INTERNATIONAL INVESTMENT

AND PORTAL

The General Statistics Office last week reported that in the first 11 months of 2022, despite geopolitical tensions and a reduction in consumption in the EU, total export-import turnover between Vietnam and the bloc hit $57.6 billion.

In which, Vietnam’s export turnover to the EU reached $43.5 billion – up 21 per cent on-year, while the nation’s import turnover sat at $14.1 billion – down 7.9 per cent on-year.

The EVFTA has helped increase the number and value of export orders, as well as export markets, photo Le Toan

The EVFTA has helped increase the number and value of export orders, as well as export markets, photo Le Toan

The Ministry of Agriculture and Rural Development also reported that the agro-forestry-fishery trade turnover in the first seven months of this year between Vietnam and the EU increased strongly from $4.3 billion in 2015 to $4.5 billion in 2020, $5.2 billion last year. The figure stood at about $5.6 billion in the first 11 months of this year, with coffee, aquatic products, pepper, cashew, vegetables, and wood and wooden products being staple exports growing strongly.

According to the Association of Vietnam Timber and Forest Product, after the EU-Vietnam Free Trade Agreement (EVFTA) entered into force in August 2020, the export turnover of wood and wooden products exported to the EU increased 17.1 per cent from $510.37 million in 2020 to $597.76 million last year. In the first 10 months of this year, despite the Russia-Ukraine conflict and high inflation, the figure hit $470.27 million, up 1.4 per cent on-year.

Phan Minh Thong, chairman of Phuc Sinh Corporation – a big exporter of farm produce, said that in 2020, the corporation’s export turnover from the EU hit $50 million, but then rose to $63 million last year. The figure so far this year is also quite positive.

“The EVFTA has helped us increase the number and value of export orders, as well as export markets,” Thong said.

The EU-Vietnam bilateral trade turnover was $56.45 billion in 2019 (including Vietnam’s exports and imports of $41.5 billion and 14.95 billion, respectively). However, in 2020, the pandemic undermined their trade relationship, with trade dropping to $50 billion (including Vietnam’s exports and imports of $35.1 billion and 14.9 billion, respectively).

The situation became brighter last year when the bilateral trade turnover sat at $63.6 billion, with Vietnam’s exports worth $45.8 billion – up 14.2 per cent on-year, and imports of $17.9 billion, up 16.5 per cent on-year.

Major leverage

Notably, according to the Ministry of Industry and Trade, in 2021, Vietnam’s exports to the EU using the certificate of origin under the EUR.1 form reached $7.8 billion, meaning many businesses in Vietnam took advantage of tariff cuts and reductions within the EVFTA.

The Centre for WTO and International Trade under the Vietnam Chamber of Commerce and Industry (VCCI) also reported that in the first two years of implementation, Vietnam’s export turnover from the 27 EU member states averaged at $41.7 billion a year, which is 24 per cent higher than the average figure of $33.5 billion in the 2016-2019 period. This means many exporters in Vietnam have been cashing on tariff decreases from the agreement.

Under a recent VCCI survey on EVFTA impacts on Vietnamese exporters, about 40 per cent of surveyed enterprises reported that they have well taken advantage of a number of benefits - including export benefits – brought about by the EVFTA. This reflects Vietnam witnessing some improvements in exports to the EU market over the past over two years.

“The dismissal of bilateral tariffs and export taxes, together with the reduction of non-tariff barriers affecting the cross-border exchanges of goods and services, are expected to boost bilateral trade considerably. The export gains are estimated at €8 billion ($8.3 billion) by 2035 for EU firms, while Vietnam exports to the EU are expected to grow by €15 billion ($15.6 billion),” said Giorgio Aliberti, Ambassador of the European Union Delegation to Vietnam.

“Regarding services, there is significant untapped potential for greater commercial links in the future. Services activities constitute the largest share of the EU economy and with the rapid urbanisation and growing middle class, the demand for services in Vietnam will only continue to rise.”

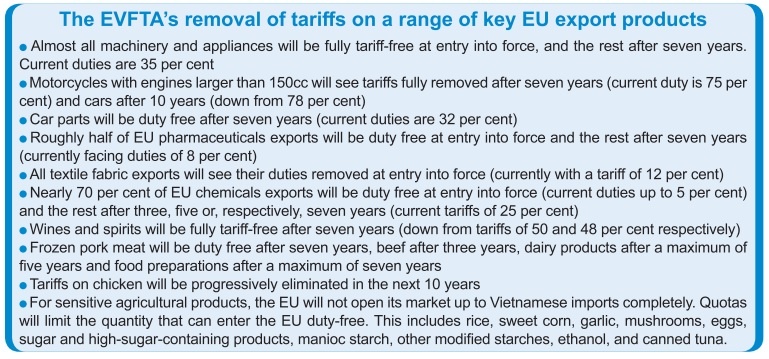

The EVFTA is the most ambitious FTA that the EU has ever signed with a developing country. The agreement will mutually remove as much as 99 per cent of the tariffs within 10 years (see Box). Duty was eradicated from 65 per cent of EU exports to Vietnam and 71 per cent of Vietnamese exports to the EU, immediately after the agreement became valid.

