INTERNATIONAL INVESTMENT

AND PORTAL

Although land is owned by citizens, the state has given people the right to use land which is considered and protected as property rights and civil rights. The focus of the current problem is the market price and the valuation at the same time with the granting of business autonomy to enterprises, based on benefit sharing with the state or paying taxes.

Le Net and Tran Thai Binh, lawyers at LNT & Partners

Le Net and Tran Thai Binh, lawyers at LNT & Partners

When identifying and addressing this problem, we rely on the theoretical basis of the legal system as well as put it in the context of the economy to analyse the benefits of applying regulations and legislation, to see if the application of legal provisions leads to policy abuse, or causes damage or loss to the interests of the state rights of land users or not. As it is concluded that the benefits of amendments and supplements are greater than the costs, some amendments to the law can be offered.

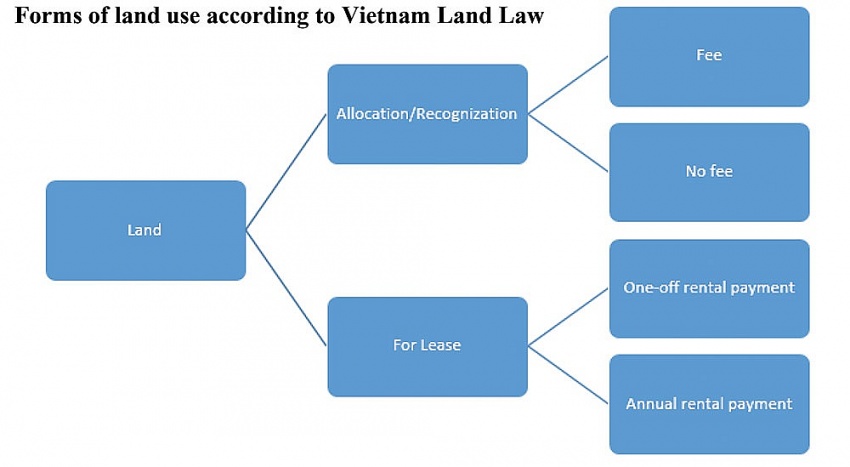

According to current regulation, there are the following forms of land use: allocation of land with/without land use levy; lease of land with one-off rental payment for the entire lease period; and lease of land with annual rental payment.

At first glance, the current regulation brings the benefit of encouraging land users to pay land use fees or one-off rental payment fees to have full land use rights, avoiding the situation of not paying enough land use levy but having transferred the rights to another person.

However, such a provision has two important disadvantages. Firstly, the one-off or annual rental payment is such that the owner does not indicate who pays more or benefits more in the case of whichever is higher. Secondly, a one-off rental payment instead of an annual rental payment leads to inherent unfairness, and it is necessary to change the view towards the form of paid land use.

Land should be viewed as a steady cash flow for the state budget (one-time collection) rather than a once-in-a-lifetime opportunity to earn money (land lease/ one-off rental payment). Thus, both the state and the people and businesses benefit. Firstly, this is because the state has a stable source of money. In the long run over, this amount can be adjusted up to market conditions and can be summed up to be much higher than a lump sum payment.

Secondly, people and enterprises do not have to pay a one-time large amount of land use fees. If land use fees and land lease fees are too high, it will lead to an increase in real estate prices that exceed the income of working people.

In addition, it is necessary to allow the transfer and mortgage of the lease rights in the land lease contract with annual rental payment and give measurements to the people who have the right to lease that land. This is also consistent with the general principle of property rights.

Avoiding instability

Although new regulations have many innovative points, it is necessary to strictly stipulate the conditions to avoid the case that investors have not yet fulfilled their land financial obligations to the state and take advantage of this policy to mortgage, transfer, and profit concession.

To avoid that risk, the best way is to issue a certificate of land use rights publicly to users, clearly stating on the certificate this land is for annual rental payment, and the state has the right to land acquisition without compensation if the user fails to pay the land rent in any payment.

Moreover, it is necessary to set conditions that users only enjoy all rights to use, transfer, and mortgage if they have fulfilled their obligations to the state.

The law should also allow people to choose a one-time or annual rental payment and can change the form at any stage of the usage process. Thus, we agree that users who pay the annual land rent are entitled to transfer and mortgage the right to rent. From there, it is possible to develop large real estate projects at a lower cost.

Meanwhile, the current regulations have the advantage of avoiding the situation of increased land banks being held before then applying for a change of land use purpose, but the state does not get as much benefit as in the case of auctions and bidding.

However, such regulations will lead to instability in the development of urban and commercial housing projects. These are large projects, and only financially strong enterprises can participate in the bidding for project implementation. Failure to recognise the freedom and voluntary agreement to assign the right to use land use is also contrary to basic principles of the civil code.

In addition, if the free transfer mechanism is not recognised, it must switch to a compensatory, even coercive mechanism and apply a land price threshold. Enterprises “borrow” the state’s function to recover land from the people, leading to long-lasting dissatisfaction and complaints related to urban real estate projects.

