INTERNATIONAL INVESTMENT

AND PORTAL

Many carmakers are hunting for suppliers to meet the demand that has been rising since last year, as well as counter the increasing prices of palladium, nickel, and aluminium for their components.

The vast majority of spare parts that make up a car have to be imported into Vietnam, but that may be slowly changing, Le Toan

The vast majority of spare parts that make up a car have to be imported into Vietnam, but that may be slowly changing, Le Toan

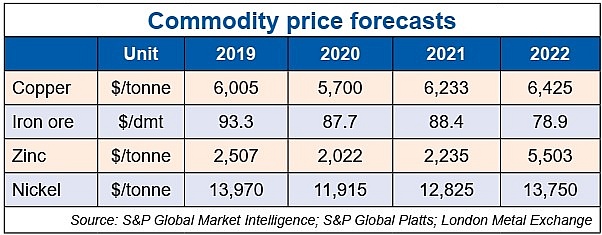

Commodities for carmakers such as copper, steel, and nickel are witnessing price records, and their limited supply has pushed brands such as Toyota and Nissan into trouble in terms of keeping up with output (see chart).

Toyota admitted in its global sales report two weeks ago, “Global production was partially affected by the part supply shortages caused by the spread of COVID-19”.

Truong Thi Chi Binh, general secretary of the Vietnam Association for Supporting Industries, said that a car has about 30,000 spare parts, with the majority being imported. There are only 20-30 suppliers in Vietnam that can produce spare parts that meet assembly standards, but the cost is 10-20 per cent higher than in other markets in the region.

Nguyen Trung Hieu, a representative of Toyota Vietnam, said that to cope with the shortage of spare parts, automobile manufacturers would have to actively seek out new supply sources.

“If it takes a long time for domestic suppliers to obtain certification in recognition of being at the correct standard for producing spare parts, it takes a long time for carmakers – as well as the state to support them – to quickly achieve the standards in the first place,” Hieu stressed.

In an effort to find local spare parts, Toyota last week hosted a conference, supported by the Ministry of Industry and Trade (MoIT), to connect with suppliers in Vietnam. At the conference, Junichiro Yamamoto, officer at the Administrative Division of Toyota Vietnam, said, “The company has strived to contribute to the development of Vietnam’s supporting industries and strengthen the network of domestic suppliers for long-term growth.”

In the last two years, Toyota Vietnam has contracted 12 new suppliers, chosen out of 46, including six Vietnamese ones. To date, Toyota has the highest localisation rate among foreign-invested carmakers in Vietnam with more than 720 components, such as body, chassis, seats, and batteries coming from the country.

During 2020-2021, 324 components were localised. This year, the company expects to localise another 200 components.

As the company is likewise under the pressure of finding sufficient components, Hyundai Thanh Cong stated that it is also looking at domestic suppliers, as well as possibly applying new technology to quickly produce components while reducing imports from other markets.

However, the high cost and lack of components is a global phenomenon. Cam Van Binh, deputy director of the Industrial Development Centre under the MoIT, explained, “Production of auto parts currently produced in Vietnam is labour-intensive. On the other hand, the links in the production chain are still not really tight, and businesses are still struggling with connecting supply and demand.”

In addition, analysts warned that the ongoing semiconductor chip shortage since last year could still take more time to recover, while carmakers cannot easily replace these crucial parts in modern cars. These analysts generally predicted that the global chip shortage will last until 2024.

By Nguyen Thu