INTERNATIONAL INVESTMENT

AND PORTAL

At last week’s conference on annual economic performance and reshuffling the state apparatus, Prime Minister Pham Minh Chinh predicted that the Vietnamese economy would likely grow by more than 7 per cent this year, higher than the initial target of 6-6.5 per cent assigned by the National Assembly (NA).

Thousands of business regulations have been eliminated or simplified in recent times

Thousands of business regulations have been eliminated or simplified in recent times

“This rate of over 7 per cent will list Vietnam in the group of some nations recording high economic growth in the region and the wider world,” he said. “The economy’s performance continues being kept stably with inflation to be controlled at below 4 per cent, lower than the initial target of 4-4.5 per cent assigned by the NA. All major balances of the economy continue being ensured with a high surplus.”

“These achievements are ascribed to the drastic involvement of the whole political system, the business community, and the entire people under the sound leadership of the Party, led by the Party general secretary,” PM Chinh stressed. “The socioeconomic situation has been on a positive uptrend of recovery.”

On-year GDP increased 5.87 per cent in Q1, 7.09 per cent in Q2, 7.4 per cent in Q3, and an expected 7.4-7.6 per cent in Q4. “It is forecasted that this year, the whole 15 major socioeconomic development indexes will have reached and exceeded, especially the economic growth index,” PM Chinh said.

Vietnam’s GDP hit $430 billion in 2023, ranking 34th globally, and is set to rise to $470 billion this year.

The government will assign specific tasks involving economic growth to all provinces and cities, especially those which are the key drivers of the economy, “so that the economic growth rate in 2025 will be about 8 per cent, which will lay a foundation for reaching a double-digit economic growth rate in the 2026-2030 period.”

Continued assistance

The government has ordered the Ministry of Finance (MoF) to review, assess, and propose policies aimed at extending exemptions, reductions, and deferrals for various taxes, fees, and land rental payments in 2025. The government emphasised the need to implement these policies as early as possible in the new year to provide timely support.

“We will also formulate new concrete mechanisms, policies, and solutions to support and encourage enterprises to expand production and business activities, including assistance in the form of cash, taxes, land, infrastructure, and electricity,” PM Chinh said.

In 2024, support worth a total $7.9 billion has been offered to enterprises and individuals in the form of exemption, reduction, and extension of assorted taxes, fees, charges, and land rental.

The MoF reported that in 2023, the total values of all policies on exempting, reducing, and extending payment of assorted taxes, fees, and charges, as well as rental for land and water surface reached about $8.33 billion, including exemption and reduction of $3.3 billion and extension of $5.04 billion.

When it comes to removing institutional obstacles and administrative reform, and improving the investment and business environment, the government established a steering committee on reviewing and handling obstructions in the system of legal documents.

It has also focused on cutting and simplifying administrative procedures, contributing to reducing compliance costs. So far, more than 3,000 business regulations have been cut and simplified, and nearly 700 administrative procedures have been decentralised to localities.

The government has also provided nearly 1,800 online public services, reaching 4,400 services of the type provided on the National Public Service Portal, accounting for 70 per cent of administrative procedures.

Fifty laws and resolutions were submitted to the NA for approval. On November 29, the NA adopted legislation on amending and supplementing laws on planning, investment, private-public partnerships, and bidding. Under this, businesses funding high-tech investment projects at industrial parks and export processing zones will not have to apply for an investment certificate, but for an investment registration certificate which must be issued to the investor within 15 days.

The law also stipulates favourable procedures for conducting environmental assessment reports and anti-fire prevention reports. Specifically, the investor is allowed to self-make and approve the reports, without having to submit them to the authorised agencies.

Minister of Planning and Investment Nguyen Chi Dung explained that these reports have been made already by the investors of the parks and zones, so it is unnecessary for secondary investors to implement and submit them.

“This shift from pre-examination to post-examination, with investors fully responsible for compliance, represents a substantial step in administrative reform,” Minister Dung said. “Investors will lose investment opportunities if it takes them several years to complete a single procedure.”

However, at last week’s conference, Party General Secretary To Lam said that currently administrative procedures were still cumbersome, adding that public services were not convenient, responsibilities unclear, and the decentralisation of power unfinished. “Enterprises need clearer legal regulations so that their production and business activities can run smoother,” he said.

The 2018 Law on Supporting Small- and Medium-Sized Enterprises provides the national framework for policies supporting innovative firms and startups, but policy support is limited and not fully implemented.

Under the law, policies are stipulated to support smaller businesses and entrepreneurs in the sectors of taxation, access to finance, innovation, and value chain development, but programme budgets are often tiny, and many programmes have a low uptake, according to the Organisation for Economic Co-operation and Development.

Additionally, parts of the law have also not been fully implemented. For example, Article 18 of the law offered tax exemptions and reductions for their investors, but the implementation of this article has not been guided by detailed corporate income tax regulations, according to the World Bank.

Overhaul of state apparatus

Discussions have been considerable following Party General Secretary Lam’s statements on a revolutionary overhaul of the apparatuses of relevant authorities, in an aim to develop an efficient apparatus suited to the current era.

“Currently, the state apparatus is cumbersome, making it difficult for the country to develop strongly. National development cannot be boosted without the state apparatus being streamlined,” General Secretary Lam said last week.

Since 2007, the government has been operating with 18 ministries, four ministerial-level agencies, and eight governmental agencies. It is expected that the number of ministries and governmental agencies will be reduced to 13 and four, respectively.

For example, a merger will be seen between the Ministry of Planning and Investment and the Ministry of Finance; the Ministry of Transport and the Ministry of Construction; the Ministry of Information and Communications and the Ministry of Science and Technology; and the Ministry of Natural Resources and Environment and the Ministry of Agriculture and Rural Development.

Meanwhile, the Ministry of Labour, Invalids, and Social Affairs will be dissolved, with its tasks to be transferred to the Ministry of Home Affairs, the Ministry of Education and Training, and other relevant agencies.

At present, about 70 per cent of the state budget is used for recurrent expenditure. In 2023, total state budget revenue and expenditure reached $72.48 billion and $73 billion, respectively, a deficit of $520 million.

According to Party General Secretary Lam, this will mean limited socioeconomic investment.

“If we want to develop the country, we have to develop projects. But financial resources remain limited. Only 30 per cent of the state budget is used for defence and security, social security, healthcare, and poverty reduction. Many other nations have used more than half of their resources for these purposes,” he said.

“One of the best solutions is that we have to continue streamlining the state apparatus, reducing the number of those working in the state budget, and cutting down recurrent spending to have more resources for national development.”

It is estimated that by late 2023, the whole country had nearly 47,600 state-owned units, which was down by almost 850 as compared to 2021. About 1.7 million people receive state salaries, while about 3.3 million people get pensions and social insurance annuities.

Hanoi's economy continues to sustain growth

Hanoi's economy continues to sustain growth

With the theme "discipline, responsibility, action, creativity, and development", Hanoi has outlined five key areas of leadership and management.

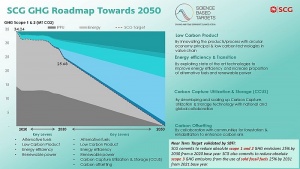

SCG promotes circular economy to drive economic growth

SCG promotes circular economy to drive economic growth

At the Vietnam Circular Economy Forum on December 10, Chana Poomee, chief sustainability officer of SCG Group, called for promoting the circular economy, especially expecting the approval of the National Action Plan for Circular Economy (NAPCE).