Therefore, the problem of the state’s interest is to determine how much the land use conversion fee is, not how much the land transfer relationship is. If the law makes the planning public, it is allowed for land owners to develop projects themselves, as long as they comply with urban and land use planning; and as long as there is full payment for land use conversion, and land rent (either annual or one-time payment).

It can mobilise the whole society to develop real estate projects quickly, without having to wait for a real estate enterprise. Even many people with land use rights can jointly establish joint-stock companies to build urban areas. After that, they will buy back the newly-built apartments and the surplus value from the sale of the apartments will also be distributed to shareholders, according to the proportion of capital contribution. That, together with urban development policies and public planning, will quickly change the face of the city.

Protecting rights

Allowing self-negotiation can lead to a land bank situation, which means that landowners hold land to wait for prices to rise. It also means the state does not know the price of land use conversion or how to pay provincial land rent.

The state should prioritise calculating land use fees through an auction mechanism. Assuming that through the auction process, the land use levy of the winning enterprise (average for the entire land area) is VND18 million ($780) per square metre, then this amount will be collected by the state, part of which should be shared to agricultural land users in order to stabilise their accommodation and occupation.

On the other hand, when negotiating with people to collect land, it will not have the same price if the planning information is made public in good time. People know that the value of land will increase after becoming an urban area, and therefore will know how to protect their rights when transferring transactions.

As self-agreement is the basic principle of the Civil Code, avoiding land acquisition is contrary to the basic principles of civil law and the market economy. Withdrawal is only a reluctant solution and the priority is still freedom of transfer and avoiding disputes.

In order to create fairness for people to be properly valued, the issue of urban planning and land use planning must be public and avoid information hiding, even manipulating policies, and collecting people’s land under the guise of “planning funding”.

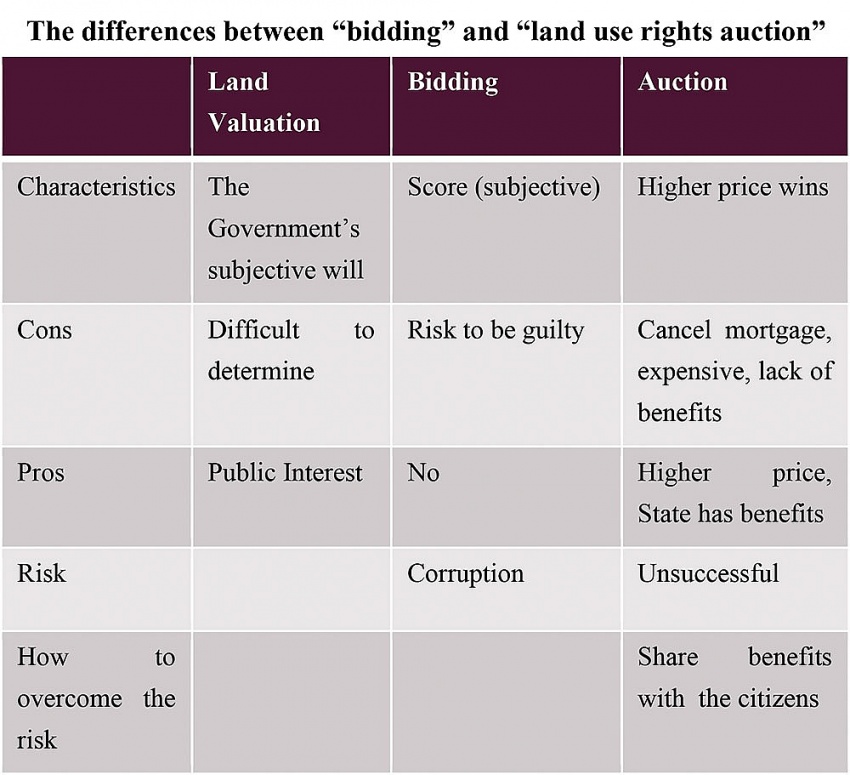

In addition, in order to protect the interests of the state and bring the highest benefits to the state budget, the determination of tax or land use levy must be made on the basis of the price of land use rights. Currently, there is still confusion between auction and bidding, even though there are noticeable differences.

Thus, the priority must be the auction of land use rights. Priority is given to the auction of land use rights because of publicity, transparency, and great benefits to the state. The term “bidding” should be changed to “project development rights auction” with simple criteria.

When forced to withdraw, what should be done? As we recommend, that is when an agreement is reached with at least 90 per cent of households; and the recovery price will be the average price agreed upon with 90 per cent of those households, to ensure publicity.

Regarding the land use regime for tourist and office real estate, we propose to allow private agreement and supplement the issuance of land use rights certificates in the form of strata (tourist real estate, offices).

Government proposes delay to submission of draft amended Land Law to NA

Government proposes delay to submission of draft amended Land Law to NA

The Government has proposed a delay to a submission of the draft Law on Land (amended) to the National Assembly (NA) until the Party Central Committee issues directions on reforms of land-related policies and laws.