INTERNATIONAL INVESTMENT

AND PORTAL

The first MoU, between UOB and Enterprise Singapore (EnterpriseSG), aims to encourage partnerships between Singaporean enterprises and foreign companies seeking to expand to Southeast Asia in manufacturing, green economy, and digital economy.

The collaboration between UOB and EnterpriseSG is expected to encourage collaborations between Singaporean enterprises and foreign companies through activities such as networking sessions, starting with markets that UOB has networks in, such as Germany, Japan, and China.

Another MoU was inked between UOB, the Federation of Malaysian Manufacturers (FMM), and the Singapore Manufacturing Federation (SMF) to facilitate business opportunities across borders.

This strategic agreement aims to promote business opportunities and foster deeper collaboration within Southeast Asia, particularly between Singapore and Malaysia. Through the MoU, the three parties will work together to facilitate cross-border projects and partnerships, focusing on the manufacturing ecosystem as a priority.

Yang Berhormat Tuan Liew Chin Tong, Malysia's Deputy Minister of Investment, Trade, and Industry, said, “One of the key visions laid out for the Johor-Singapore Special Economic Zone (JS-SEZ) is to establish a better integrated and resilient supply chain ecosystem across the Malaysia-Singapore border. Both Johor and Singapore can leverage our complementary capacities, and join hands to drive innovation and enhance productivity. This MoU between FMM, SMF and UOB is therefore timely and propitious to align the strengths of Malaysia and Singapore for greater regional economic growth in the current global trade climate.”

Since 2024, UOB has committed RM11.5 billion in financing to support businesses in the state of Johor and is actively facilitating RM10 billion of FDI flows into the SEZ. Today, UOB reaffirmed its commitment to supporting regional growth by signing a landmark tripartite MoU with the FMM and SMF.

Eunice Koh, assistant managing director for Southeast Asia and China at EnterpriseSG, said, “Southeast Asia remains a bright spot for businesses with its growing population and economy. We see emerging opportunities for our enterprises to collaborate with foreign companies for their expansion into Southeast Asia from Singapore. EnterpriseSG is pleased to work with strategic partners like UOB, who have a wide network of foreign clients and can match them effectively with our enterprises to explore growth opportunities in the region.”

To support these efforts, UOB will offer complementary advisory services to members of the SMF and FMM. These services include tailored market entry strategies and in-market guidance, designed to help businesses navigate the financial and operational complexities of expanding into Singapore, Malaysia, and the broader Southeast Asian region.

