INTERNATIONAL INVESTMENT

AND PORTAL

The new decree on offering and trading private placement bonds helps standardise and improve bond issuance conditions, supervision of capital use purposes and information transparency, said analysts.

The Government on September 16 issued Decree 65/2022/ND-CP which amends and supplements a number of articles of Decree 153/2020/ND-CP dated December 31, 2020 on offering and trading private placement bonds in the domestic market and offering corporate bonds to the international market.

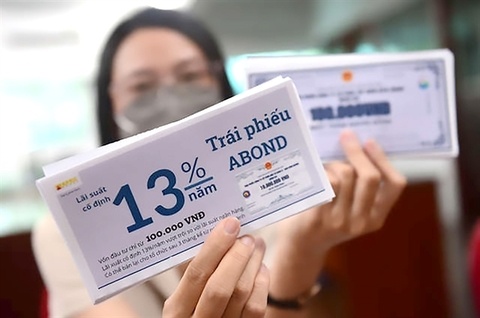

A bondholder shows her ABOND bonds.-VNA/VNS Photo

A bondholder shows her ABOND bonds.-VNA/VNS Photo

The new decree seeks to strengthen issuers' responsibilities and obligations in using bond proceeds for the intended purposes.

Analysts from Mirae Asset Securities Vietnam Joint Stock Company, Nguyen Nam Son and Nguyen Duong Cong Nguyen, said that the corporate bond market will see many fluctuations in the short term, related to the review of the compliance level of bond issuance.

The development potential of this market remained very large. If compared with countries in the region, the ratio of corporate bonds to GDP of Vietnam is currently at a low level of 15 per cent, while that of Thailand is about 97 per cent or Malaysia with 58 per cent.

The issuance of this new decree shows the determination of the management agency to stabilise the corporate bond market, which has faced many risks and shortcomings, leading to cases of violations in recent years, they said.

The new decree adds provisions on ensuring publicity and sets standards and strengthens sanctions enforcement measures and removes unreasonable constraints on the corporate bond market, according to Vu Tien Loc, president of the Vietnam International Arbitration Centre and member of the Economic Committee of the National Assembly.

All the adjustments in the new decree are believed to strengthen the State's management role to protect investors, Loc said.

According to the Vietnam Bond Market Association (VBMA), in the first eight months of 2022, there were 344 private placements of bonds worth about VND211.3 trillion, accounting for 96 per cent of the total issuance value. The value of bond private placement decreased by about 40 per cent compared to the same period last year.

KB Securities Vietnam Joint Stock Company (KBSV) said that since 2005, when the Vietnamese corporate bond market started operating, the total issuance value has reached nearly VND2.5 quadrillion with more than 5,000 issuances, playing an important role in providing capital for the economy. The market size has increased sharply by 140 times, equivalent to nearly 18.3 per cent of GDP.

Most businesses choose to issue in the form of private placement, with the private issuance rate usually reaching 85-95 per cent of the total issuance, because of public issuance regulations at a higher cost.

Do Bao Ngoc, deputy general director of Vietnam Kien Thiet Securities Company, said that the new decree would help the market solve the current shortcomings in legal issues.

Under the new decree, the bond owner's representative also participates in the process of controlling the purpose of capital use of the issuer and must periodically report to the management agency. Thus, there will be an additional unit to monitor the process of using capital.

According to Ngoc, Decree 65 has a positive and huge impact on the corporate bond market, contributing to solving capital problems and promoting positive changes in businesses in terms of transparency, while limiting investor risks.

Clearer regulations a wise move for corporate bonds

Clearer regulations a wise move for corporate bonds

Over the last 12 months real estate stocks, which have about 22 per cent of the total VN-Index weighting, outperformed bank stocks, which have about a 30 per cent weighting.

Changes in regulations to strengthen private placement bonds

Changes in regulations to strengthen private placement bonds

Decree 65 amends regulations on bond issuance purposes to strengthen the responsibilities and obligations of issuers in using raised capital for the right purposes.

By VNS