In September, Bernd Lange, chairman of the European Parliament’s Committee on International Trade, came to Vietnam for the fourth time over the past three years, with a view to overseeing the nation’s EVFTA deployment and evaluating the operations of local organisations in charge of supervising the implementation of FTAs and Vietnam’s related policies.

“We will continue supporting Vietnam in delivering on commitments in the EVFTA as well as in expanding collaboration in sustainable development. It is a strong foundation for boosting the EU-Vietnam trade and investment cooperation in the present and the future. It has had positive effects on both the EU and Vietnam, with larger trade and investment flows recorded,” Lange said.

According to the European Union Delegation to Vietnam, it is likely and desirable that the EVFTA and the EU-Vietnam Investment Protection Agreement, which is now waiting for approval from many EU nations, will trigger a new wave of foreign direct investment from the EU into Vietnam.

“Investments from the EU are of top quality. European companies bring high skills, best practices of organisation, and world-leading technologies to Vietnam. European investment comes with high standards of corporate social responsibility for protecting and training workers and employees, as well as for respecting and protecting the environment,” Aliberti said.

“It allows Vietnam to promote economic growth, create better jobs at the same time while ensuring sustainable development. These spillover effects are essential for economies like Vietnam to avoid the middle-income trap.”

According to the Ministry of Planning and Investment, the EU is now one of the most important sources of foreign direct investment for Vietnam. As of November, 22 EU investors have registered over $26 billion for nearly 2,250 projects.

The most recent major is by Danish toy giant Lego Group, which earlier this year was licensed to pump $1 billion into a 44-hectare site in the southern province of Binh Duong for a carbon-neutral factory. This project will be Lego’s sixth manufacturing site and second in Asia, and it aims to create about 4,000 jobs over the next 15 years.

Removing hurdles

The World Bank once estimated that by simply enjoying the tariff reduction as agreed, the EVFTA could boost Vietnam’s GDP and exports by 2.4 and 12 per cent, respectively, by 2030, while lifting an additional 100,000-800,000 people out of poverty by 2030. Such benefits are particularly urgent to lock in positive economic gains as the country responds to the pandemic.

However, the World Bank argued that Vietnam could benefit even more from the next-generation trade deals such as the EVFTA and Comprehensive and Progressive Agreement for Trans-Pacific Partnership if the country stimulates a comprehensive agenda of economic and institutional reforms to facilitate compliance with non-tariff agreements.

The World Bank estimated that such reforms would result in a productivity kick, increasing GDP by 6.8 per cent, relative to the baseline scenario, by 2030. The bank has highlighted the need for Vietnam to increase capacity to handle certain key issues, including rules of origin, animal and plant sanitary standards, and additionally investor-state dispute settlements.

In its report on deepening international integration and implementing the EVFTA from 2020, the bank cites the rules of origin requirement as one of the key challenges for Vietnam to overcome.

Specifically, even if a product is produced in Vietnam, EU importers might not determine it as such due to the high dependence on imported materials. The report found that in key export manufacturing industries, a majority of inputs are sourced from foreign countries (for instance, 62 per cent in electronics and 53 per cent in the automotive sector).

The World Bank has called for greater efforts to improve links between domestic suppliers and foreign enterprises as lead firms in major global value chains. At the same time, rigorous European food safety standards make it imperative for Vietnam to improve the clarity and consistency of its sanitary measures. By one estimate, the cost of full compliance with existing non-tariff measures in Vietnam will be equivalent to a 16.6-per cent tariff (compared to a regional average of 5.4 per cent).

EU keen to cement obligations in EVFTA

EU keen to cement obligations in EVFTA

Vietnam and the EU are increasing trade and investment ties backed by a bilateral free trade agreement, with the EU committing to assist in deployment of the deal despite current geopolitical tensions.

EVFTA advantages threatened by tough competition

EVFTA advantages threatened by tough competition

Although Vietnam is hoping for stunning growth in seafood exports, particularly in the likes of basa fish and shrimp, the nation’s share in the EU market and utilisation of its trade deal with the bloc remain under some pressures.

Vietnamese businesses trained in EVFTA’s Rules of Origin

Vietnamese businesses trained in EVFTA’s Rules of Origin

Vietnamese businesses had the opportunity to improve their knowledge on Rules of Origin (ROO) and receive useful information from experts to take full advantage of the recent European Union–Vietnam Free Trade Agreement (EVFTA) at a workshop organised by the ARISE+ Vietnam Project.