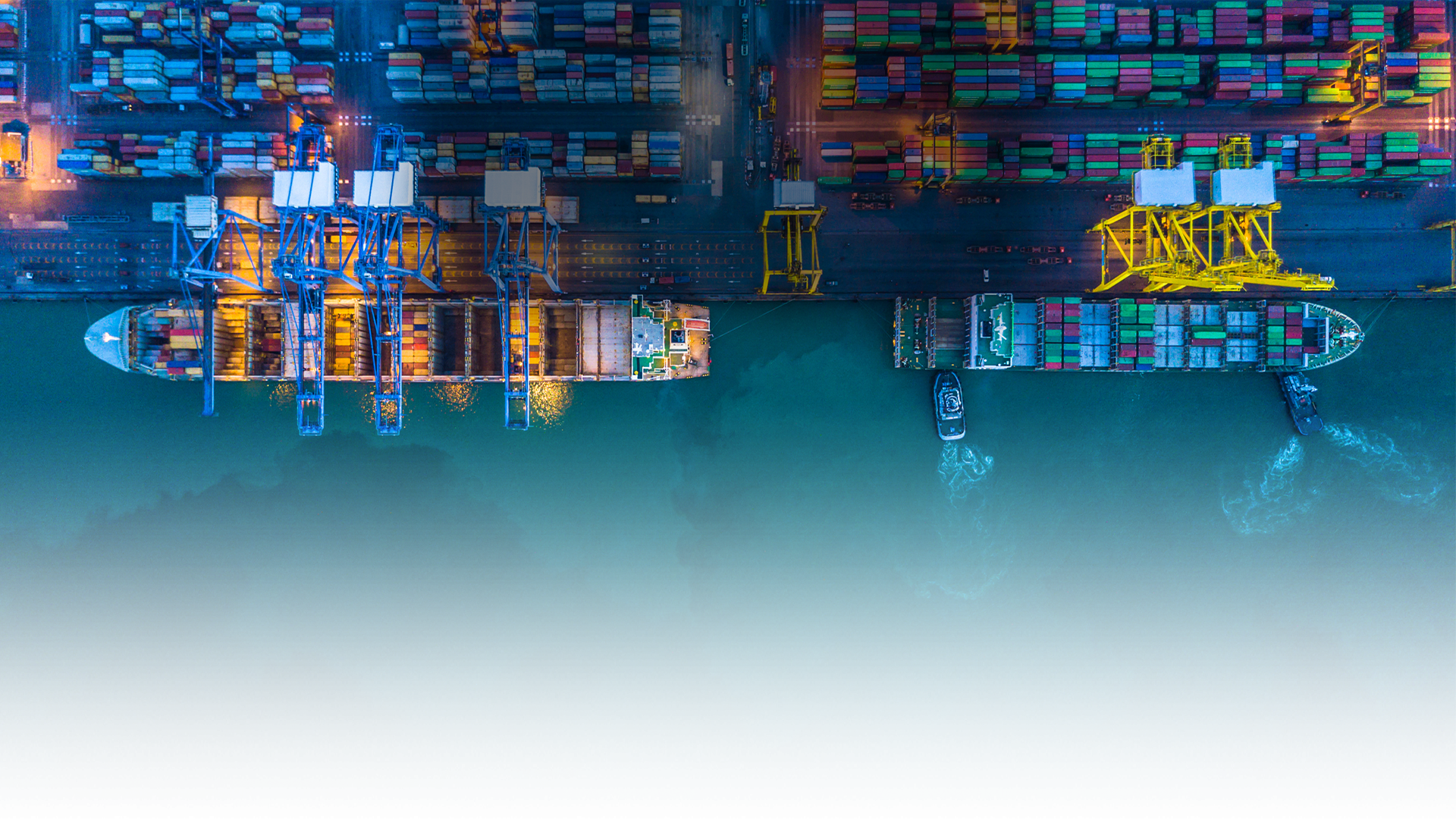

“ASEAN remains an attractive destination for businesses despite global tensions. As opportunities arise from the rewiring of global supply chains, trade flows within ASEAN and between China and ASEAN are expected to increase. Through UOB’s network of FDI advisory centres across key Asian cities and our strategic partnerships, we help businesses enter new markets and seize opportunities in the region,” said Wee Ee Cheong, deputy chairman and CEO of UOB.

UOB sealed strategic MoUs with government agencies and regional industry players at the ASEAN Conference. Photo: UOB

UOB sealed strategic MoUs with government agencies and regional industry players at the ASEAN Conference. Photo: UOB

Three other MoUs were also signed, facilitating FDI flows into ASEAN from around Asia, including Japan and Greater China. These MoUs signal growing investor confidence in ASEAN’s economic trajectory, reaffirming UOB’s commitment to driving sustainable growth across the region amidst an increasingly complex geopolitical landscape.

UOB Hong Kong signed an MoU with Hong Kong Trade Development Council (HKTDC). This marks the first MoU that HKTDC has signed with a Singapore-based bank. It aims to establish a framework of cooperation to strengthen regional ties and promote sustainable growth through strategic initiatives that enhance connectivity, promote trade, and foster inclusive development across the Greater Bay Area, including Hong Kong and ASEAN.

This will be achieved through leveraging mutual expertise to enhance cross-border collaboration, match FDI with local value chains, strengthen financial connectivity, and build business capacity for inclusive and competitive regional growth.

“We are delighted to partner with UOB Hong Kong in this strategic initiative to strengthen GBA-ASEAN collaboration. This MoU reflects our shared vision of fostering inclusive and sustainable economic growth through deeper trade and investment ties. By riding on our respective strengths, we aim to enable businesses to seize emerging opportunities and navigate the evolving global landscape with confidence,” stated Vivienne Chee, director of Singapore, HKTDC at the conference.

A fourth MoU was signed between UOB China and ZGC International, marking a significant step towards supporting the cross-border development of companies based in ZGC industrial parks.

Under this partnership, UOB China will provide a suite of comprehensive financial solutions, including working capital loans, cash pooling and management, supply chain financing, and investment banking services, to facilitate these companies’ overseas expansion into Hong Kong, ASEAN, and other global markets.

Beyond financial support, the collaboration aims to strengthen supply chain resilience and promote sustainable, innovation-led growth. By combining UOB’s deep expertise in ASEAN markets with ZGC International’s leadership in the industrial park sector, the partnership will drive cross-border business collaboration, enhance value chain connectivity, and contribute to job creation across both ASEAN and China.

UOB also signed an MoU with J-Will Corporation Ltd and fund management company Hildrics Capital aimed at jointly developing business opportunities and supporting Japanese companies entering the ASEAN market. UOB will provide financial solutions such as cash management and financing facilities.

These MoUs signify the bank’s commitment to the region as it continues to contribute to the region’s economic growth in a sustainable manner.

Government seeks FDI boost to achieve 8 per cent growth

Government seeks FDI boost to achieve 8 per cent growth

The government has ordered the clearance of obstacles for the international business community to invest in Vietnam, according to Minister of Finance Nguyen Van Thang.

FDI inflows can be growth innovator

FDI inflows can be growth innovator

Vietnam stands at a critical juncture in its economic transformation. Emerging technologies like AI and semiconductors offer a rare chance to move beyond low-cost manufacturing and become a regional innovation hub. To be a leader of Southeast Asia’s digital future, Vietnam should accelerate the sustained effort to attract the next wave of foreign investment and help shape the region’s tech landscape.

UOB committed to Vietnam with fresh capital and new headquarters

UOB committed to Vietnam with fresh capital and new headquarters

UOB announced on April 8 that it will increase its charter capital of its Vietnamese subsidiary to VND10 trillion ($385 million).

UOB recognised among ‘Top 10 Green Services' in Vietnam

UOB recognised among ‘Top 10 Green Services' in Vietnam

United Overseas Bank (UOB) Vietnam was named among the Top 10 Green Services for 2025 at the 22nd 'Enterprises for a Green Environment' awards, held in Hanoi on April 26 by the Institute of Economics and Culture under the Ministry of Science and Technology.

UOB Vietnam debuts supply chain finance solutions on UOB Infinity

UOB Vietnam debuts supply chain finance solutions on UOB Infinity

UOB Vietnam announced the launch on June 6 of its new Financial Supply Chain Management (FSCM) capabilities on UOB Infinity – the bank’s digital banking platform for businesses.

Tariff risks continue to weigh on economic outlook

Tariff risks continue to weigh on economic outlook

United Overseas Bank (UOB) has maintained its forecast for Vietnam's economic growth in 2025 at 6 per cent, and believes that the State Bank of Vietnam will hold rates steady due to tariff risks from the United States.