness, transparency, and professionalism, and implement improved risk management. Even more so, climate change’s negative effects will progressively weigh on agricultural productivity as well as community health and wellbeing.

In addition, as the domestic demand recovery may not be as robust as that of 2022, it is forecast that the country’s economic development would slow down in 2023, gradually reverting to pre-pandemic levels.

A variety of simultaneous breakthroughs are needed, both in terms of awareness and institutions, in order to eliminate supply and demand stability bottlenecks and the pricing of key commodities (particularly petrol and oil) for living and production, especially on holiday occasions.

Vietnam should take pride in the outcomes of 2022, while acknowledging the obligation to act prudently in both business and management, macro and micro, in the short and long term. It is believed that to accomplish the socioeconomic goals of 2023, monetary and financial policies have to be closely integrated.

Local authorities need to accelerate the disbursement of public investment and enhance corporate bond market health, as well as ensure information transparency to mitigate risks and cope with the economic tidal waves ahead.