INTERNATIONAL INVESTMENT

AND PORTAL

To support this, a series of synchronised policies have been introduced, notably a 16 per cent increase in public investment spending, directed at key infrastructure projects such as the North-South Expressway, Long Thanh International Airport, and urban transport enhancements in Hanoi, Ho Chi Minh City, and neighbouring provinces.

Nguyen Thi Vinh Ha, deputy general director Grant Thornton Vietnam

Nguyen Thi Vinh Ha, deputy general director Grant Thornton Vietnam

In parallel, private consumption is expected to be the main driver of GDP growth in 2025.

Since 2014, Vietnam’s private consumption has grown at a compound annual growth rate of 8.29 per cent, with a notable 10.6 per cent increase in 2024, the highest post-pandemic. If the government continues to maintain consumer-supportive policies, such as keeping VAT at 8 per cent, controlling inflation, and ensuring labour market stability, the projected consumption-led growth prospect is positive.

Vietnam’s real estate market is expected to recover thanks to comprehensive government initiatives, including new legislative frameworks regulating business activities, institutional reforms aimed at removing bottlenecks in stalled projects, extensive infrastructure funding supported by public investments, and continued low-interest rate environment and financial stimulus packages.

In 2024, Vietnam ranked among the top 15 developing countries globally in terms of foreign direct investment, registering $38.23 billion in new capital. This came from a mix of new projects and merger and acquisition (M&A) activities. These figures reflect foreign investors’ growing confidence in Vietnam’s investment climate, governance reforms, and economic prospects.

Vietnam’s 2025 foreign funding outlook remains positive, driven by ongoing regulatory reforms to enhance transparency and investor protection, stable political and economic conditions, and Vietnam’s comparative advantage in terms of economic growth compared to the regional nations.

Notably, the industrial real estate segment is well-positioned to ride this wave. The ready-built factory and warehouse supply has doubled since 2018, while occupancy rates remain above 80 per cent.

Meanwhile, unpredictable monetary policies changes from both the US and China pose macroeconomic risks for Vietnam’s exchange rates and inflation. This potentially increases volatility in Vietnam’s financial market and dampens investor sentiment.

Nonetheless, the Vietnamese government is actively engaged in bilateral negotiations aimed at mitigating the impact of these tariffs and preserving supply chain stability. Additionally, policy support has been extended to local exporters to diversify markets and strengthen operational resilience.

While administrative restructuring is intended to improve long-term governance, it may result in short-term procedural delays, particularly in licensing and investment approvals, which potentially slows down M&A execution.

In 2024, Vietnam’s M&A market, like many others globally, faced considerable headwinds due to macroeconomic volatility, geopolitical instability, and concerns over potential recessionary pressures.

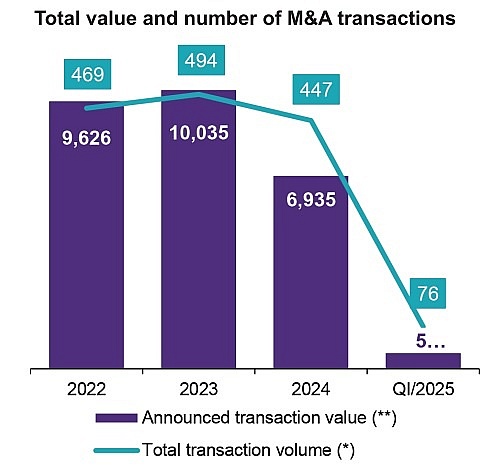

These factors led to heightened caution among investors, particularly foreign ones, resulting in a cooling of market activity. The market recorded almost 450 transactions with a total disclosed value of $6.93 billion, reflecting a 9.5 per cent drop in deal volume and a notable 31 per cent drop in deal value on-year.

Despite this overall slowdown, a major highlight was the significant rise in the role of domestic investors, whose share in total deal value increased from 16 per cent in 2023 to 29 per cent last year. This remarkable growth demonstrates improved confidence, financial capacity, and deal-making maturity among local players.

The average deal size also declined from $52.3 million in 2023 to $41.5 million in 2024, and further down to $23.5 million in Q1 of 2025.

Nevertheless, large-scale transactions remained active in core sectors such as industrial, financial services, and real estate, suggesting strategic investors were seizing the opportunity to strengthen market positions amid more favourable valuations.

Real estate took centre stage in 2024, contributing 36 per cent of total M&A deal value. This marks an early sign of demand recovery and paves the way for a more sustainable growth cycle in 2025.

The industrial sector attracted robust capital inflows, particularly from domestic and Singaporean investors. A standout transaction was Foxconn Singapore’s $383 million investment into Foxconn Circuit Precision Vietnam.

Financial services, although dipping from its 2023 peak, remained in the top three most active sectors, with the highlight being an $852 million transaction between SCB and Home Credit Vietnam. In contrast, the consumer sector witnessed a sharp decline in both volume and value, due to the lack of sizeable deals. Similarly, technology lost its previous momentum, largely because of the absence of unicorn-scale investments, which once buoyed the sector’s prominence.

Vietnam’s 2025 M&A outlook is cautiously optimistic, anchored in domestic momentum but tempered by external risks. The country stands to benefit from global supply chain diversification. However, realising this potential depends on strategic visions and the ability to navigate a rapidly evolving landscape.

The key factors shaping Vietnam's M&A market for 2025

The key factors shaping Vietnam's M&A market for 2025

Nguyen Cong Ai, senior partner of Deal Advisory at KPMG Vietnam, delivered his keynote speech at the 2024 Vietnam M&A Forum on November 27, highlighting the key factors shaping the outlook for next year.

M&A market set to boom again in 2025

M&A market set to boom again in 2025

The M&A market is expected to become more dynamic in 2025 with the return of investors from Japan and South Korea across various sectors, driven by positive institutional changes and recent efforts toward dual transformation.

M&A market braces for policy slowdown

M&A market braces for policy slowdown

The wave of dealmaking activities in Vietnam may face a slowdown amid unpredictable policies that will have a knock-on effect.